Shares of interactive exercise equipment maker Peloton (PTON) are looking to test new lows at around $19. It’s been such a massive fall from grace for a company that investors could not get enough of through most of 2020.

Against unfavorable comparables, the stock eventually crumbled, surrendering all of its massive pandemic gains. Though there was chatter about a potential acquirer stepping in, such talks have since faded, and there has not been much to keep the fallen pandemic darling from backpedaling further.

I am bullish on the stock, primarily due to the severely depressed valuation.

Peloton Stock’s Downhill Slide Continues

Peloton stock is now down a grand total of 88% from its all-time high just north of $160 per share. Such a high is unlikely to be seen again over the next decade. Regardless, the $6.8-billion stationary bike maker does have some growth levers it can pull to put the brakes on the stock’s massive roll downhill.

With the massive layoff of 2,800 employees in the books, it seems as though the company has lost its way. After such a shocker, it will be tough for the firm to attract talent in the near future.

What separates Peloton from most other equipment makers is its ability to innovate. With product markdowns and layoffs, cost-cutting initiatives may have cut too deep.

R&D is likely the only wild card that can help propel Peloton above $50 again. Still, I wouldn’t rule out the possibility of an acquirer stepping in at these valuations.

There’s a lot of intangible value in the Peloton brand, and its many subscribers that could prove sticky over the long haul. Such an addition is sure to bolster any company’s service revenue stream.

For now, Peloton stock’s default move looks to be lower, which will continue to be a problem for dip-buyers who jump in without a catalyst in mind. As the company pursues other growth opportunities, it also risks sticking its hand in too many pies.

Regardless, the valuation has been reset so sharply, and the stock has already been made an example of. Though Peloton’s path forward may be less clear, the bar has been set so low that I don’t think it will take much for shares to spike on a better-than-feared result.

At 1.5 times sales, it’s difficult to be bearish on the former tech darling that could be approaching deep-value territory.

Peloton’s Outlook Seems Bleak

As a retailer of big-ticket discretionary goods, Peloton could see salt rubbed into its wounds if the U.S. Federal Reserve’s rate hikes were to experience a harder-than-expected landing.

There just isn’t much demand for pricey stationary bikes when times are tough. Further, recession-driven demand destruction could hurt Peloton’s ability to navigate through inflationary pressures.

Peloton has made a brand for itself, but it’s not at a level that gives me confidence about the firm’s ability to pass on higher costs to its consumers.

If anything, Peloton may need to introduce further markdowns on its products in the face of higher prices.

That doesn’t bode well for margins, but the key to long-term growth could lie in the firm’s subscriber base. In a way, Peloton may be more of a tech stock, and less of a retailer of durable goods.

Anything to Look Forward To?

In the long term, there is a path higher if Peloton can innovate to differentiate itself from new entrants in the interactive fitness space.

Still, Lululemon (LULU) and other players like Tonal could take a stride out of Peloton’s step as they push forward with their own offerings.

Peloton can expand into resistance training, yoga, or boxing in search of growth beyond its current lineup. Still, the environment is getting competitive such that any such lateral moves are likely to be met with only margin-eroding sales growth.

Until Peloton can be valued more on its userbase, rather than on hardware sales, such growth is unlikely to be appreciated by Wall Street. Not with rates rising as quickly as they are.

Wall Street’s Take

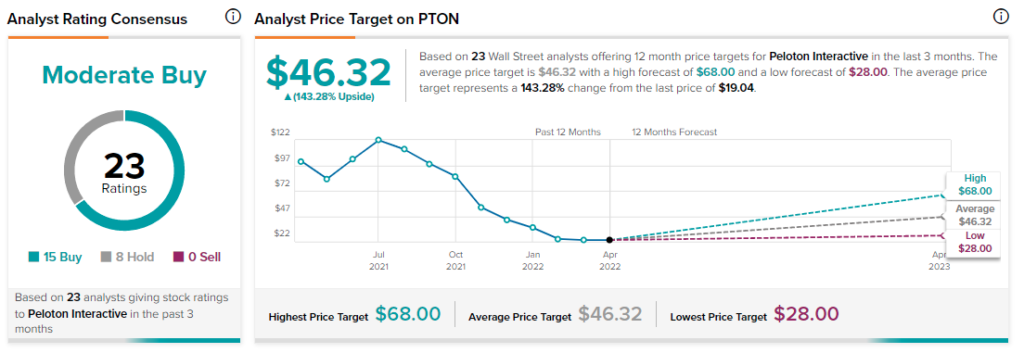

According to TipRanks, PTON stock comes in as a Moderate Buy. Out of 23 analyst ratings, there are 15 Buy recommendations, and eight Hold recommendations.

The average Peloton price target is $46.32, implying 143.3% upside potential. Analyst price targets range from a low of $28 per share to a high of $68 per share.

Bottom Line on PTON Stock

There are challenges ahead, but if Peloton can overcome them, the upside could have the potential to be sizeable. As Fed rate hikes weigh on economic growth, things could get more challenging over the near term.

That said, over the longer term, Peloton has a lot of runway to expand into new verticals, and bolster its userbase. Further, Peloton may still be appealing as a potential takeover target.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure