After underperforming the broader market averages for several months, shares of PayPal Holdings (NASDAQ: PYPL) bounced back 18.4% in the last five trading days. Despite the recovery, PYPL stock is still down over 57% in six months.

The migration of eBay’s (NASDAQ: EBAY) payments, challenges stemming from the pandemic, the slowdown in e-commerce growth, and supply-chain headwinds took a toll on PayPal stock.

Now What?

While PayPal stock has witnessed a sell-off, MoffettNathanson analyst Lisa Elis sees this decline in PayPal stock as an opportunity to buy. Elis expects the strength in the U.S. market, launch of new services, and recovery in the international markets to support PayPal stock.

Elis has a Buy recommendation on PYPL stock, and she expects the company to achieve a 20% revenue growth target in the medium term.

It’s worth noting that PayPal is focusing more on driving engagement. The company is transitioning towards a higher return on investment model, which is focused on retaining high-quality customers. It means that PayPal is concentrating on driving more average revenue per user.

This could hurt the growth in the new active accounts and lead to higher churn, noted Trevor Williams of Jefferies.

Unlike Elis, Williams lacks confidence in PayPal to sustain a +20% growth rate in the future, limiting multiple expansion, which is why the analyst has a Hold recommendation on PayPal stock.

However, Williams expects e-commerce and digital wallet penetration to reaccelerate in the second half of 2022, which would benefit PayPal.

Bottom Line

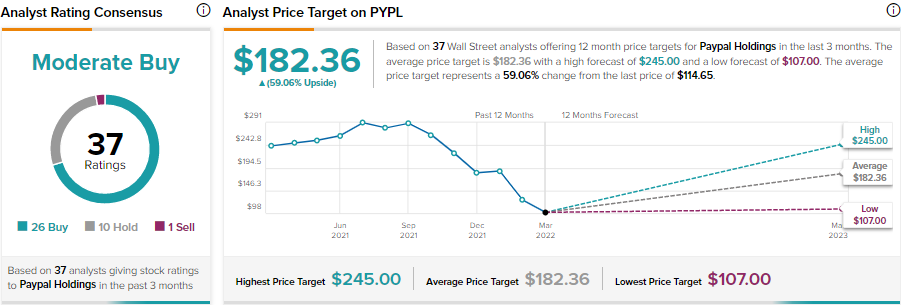

Given the significant correction in its price, PYPL’s stock price forecast on TipRanks shows stellar upside potential. PayPal’s average price target of $182.36 indicates 59.1% upside potential from current levels.

PayPal stock will benefit as eBay’s drag diminishes, year-over-year comparisons normalize, and new offerings and initiatives begin to contribute to its financials. Its strong competitive positioning, deal with Amazon (NASDAQ: AMZN), and growth opportunities in the BNPL (buy now pay later) segment are positives.

However, the short-term headwinds keep Wall Street analysts cautiously optimistic on PYPL stock. It has received 26 Buys, 10 Holds, and one Sell recommendation for a Moderate Buy consensus rating.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure