PepsiCo, Inc. (PEP) is a diversified food and beverage colossus whose vast portfolio comprises some of the world’s most well-known brands. These include Pepsi, Doritos, Cheetos, Mountain Dew, and Quaker, among many other household names.

Due to the company operating in the consumer staples sector and owning a mature-brand portfolio, PepsiCo produces highly predictable and stable financials that are largely uncorrelated with the underlying performance of the overall market.

This has been demonstrated several times during recessions and was once again the case during the COVID-19 pandemic. Even during the violent correction that a great number of stocks have experienced year-to-date, PepsiCo’s shares have held their ground quite firmly. I remain bullish on the stock.

Rock-Solid Results

PepsiCo’s performance came in robust once again during its latest results, with the company posting exceptional financials. Revenues grew by 12.4% year-over-year to $25.2 billion in Q4, wrapping up FY 2021’s sales to a new all-time high of $79.4 billion.

Organic revenue growth was 11.9%, underlining the strength of PepsiCo products’ brand value, which enabled PepsiCo to efficiently gain market share in emerging markets.

In Africa, the Middle East, and South Asia, full-year revenues grew by 33% year-over-year. Emerging markets should continue to represent a tremendous growth avenue for the company in the medium term.

Following an excellent FY 2021, management now expects to achieve organic revenue growth of 6% and core constant currency EPS growth of 8% year-over-year in FY 2022.

It’s worth mentioning that aside from the growing top line and economies of scale, EPS growth is aided notably by PepsiCo’s consistent share repurchases.

A Capital-Return Machine

Speaking of stock repurchases, PepsiCo’s broad capital returns have been outstanding, driving remarkable shareholder value over the years.

PepsiCo announced a new share repurchase program, aiming to buy back up to $10 billion of PepsiCo common stock through February 28, 2026. The company also counts 50 consecutive years of annual dividend hikes, which means it has rightfully attained its place amongst the elite group of Dividend Aristocrats.

Despite its extended dividend growth record, the rate of DPS growth remains quite significant. The latest DPS hike was 7%, implying an acceleration from the previous hike of 5.1%. Yet, the company has preserved a very comfy payout ratio relative to the underlying EPS.

Specifically, the current annual dividend of $4.60 per share implies a payout ratio of around 69%, against management’s FY 2022 EPS guidance of about $6.67.

Believing that the company’s organic growth should be maintained in the medium-to-long term, PepsiCo’s dividend growth prospects remain quite attractive.

Wall Street’s Take

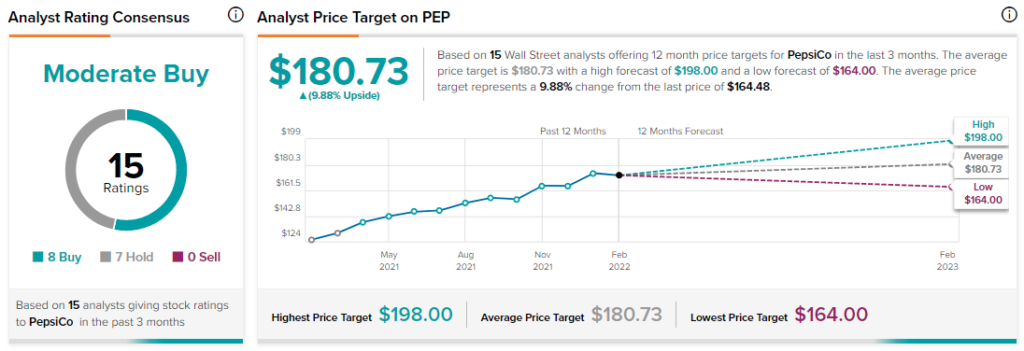

Turning to Wall Street, PepsiCo has a Moderate Buy consensus rating, based on eight Buys and seven Holds assigned in the past three months. At $180.73, the average Pepsi stock forecast suggests 9.9% upside.

Conclusion

Overall, PepsiCo showcases several competitive advantages, including a diversified portfolio of well-established brands, and global scale capabilities.

This assures optimal shelf space at retailers and decisive pricing power over smaller competitors. The company also retains the needed financial flexibility and expertise to acquire and incorporate any competitor brands into its own portfolio.

In my view, PepsiCo’s performance during FY 2021 remained exceptional, with vigorous organic growth reassuring investors of the overall portfolio’s brand power. Amid growing capital returns and strong expansion prospects in emerging markets, I remain bullish on PepsiCo.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure