Without any question, pet products and services specialist Petco Health and Wellness Company (NASDAQ:WOOF) suffers from a major credibility crisis. From hefty losses in the charts to fading revenue and profitability stats, Petco appears to be a money pit. Nevertheless, the options market may be pointing to a short-squeeze gambit. As a form of pure speculation using only pocket change, I am bullish on WOOF stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Intriguing Risk-Reward Profile for WOOF Stock

At first glance, no one would blame you for holding WOOF stock in contempt. Since the start of the year, shares have tumbled by nearly 62%. Ever since Petco made its public market debut, the enterprise lost 88% of its equity value. Fundamentally, circumstances don’t seem particularly encouraging for a bounce-back effort.

Primarily, the overwhelming headwind working against WOOF stock is inflation. Certainly, high prices have crimped consumer demand and may threaten to damage the economy if left unaddressed. However, studies show that the cost of pets and related products jumped 10.6% from May 2022 to May 2023. That’s over twice the inflation rate for regular goods and services.

Further, pet-owning households report trouble covering the cost of veterinary care and other critical services. Under this context, it’s not surprising that WOOF stock has collapsed.

At the same time, Americans love their four-legged friends. With the American Pet Products Association reporting that total industry sales last year hit $136.8 billion – up 10.8% from 2021 – it’s difficult to dismiss the upside narrative altogether.

Also, what’s interesting to note is that according to options flow data – which filters exclusively for big block trades likely made by institutions – most of the major, market-moving derivative transactions have already expired.

Yes, traders are still taking potshots against WOOF stock. For example, the most recent significant trade involves selling 1,028 contracts of the Nov 17 ’23 4.00 Call on November 7. By and large, though, institutional bears appear to have lost interest in betting against WOOF.

Plus, when too much pressure builds on one side of the trade, there’s always a risk that something, anything, could push shares higher. After all, as ugly as Petco is now, it still caters to a relevant industry.

A Short-Squeeze Play Could be Viable

Although it’s a high-risk proposition, WOOF stock just might benefit from short-squeeze speculation. Essentially, a rising share price applies increasing pressure on bearish traders because covering a short position requires purchasing the targeted stock. Since no upside price limit exists, theoretically, short traders run the risk of unlimited losses. Of course, brokerages usually step in with margin calls before circumstances get out of hand.

As stated earlier, options flow data shows a relative dearth of open interest for options contracts that major entities placed; most of the transactions – particularly the outright bearish trades – have already expired. Thus, this dynamic suggests that the remaining open contracts in WOOF’s options chain may be predominantly held by retail traders. If so, they may be more susceptible to short-squeeze pressure.

Enticingly, for contrarian speculators, the short interest for WOOF stock stands at 26.2% of its float. Generally speaking, market experts agree that short interest above 10% is elevated, while anything above 20% is extremely high. So, if Petco shares move higher for whatever reason, that could be bad news for the bears.

So far, that’s exactly what investors see. Yes, WOOF stock has cratered on a year-to-date basis. However, in the trailing one-month period, it popped up by more than 11%. With options trades carrying the leverage of 100 shares of the underlying security per contract, circumstances risk getting ugly for the pessimists.

The Worst-Case Scenario

What’s more, if Petco bears decide to short WOOF stock through naked call writing, the intense pressure may force shares to skyrocket. Basically, selling a call involves a bet that the underlying stock won’t rise to the listed strike price. If it exceeds the strike, call writers must sell the security at the lower strike price.

If call writers don’t own the stock, they must buy it at a higher price to sell lower, a dubious proposition. Again, since no upside limit exists, it’s possible for WOOF stock to skyrocket to absurd levels. At that point, it becomes a stare-down contest of how much traders can absorb.

If indeed we’re talking about retail traders, the pain threshold should be relatively modest.

Is WOOF Stock a Buy, According to Analysts?

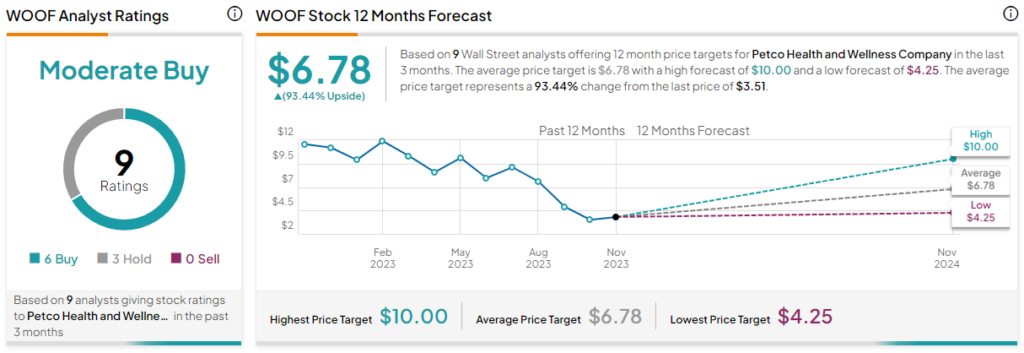

Turning to Wall Street, WOOF stock has a Moderate Buy consensus rating based on six Buys, three Holds, and zero Sell ratings. The average WOOF stock price target is $6.78, implying 93.4% upside potential.

The Takeaway: Bears Should Probably Stay Away from WOOF Stock

As stated earlier, WOOF stock already suffered a catastrophic loss this year. If you wanted to short Petco, you should have done it earlier. With institutional traders seemingly no longer interested in this trade, it’s quite possible only retail bears are speculating against WOOF. If that’s the case, the security may be acutely vulnerable to a short squeeze.