Pfizer (PFE) might be a pharma giant with a long list of products, but in recent times, as far as investors are concerned, the company has almost turned into a Covid pure play.

In partnership with BioNTech, the company boasts the world’s leading Covid-19 vaccine, Comirnaty, and it has also developed the antiviral Paxlovid.

As such, investors reacted negatively to Pfizer’s 4Q21 earnings after the company’s 2022 sales guidance did not appear to meet expectations. But that could all stem from a misinterpretation of Pfizer’s outlook.

Its forecast accounts only for sales made to so far for the vaccine and oral Covid treatment and the figures are likely to rise as the year progresses. As such, the downbeat reaction was rather unmerited, according to Mizuho’s Vamil Divan. In fact, the analyst thinks the company is taking the right tack.

“It appears clear that Pfizer will wisely continue to take a relatively conservative approach to guidance for both products, focusing primarily on doses or treatment courses that are agreed to based on contracts as of late January,” the analyst noted.

Divan’s FY22 guidance for both products, remains above Pfizer’s; for Comirnaty, the analyst estimates sales of ~$34.8 billion, compared to Pfizer’s ~$32 billion and expects ~$25.8 billion for Paxlovid vs. guidance of ~$22 billion.

Given Pfizer’s manufacturing capacity, and subject to how orders evolve in the months ahead, the analyst acknowledges “there is room for greater upside.”

So, a bullish outlook, right? Not quite. While the “remarkable success” of the Covid pipeline is not in doubt, Divan’s concerns regarding the post-Covid opportunities still linger.

“Business development remains more of a wild card and, while we are supportive of recent deals such as the Arena acquisition and Biohaven ex-US collaboration, we wait for Pfizer to make more progress utilizing its enhanced balance sheet before we get more comfortable with Pfizer’s longer-term outlook and more constructive on the stock,” the analyst summed up.

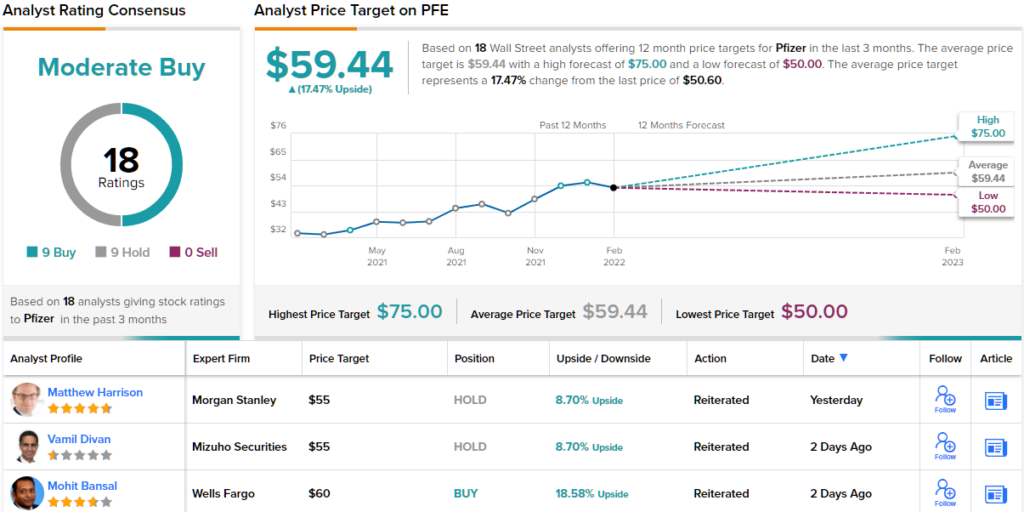

As such, Divan’s rating stays a Neutral (i.e., Hold) and the price target gets a symbolic trim – dropping from $56 to $55, and suggesting room for ~9% growth in the year ahead. (To watch Divan’s track record, click here)

Considering Pfizer’s prospects, it’s evens stevens between the bulls and fence sitters amongst Wall Street’s analyst corps. With 9 Buys and Holds, each, the stock has a Moderate Buy consensus rating. Going by the $59.44 average target, shares will climb by 17.5% in the year ahead. (See Pfizer stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.