PepsiCo (NASDAQ:PEP) is one of these “safe-haven” stocks on which investors can comfortably rely no matter how uncertain the underlying economic situation is. The company has proven its resilience through decades of rising revenues, profits, and dividends in the face of all sorts of recessionary and uncertain economic environments.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

While the current market situation may not entail a recession, investors find themselves treading cautiously on the delicate balance between mounting interest rates and inflation — factors that could potentially trigger economic setbacks. In light of this, PepsiCo emerges as a prudent choice for individuals seeking insulation from potential future obstacles.

That said, it appears that PepsiCo could be best suited for conservative investors who prioritize stability over market-beating returns. The company’s reputation as a dependable “safe-haven” stock has led to its shares commanding a substantial valuation, potentially placing a cap on investors’ overall return prospects. Consequently, I am neutral on the stock.

A Resilient Product Portfolio That Drives Robust Results

PepsiCo boasts an extensive and impressive collection of globally recognized brands within its vast portfolio. This remarkable assortment includes renowned names such as Pepsi, Doritos, Quaker, Cheetos, and Mountain Dew, among many other household favorites.

With such a mature portfolio of consumer staples, the company consistently generates reliable revenues that are minimally influenced by the overall market’s fluctuations. Despite recent inflationary pressures and the possibility of rising interest rates, which have investors worrying about a potential decline in consumer spending, PepsiCo remains well-positioned.

This is primarily due to the fact that consumers are likely to prioritize reducing expenditures on discretionary goods and services before cutting back on their beloved beverages and snacks. We have seen this theme hold true multiple times throughout the decades, with PepsiCo driving growing sales during the Great Financial Crisis, the COVID-19 pandemic, and the current highly-inflationary landscape.

Despite PepsiCo’s recent price increases, consumers remain unfazed, leading to a remarkable upswing in financial performance and robust organic growth. The company’s most recent Q1 results vividly exemplify this prevailing trend. Revenues advanced by 10.2% year-over-year to $17.8 billion, even managing to record an acceleration from the prior-year period’s Q1 revenue growth of 9.3%.

Remarkably, PepsiCo achieved an impressive organic revenue growth rate of 14.3%, showcasing the resilience and enduring brand value of its products. In fact, PepsiCo’s outstanding performance showed market share gain regarding both macro-snack and savory snacks, particularly in emerging markets.

Notably, in Africa, the Middle East, and South Asia, PepsiCo experienced an impressive year-over-year organic revenue surge of 29%. Latin America, another emerging market for PepsiCo, also reported satisfactory organic revenue growth of 16%.

In terms of profitability, PepsiCo once again impressed, with Core constant-currency EPS rising by 18% as the company mitigated the impact of inflationary forces by concentrating its efforts on holistic cost management initiatives and revenue management capabilities.

With PepsiCo beating its own previous expectations, management raised its forecast for the year. They are now expecting the company to post organic growth of 8% (up from 6% previously) and 9% growth in Core earnings per share (up from 8% previously). In my view, these could be modestly conservative estimates, as the company seems to be charging ahead with a much stronger momentum. Still, it makes sense for management to retain a reasonable margin of safety regarding their projections.

Dividends, Buybacks, and Valuation

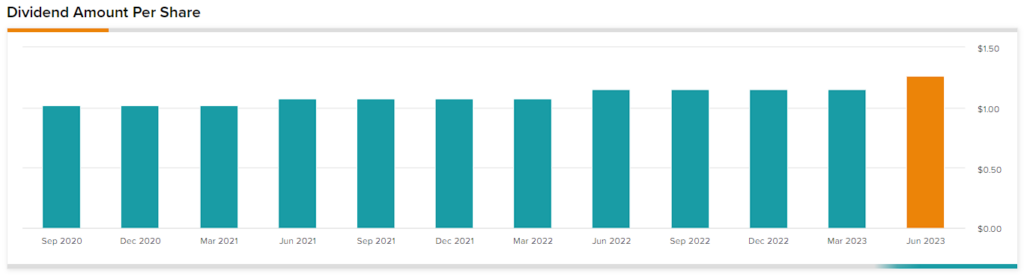

PepsiCo’s unwavering ability to deliver growing revenues and profits allowed the company to continue rewarding shareholders with expanding capital returns. Management expects that PepsiCo will return roughly $7.7 billion to shareholders, including $6.7 billion in dividends and $1.0 billion in share buybacks.

Although it may not appear as an overwhelmingly substantial total capital return at first glance for such a large company, it remains a commendable tangible return, especially considering the highly-resilient nature of the company and the significant reduction in uncertainty associated with it.

This is evident in the fact that the seemingly “modest” combined yield is a result of a high share price, which, in turn, stems from investors’ willingness to pay a premium for PEP stock. This premium is a testament to PepsiCo’s recession-proof qualities and the trust placed in the company’s ability to weather economic downturns. After all, don’t forget that PepsiCo has increased its dividend annually for the past 51 consecutive years.

Is PEP Stock a Buy, According to Analysts?

Turning to Wall Street, PepsiCo has a Moderate Buy consensus rating based on seven Buys and six Holds assigned in the past three months. At $197.67, the average PepsiCo stock price target suggests 7.6% upside potential.

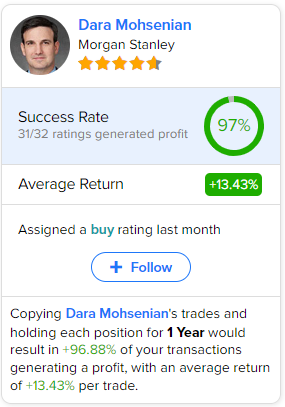

If you’re wondering which analyst you should follow if you want to buy and sell PEP stock, the most accurate analyst covering the stock (on a one-year timeframe) is Dara Mohsenian from Morgan Stanley, with an average return of 13.43% per rating and a 97% success rate. See below.

The Takeaway

PepsiCo stands out amid the ongoing economic uncertainty, possessing a range of exceptional qualities. Foremost among these is the company’s diversified portfolio of iconic brands, which ensures the generation of resilient cash flows regardless of how the macro environment unfolds.

This has been reaffirmed by management’s guidance, instilling further confidence. Furthermore, PepsiCo’s well-established track record of delivering impressive capital returns continues to strengthen the investment case for its stock.

However, it is worth noting that the stock’s elevated valuation may potentially curtail future shareholder returns. Currently trading at a forward P/E ratio of over 25x, the stock exceeds its historical average range of 18-22x.

Again, this is somewhat justified, as investors have enthusiastically embraced PepsiCo shares due to the company’s exceptional attributes in an uncertain environment. Still, it could limit investors’ potential for market-beating returns moving forward, as the risk of a valuation compression toward its historical average is always a possibility, particularly with interest rates on the rise.