Pinterest (NYSE: PINS), the company behind the namesake visual discovery engine for finding ideas like recipes, home and style inspiration, and more, has developed to become one of the biggest social networks out there.

While the company has been focusing on improving its monetization, the stock has undergone a crazy ride. I believe this is partly because the market would like to see more prominent user growth and partly because of the overall concerns regarding the platform’s long-term viability in an ever-changing social network landscape.

Pinterest shares had jumped back in October following news that Paypal (NASDAQ: PYPL) intended to buy the company for $70 a share, which, as turned out, won’t be happening. Hence, we should go back and assess the company based on its underlying results alone.

The company’s Q3 results illustrated Pinterest’s focus on user monetization, which should be its most critical revenue growth catalyst going forward. I remain bullish on the stock, but investors should be aware of the risks attached to it.

Focusing On ARPU Growth

The most important aspect to understand regarding Pinterest’s investment case is that the company should occasionally attract a diverse user base instead of a stable user base on a daily/monthly basis like most social media platforms. As an idea-sharing platform, traffic is driven by various factors that are not easily predictable.

The company’s latest results illustrated precisely that. Global Monthly Active Users (MAUs) rose just 1% year-over-year to 444 million. This, of course, is a microscopic increase, but it is also quite reasonable and not that worrying.

In the prior-year period, consumers would spend time and money on home improvement following the transition to the working-from-home economy. Since Pinterest is the ideal place to browse home-improvement ideas, MAU growth was 37% in Q3 2020. Hence, you can see why Pinterest’s MAUs can fluctuate from time to time.

In terms of Pinterest’s monetization, the company delivered fantastic ARPU (average revenue per user) growth of 37% globally. Most importantly, in the U.S. (the most important market for social media networks), ARPU expanded by 44%, which is very encouraging since the U.S. always portrays the most profitable per-user metrics across all platforms. Seeing strong growth here is great news.

Management expects revenue growth to be in the high-teens year-over-year in its upcoming earnings, which, assuming a stable user base, should once again suggest rather strong ARPU growth.

Has the Stock Bottomed?

Since we discovered that the potential acquisition by Paypal won’t be taking place, Pinterest shares have continuously slid lower, hitting new 52-week lows every other week.

Considering that FY 2021 revenues should be around $2.6 billion based on Pinterest’s nine-month 2021 results and management’s guidance, the stock’s forward P/S ratio of around 8x seems rather attractive.

Pinterest’s adjusted EBITDA margins expanded from 21% in the prior-year period to 32%, so the platform’s profitability prospects seem quite strong. I believe that the company’s brand value alone is worth a higher multiple.

After all, Pinterest is one of the most beloved social networks out there, having never received any meaningful scrutiny and PR issues similar to its industry peers. Hence, I am confident regarding the company’s long-term prospects, and ability to draw a higher number of MAUs over time.

Wall Street’s Take

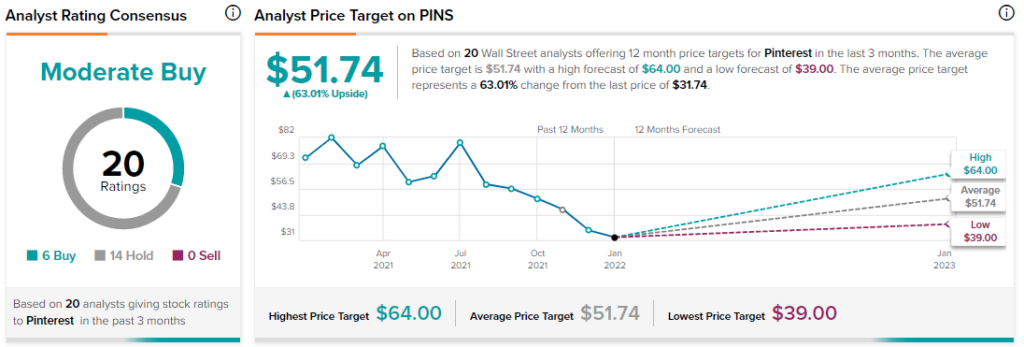

Turning to Wall Street, Pinterest has a Moderate Buy consensus rating, based on six Buys and 14 Holds assigned in the past three months. At $51.74, the average Pinterest stock prediction implies 63% upside potential.

Conclusion

Pinterest’s steep decline over the past year could have opened an excellent opportunity for investors to buy the stock on the cheap.

In my view, Pinterest shares are cheap both from a sales and a potential future profitability standpoint. That said, investors should be wary of the possibility that Pinterest’s MAUs may constantly be fluctuating going forward, resulting in volatile earnings.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure