The last couple of days have been no fun to own Peloton Interactive (PTON) stock, as successive news media reports detailed a gathering crisis at the maker of “interactive” exercise bicycles and treadmills.

On Wednesday, Business Insider reported that Peloton may need to lay off more than 40% of its sales and marketing staff in an effort to cut costs. One day later, CNBC reported that the company is also planning to halt production of bikes and treadmills for anywhere from six to eight weeks, in an effort to bring its inventories into balance with decreasing demand for Peloton products.

Oh, and Peloton stock closed down nearly 24% on Thursday.

Not to worry though. True, Peloton stock sold off pretty hard in ordinary trading hours, but after-hours, management released preliminary earnings for fiscal Q2 2022 — and that news wasn’t so bad. As Peloton described, “Connected Fitness Subscriptions” for its services fell a bit short of guidance at 2.77 million subscriptions at quarter-end. Regardless, revenues for the fiscal second quarter came in near the middle of its previously predicted range — $1.14 billion for the quarter. Churn was modest at just 0.8%. Best of all, losses (technically, “adjusted earnings before interest, taxes, depreciation, and amortization”) were smaller than expected.

Management thinks that by the time it has its final results nailed down and reported on February 8, they will show an adjusted EBITDA loss of no more than $270 million, versus a previously guided range of from $325 million to $350 million. As management explained, it is busy “taking significant corrective actions to improve our profitability outlook and optimize our costs across the company” — and as the new profits forecast suggests, these efforts are already bearing fruit in the form of lower losses.

Peloton’s earnings preannouncement prompted Baird’s Jonathan Komp to issue a “flash report” on the company Thursday evening. In it, the 5-star analyst explained why he is maintaining his “outperform” rating on Peloton’s struggling stock, and his $70 price target on the $26 stock. Should the target be met, investors are looking at returns of ~190% in the year ahead. (To view Komp’s track record, click here)

“After chasing growth for years,” wrote Komp, Peloton “has developed a bloated corporate expense waistline” that needs to slim down. If the media reports this week are true, Komp thinks that raising prices on Peloton products (extra charges for delivery and set-up of both bikes and treadmills were discussed earlier this week), and “potential headcount/cost reductions,” would both “be consistent with prior directional commentary and guidance calling for a return to positive adjusted EBITDA in fiscal 2H22.”

In total, Komp calculates that Peloton has added about $500 million to $600 million to its annual cost structure over the past couple years, “ballooning” its payrolls and building out showrooms (and adding lease expense) unnecessarily. It’s probably too late to reverse all this spending and turn Peloton GAAP profitable this year, calculates Komp. But were the company to even start to reverse all this spending, that would be a move in right direction — and help make Peloton stock look like more of a “buy” than it does today.

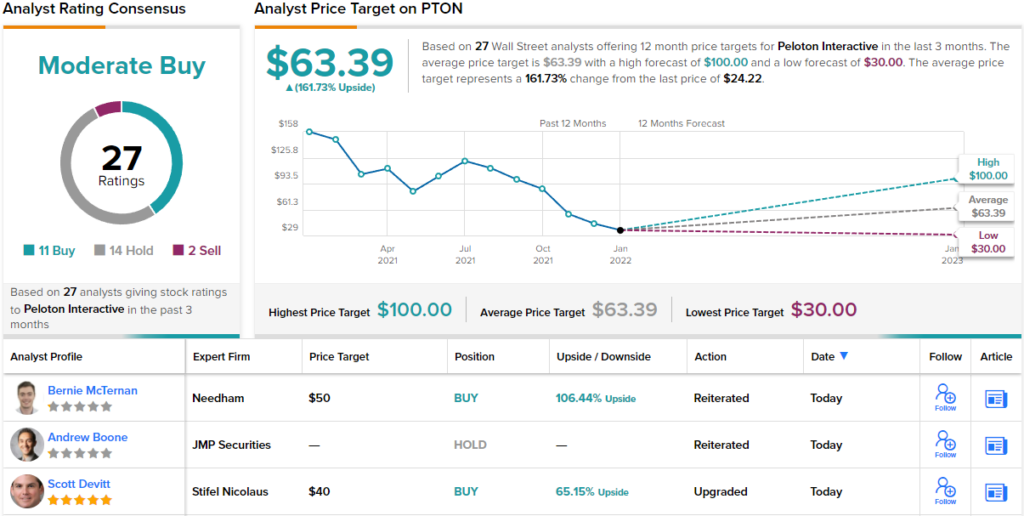

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 11 Buys, 14 Holds and 2 Sells add up to a Moderate Buy consensus. In addition, the $63.39 average price target indicates ~162% upside potential. (See PTON stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.