Peloton Interactive (PTON) stock has continued backpedaling in recent weeks, alongside many other lockdown plays.

Indeed, many companies that shined during last year’s lockdowns are quickly surrendering the gains back to the hands of Mr. Market, as they struggle to hold up against some very unfavorable year-over-year and even quarter-over-quarter comparables.

Despite the marked-down valuation in shares of PTON, I am bearish on the stock. Why? Reopening headwinds (people heading back to the gym) could persist going into an environment where budgets for big-ticket discretionary goods, like stationary bikes, fade further.

Will Analysts Keep Their Original Price Targets?

Given such profound headwinds and margin-eroding negative catalysts, analysts may need to downgrade their price targets or Buy ratings over the coming months and quarters.

The stock has fallen hard and very fast such that original price targets (the current consensus $83.80 price target implies over 70% in upside) may now be too far out of reach unless Peloton can pull the curtain on a strategic plan to get back to the top, as the home fitness space gets that much more crowded.

Investors have not spared companies that have been on the receiving end of analyst downgrades, even after steep losses fall into the rearview mirror. The new year will be full of challenges, and it becomes tough to evaluate a company as it faces its first “perfect storm” of headwinds as a publicly traded entity.

Peloton now trades at around four times sales. Such a multiple suggests pain ahead, both via unfavorable industry trends and a pick-up in competition. If Peloton is unable to innovate, such a multiple could be more than warranted.

Can Peloton Innovate its Way Out of Trouble?

Investors and analysts all knew that pandemic tailwinds wouldn’t last forever. That’s a major reason why lockdown stocks like Peloton have been treading water for quite some time.

At this juncture, it certainly seems as though the fading of pandemic tailwinds were less benign than expected. The real question on investors’ minds moving forward is if lockdown plays like Peloton can bounce back after a slump that could make up for that drastic pull forward in demand experienced for most of 2020.

Should Peloton flex its muscles with some sort of technological offering or surprise M&A deal, the company could make a case for why it deserves a better price-to-sales multiple.

Sure, stationary bike and treadmill sales are the company’s bread and butter. Still, subscriptions could be key to Peloton’s real long-term growth, especially if it can invest in technological initiatives to ease a transition into the next frontier that could allow for subscription price increases.

Could Peloton Pedal Into the Metaverse Next?

As a part of Mark Zuckerberg’s Meta Platforms’ (FB) much-watched presentation that included a name change, he outlined the potential for genuinely immersive exercise experiences in the metaverse. It seems far-fetched, but Peloton is a company that could make a mark on such a niche of tomorrow’s metaverse.

Undoubtedly, many companies are capitalizing on the metaverse buzzword with plans of their own. If Peloton can commit a greater chunk of investments towards software development and next-generation experiences while being able to deliver the absolute best hardware product, Peloton stock deserves to be looked at as a technology company, not just a mere seller of fitness equipment.

Today, Peloton is on the receiving end of a challenging macro environment and quickly reversing trends. In a few years from now, Peloton bikes may be viewed as more of a computer, fully equipped with innovative technologies.

Wall Street’s Take

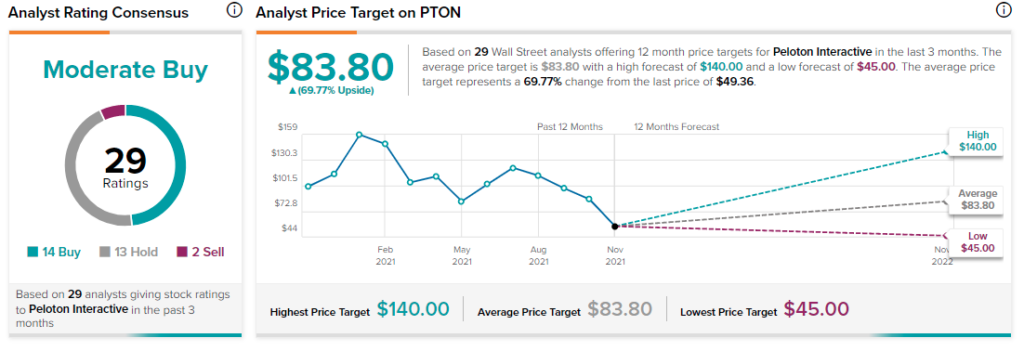

According to TipRanks’ analyst rating consensus, PTON stock comes in as a Moderate Buy. Out of 29 analyst ratings, there are 14 Buy recommendations, 13 Hold recommendations and two Sell recommendations.

The average Peloton price target is $83.80. Analyst price targets range from a low of $45 per share, to a high of $140 per share.

Disclosure: Joey Frenette doesn’t own shares of any mentioned companies at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.