Pfizer (PFE) is a leading pharma company that has offered reliable dividends for many years and that operates a recession-resilient business, making it suitable for income investors. In 2021, Pfizer is experiencing tailwinds from its COVID-19 vaccine that was developed by BioNTech (BNTX).

At current valuations, Pfizer is not ultra-cheap any longer, but shares are far from expensive, which is why I am bullish on the stock at current prices. (See Pfizer stock charts on TipRanks)

A Reliable Dividend Payer at a Reasonable Valuation

Pfizer has raised its dividend reliably for many years. The payout has been raised for 11 years in a row, with the dividend growth rate averaging 6.3% over the last five years. At current prices, Pfizer’s dividend yield is 3.4%, which is significantly more than the yield one can get from the broad market or treasuries today.

The combination of Pfizer’s dividend yield and its historic dividend growth rate is reasonably attractive, as this allows for annual returns in the 10% range, as long as the company can maintain its dividend growth rate in the long run. That’s under the assumption that the yield remains stable, i.e., shares rise in line with dividend increases.

Seen in another way, one can argue that one’s income stream will grow by about 10% a year as long as dividends are reinvested. Of course, that’s assuming the future dividend growth rate is more or less in line with Pfizer’s historic dividend growth rate.

Looking at Pfizer’s valuation, we see that the company trades for a little more than 11x this year’s expected earnings per share of $4.05, which is far from a high valuation. The broad market, for reference, trades at well above 20x this year’s expected net profits.

It should be noted, however, that Pfizer’s earnings per share are forecasted to decline to some degree in 2022, as tailwinds from its COVID vaccine will be less impactful next year, according to current analyst estimates. Pfizer trades for 12-13x next year’s net profits, which is still a relatively inexpensive valuation.

Comirnaty as a Near-Term Boost

In 2021, Pfizer will see massive tailwinds from its COVID shot Comirnaty, as the CEO expects revenues of more than $33.5 billion during the current year. Not all of that will flow through to the company’s bottom line, of course, and margins will not be overly high on these vaccine sales. Still, Pfizer is seeing significant tailwinds from its COVID shot this year, and likely in 2022 as well, especially if booster shots are rolled out on a broad basis.

Unlike other COVID vaccine suppliers, Pfizer has not seen its shares climb tremendously over the last year — shares are up 28% over the last 12 months. This may indicate that Pfizer is a value pick among the COVID vaccine suppliers, as its peers BioNTech and Moderna (MRNA) have seen their shares climb way higher.

Beyond Comirnaty, Pfizer has a relatively deep pipeline, featuring many Phase II and Phase III candidates that should result in ample business growth prospects over the coming years. Among others, the company’s portfolio includes small molecules and biologics targeting indications such as lung cancers, melanoma, and many more.

Pfizer also has a sizeable vaccine pipeline apart from its COVID shot, with candidates for pneumococcal infections and other virus infections. With a total of 23 Phase III studies, Pfizer has a solid near-term outlook when it comes to bringing new products to the market over the next couple of years, and with 40 Phase II trials being run right now, the outlook through the mid-2020s is solid as well.

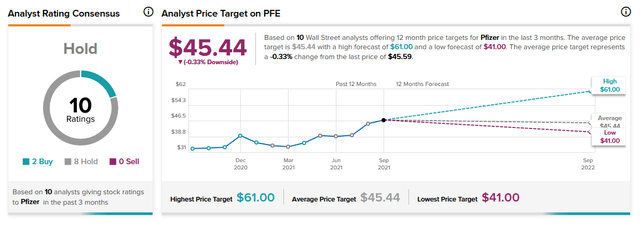

Turning to Wall Street, Pfizer has a Hold consensus rating, based on the 2 Buys, 8 Holds, and 0 Sells assigned in the last three months. At $45.44, the average Pfizer price target implies 0.3% downside potential.

Disclosure: At the time of publication, Jonathan Weber did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.