The aerospace giant Boeing (BA) has lately come under a lot of regulatory pressure due to a series of manufacturing defects, resulting in delays in the company’s scheduled aircraft deliveries.

Recently, Boeing announced that undelivered 787s would require further work, after the Federal Aviation Administration (FAA) identified certain manufacturing quality issues while undertaking a system-wide inspection of Boeing’s 787 shimming processes.

The FAA stated that the problem detected is near the nose of some of the planes but does not pose any immediate threat to flight safety. Boeing announced that it would fix the issue before sending the aircraft out for delivery. (See BA stock charts on TipRanks)

As a result, the plane maker now intends to temporarily slow down the production of 787 and gradually plans to increase the monthly output to its target of five a month.

The news did not go over well with Ronald Epstein of Bofa Securities. Epstein expressed his concerns about the frequent delays in deliveries of aircraft due to production and manufacturing issues, stating, “We remain concerned about the impact of Boeing’s engineering problems on the business’s cash flow and long-term market share as the company fixes the 787 and deals with several defense programs under development.”

The two-star analyst appears to be unsatisfied with the company’s decision to slow the production of the aircraft. He is of the opinion that another decrease in production could result in cost overruns and margin contractions, which will “create a forward loss for the program.”

Bolstering his claim, the analyst said that back in 2020, Boeing had to suspend its deliveries due to flaws at fuselage joins, with 787 delivery operations recommencing only this March.

Unfortunately again in May, Boeing had to halt 787 deliveries when FAA demanded more data on Boeing’s proposal to conduct further inspections by sampling.

Therefore, the analyst thinks that these continuous delays would eventually convert into order cancellations, putting the company’s share and profits at a big risk.

In sum, as the global airline industry recovers from the pandemic, Epstein believes that the company is clearly facing some company-specific challenges. The analyst remains concerned about Boeing’s excess inventory and henceforth maintained a Hold rating with a price target of $265 on the stock, suggesting a possible 12-month upside of 18.1%.

Boeing closed up 1.6% lower on Wednesday at a price of $224.45 per share. The company has lost 1.3% in the past five days but gained 19.4% over the past year.

On TipRanks, Boeing has an analyst rating consensus of Moderate Buy, based on 9 Buy ratings and 8 Hold ratings. The average BA price target is $272.76, reflecting a potential 12-month upside of 21.5%.

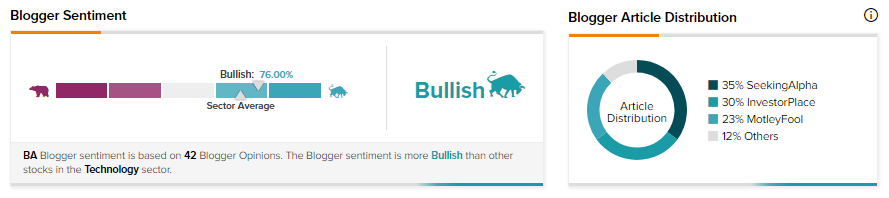

TipRanks data shows that financial blogger opinions are 76% Bullish on BA, compared to a sector average of 70%.

Disclosure: Shalu Saraf held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.