In the United States, the increasing trends of pet adoption and people’s willingness to spend more on their pets have given rise to higher demand for pet food and wellness products and services.

According to a Fortune Business Insights report, the pet food market is expected to be worth $127.21 billion by 2027, exhibiting a compounded annual growth rate (CAGR) of 4.6% between 2019 to 2027.

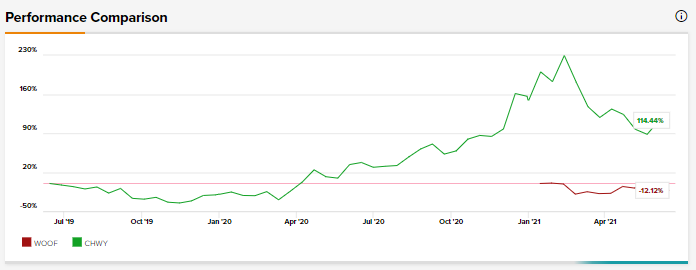

Using the TipRanks Stock Comparison tool, let us compare two pet food companies, Petco Health and Wellness Company and Chewy Inc., and see how Wall Street analysts feel about these stocks.

Petco Health and Wellness Company (NASDAQ : WOOF)

Petco Health and Wellness Co. has a comprehensive product portfolio and services offering. The company’s products include pet food, supplies and supplements. WOOF also offers professional grooming, training and veterinary services.

The company sells its products and services through its digital channels and through a strategic physical network of pet care centers. Currently, Petco operates around 1,500 pet care centers across the U.S., Puerto Rico and Mexico.

In the first quarter, WOOF reported adjusted earnings of $0.17 per share, topping Street estimates of $0.09. A loss of $0.07 per share was reported in the same quarter last year. The company posted net sales of $1.41 billion, a jump of 27% year-over-year, beating analysts’ expectations of $1.27 billion. Comparable sales growth was 28% during the quarter.

The company raised its guidance for FY21 following its record Q1 results. In FY21, the company expects revenues to land between $5.475 billion and $5.575 billion and has forecast adjusted EPS to be in the range of $0.73 to $0.76 per share, versus previous guidance of $0.63 to $0.66 per share.

Following the earnings release, Wells Fargo analyst Zachary Fadem reiterated a Buy with a price target of $30 (31.3% upside) on the stock. Fadem commented on the Q1 results, “All in, Q1 results should add further credibility to the narrative that WOOF has considerably improved its competitive position, the underlying category is strong/stable (despite lingering concerns), and the company’s multi-channel initiatives are resonating. With a +4%/+6% increase in the FY21 sales/EBITDA outlook now in the base, we continue to see a very achievable/beatable model for FY21.”

In Q1, WOOF added a record 1.2 million net new customers. Spend per pet increased 5% year-over-year. The company is planning to expand its premium food brand, Just Food for Dogs, to around 300 additional locations in Q2.

WOOF stated at its earnings call that its market share in the digital channel is up by around 50% year-over-year and the company added, “As we lapped the large pandemic related growth in April of 2020, retention of these large COVID cohorts is roughly in line with previous historic cohorts, demonstrating the stickiness of our model.” (See Petco Health and Wellness Co. stock analysis on TipRanks)

Petco believes that its 1,453 Pet Care Centers micro distribution points gives it a strategic advantage over its pure-play digital competitors, as these centers help the company reach the customer at a lower cost than when it ships from a digital channel. Currently, the company’s Pet Care centers fulfill around 83% of orders from Petco.com.

WOOF said at its earnings call that this year, it “plans to do a few of these small one or two vet practice tuck-in acquisitions, where we will move them into our pet care centers, gain learnings and then determine how best to integrate this approach into future plans.”

Consensus among analysts on Wall Street is a Strong Buy based on 5 Buys and 1 Hold. The average analyst WOOF price target of $29.40 implies approximately 28.7% upside potential to current levels.

Chewy (CHWY)

Chewy, Inc. is an online retailer of both its proprietary brand and third-party brand of pet foods and related products. The company generates revenues through sale of these products and shipping fees.

In Q1, CHWY reported solid first quarter results, driven by an increase in active customers, although supply disruptions and labor shortages pulled down the company’s top line. The company posted revenues of $2.14 billion, an increase of 31.7% year-over-year, while earnings for the quarter stood at $0.09 per share, compared to a loss of $0.12 per share reported in the prior-year period.

At the end of Q1, the company had 19.8 million active customers, an increase of 31.6% year-over-year. CHWY has increased its active customer base by 75% over the past two years.

The company explained further on its earnings call, “…our customers historically spend over $400 with us in their second year compared to approximately $700 in their fifth year and almost $900 in their 9th year. As such, we believe that we still have significant future share of wallet gains left to realize from a substantial component of our customer base.”

In Q1, CHWY’s net sales per active customer (NSPAC) rose 8.7% year-over-year to $388. CHWY has also entered into fresh and prepared pet food space with Freshpet and its premium proprietary brand, Tylee’s.

The company is expanding its healthcare service offerings for pets. Those offerings include a pharmacy, a telehealth service called “Connect with a Vet,” and Petscriptions, a proprietary prescription management system.

Petscriptions allow pet owners to order customized, pharmaceutical grade, prescription medications. According to Chewy, this channel is proving to be a strong recurring driver of revenues, with currently 60% of its shipments being delivered through the company’s Autoship subscription program.

CHWY is targeting a reduction in shipping times and costs through the expansion of its fulfillment center in Arizona, and intends to open a third automated fulfillment center in Nevada next year. (See Chewy Inc stock analysis on TipRanks)

Following the earnings release, Wells Fargo analyst Brian Fitzgerald assigned a Buy with a price target of $120 (55.4% upside) on the stock. Fitzgerald noted in his research note to investors, “We continue to believe CHWY’s wallet/market share gains will persist as newly acquired customers (42% of total customer base acquired within last two years) continue to move along their LTV [long term value] timeline.”

He added, “Continued progress with new initiatives, particularly in pet health & wellness, remain compelling, in our view, as some of these endeavors are still in relatively nascent stages.”

Consensus among analysts on Wall Street is a Moderate Buy based on 10 Buy and 4 Hold ratings. The average analyst CHWY price target of $103.27 implies approximately 33.7% upside potential to current levels.

Bottom Line

It is important here to note that while Chewy is an online retailer of pet foods and health services for pets, Petco is a brick-and-mortar as well as an online retailer of pet services.

While analysts are cautiously optimistic about CHWY, they are bullish about WOOF. However, based on the upside potential over the next 12 months, CHWY seems to be a better Buy.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.