Penn National Gaming (PENN), an online sports betting operator, will release third-quarter 2021 earnings after the market closes on November 4.

Despite the fact that the COVID-related closures had a significant negative impact on revenues and profitability in 2020, Penn rebounded strongly in 2021. The firm performed admirably in Q2, with top-line growth of 406% year-over-year and adjusted profitability of $1.17 per share, significantly exceeding the preceding year’s loss of $1.69 per share.

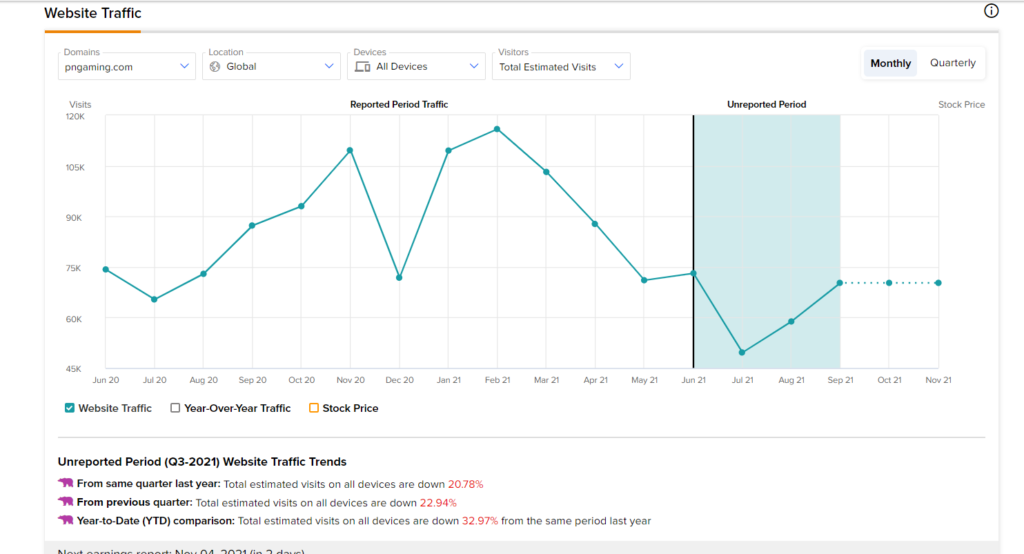

Investors should be aware that the rise or decline in website traffic is a critical measure for an online sports betting firm like Penn. It will primarily assist investors in determining how good Penn is at generating more visitors to its website.

So, using TipRanks’ Website Traffic tool, which analyzes website traffic volume data provided by Semrush (SEMR), we’ll try to glean some useful information about the gaming behemoth ahead of its Q3 print.

See Analysts’ Top Stocks on TipRanks >>

Declining Website Traffic Numbers

As we probed deeper into the statistics, the website traffic patterns appeared to be dismal for Penn. The total number of unique visitors using all devices in 3Q21 was 115,000. This figure was down 25.29% from the year-ago third quarter.

Next, on a quarter-to-date basis, the number of total visitors declined 20.78% to 178,800 during the period of July 2021 – September 2021, against the same period last year.

Now, when we look at the number of total unique visits to Penn’s website on a year-to-date basis, we again notice a decrease of 32.97% from January to September 2021, compared to the same time last year.

Why are Traffic Numbers Falling?

One concern that investors may have is why this company’s internet traffic has decreased.

I believe that the gaming industry’s fierce competitiveness is a major contributor to traffic congestion. Various casinos, video lottery, tavern gaming, and other online wagering businesses compete fiercely with Penn National Gaming.

Nonetheless, Penn should be able to improve efficiency and customer service, and thus traffic visits in the future. That’s due to a variety of factors: sports betting becoming legal in more states, coronavirus fears dissipating, strength in the company’s Barstool Sports bars and sportsbooks, growth-driven acquisitions, and a greater focus on the new generation of cardless, cashless, and contactless technology, collectively known as the 3C’s.

Investors will be watching to see how the firm performs this quarter and what management has to say about the company’s future plans.

Analyst Recommendations on PENN

Ahead of the Q3 earnings announcement, Morgan Stanley analyst Thomas Allen initiated coverage on the stock with a Hold rating and a price target of $85.00.

Penn’s long-term growth prospects remain positive, according to Allen. However, he cautions that there are dangers to be aware of.

“We see PENN as a key beneficiary of the inflection in growth of US casino revenue and the legalization of US sports betting,” Allen said. He also anticipates “PENN’s Regional revenues” and “property EBITDAR margins” to continue to grow in the future.

The five-star expert, on the other hand, feels that the company lacks the essential technological infrastructure to compete with the main sports betting firms.

Turning to the rest of the Street, Penn National Gaming has a Moderate Buy consensus rating, based on 8 Buys, 3 Holds, and 1 Sell assigned in the past three months. At $94.58, the average Penn National Gaming price target implies 32.1% upside potential.

Disclosure: At the time of publication, Shalu Saraf did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.