Shares of fintech behemoth PayPal (PYPL) went from worthy tech stock to virtually untouchable over a very short timespan. The payments player has shed around 77% of its value amid economic headwinds and rising competition. Undoubtedly, the fintech boom got a bit out of hand in 2021, when many Buy-Now Pay-Later (BNPL) firms hit the scene with their new issues.

Now that the payments stocks have gone bust, PayPal stock actually seems like an exciting value play. While growth may grind to a slowdown over the medium term, with rivals still hungry for its slice of the pie, I do find it tough to pass up the stock while it’s trading at levels below the bottom of the 2020 market crash.

Sure, fintech isn’t nearly as lucrative as it seems, given the magnitude of disruption by some of the smaller, up-and-coming firms out there. I’d say the payments space is comparable to the video-streaming market in that the formerly “growthy” market has become too crowded and too mature for growth-focused investors.

As competitive pressures weigh on margins while economic sluggishness weighs on sales growth, PayPal seems to be out of options. There aren’t that many catalysts to get excited about, as the consumer recession looks to worsen in the back half of the year.

Despite all the negatives, I am neutral on PayPal stock, primarily due to the enticing valuation. CEO Dan Schulman is a very capable leader, and the firm is well-positioned to out-innovate many of the disruptive forces, as the tides change in the tech seas.

Though it would be nice to have some catalysts on the horizon, the unprecedentedly-depressed multiple in the stock may be more than enough reason to give the firm the benefit of the doubt. Much of the punishment may have already been doled out by Mr. Market. Much of Wall Street seems to think so, with a “Strong Buy” overall rating on the name.

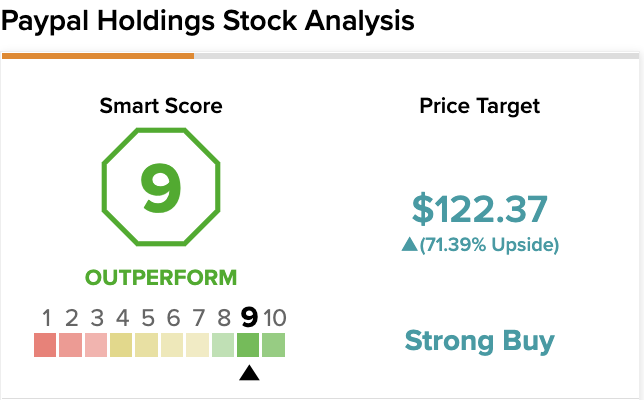

On TipRanks, PYPL scores a 9 out of 10 on the Smart Score spectrum. This indicates a high potential for the stock to outperform the broader market.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, PYPL stock comes in as a Strong Buy. Out of 31 analyst ratings, there are 25 Buy recommendations, five Hold recommendations, and one Sell recommendation.

The average PayPal price target is $122.37, implying an upside of 71.4%. Analyst price targets range from a low of $80 per share to a high of $180 per share.

PayPal Needs a Disruptive Differentiating Technology

Markets are forward-looking. And right now, there’s not a heck of a lot to look forward to when it comes to PYPL stock. The pandemic-driven digital payments boom has reversed in a violent way. The boom has turned into a major bust that could be exacerbated by a coming recession.

Indeed, PayPal needs to innovate or run the risk of losing considerable share to some scary rivals, both big and small.

It’s not a mystery that PayPal has its sights set on e-commerce to jolt its payments. This may not be enough, though. Retail sales are at the mercy of the coming economic slowdown. And there hasn’t been much in the way of payments innovation that can help differentiate PayPal from its hungry peers.

There’s only so much innovation you can put into payments these days.

Buy-Now Pay-Later may have been viewed as an intriguing payment technology innovation. However, it may be just a feature for the times. As convenient as BNPL offerings are for certain consumers, it’s not innovative enough to give any single company the edge. Now that consumers are beginning to put away their wallets, I think many BNPL firms are discovering this.

Many companies in the payments game, including PayPal, have installment-based payments services of their own. But as BNPL hype fades, PayPal needs something more durable to defend its turf.

Unless PayPal acquires a bank charter or a social-media firm, it may not be able to maintain the width of its moat.

Apple and Amazon Target Digital Payments

Even Apple (AAPL) is getting in on the action with its “Pay in Four” product integrated with Apple Pay. In terms of network effects, it’s virtually impossible to beat Apple, given its legendary ecosystem that’s proven difficult to replicate.

While PayPal is a top payments partner, things could change as big tech looks to get a bigger cut of the digital payments pie.

Apple isn’t the only firm looking to make a big splash in e-commerce payments. E-commerce behemoth Amazon (AMZN) plans to kick its online payments service into high gear as it doubles down on its “Buy Now With Amazon Prime” service.

Amazon’s exclusive new service doesn’t just offer payment processing; it provides logistical services and warehouse storage for its retail clients. With payments, storage, and logistics bundled together, Amazon’s disruptive impact on the payments space could have the potential to be unprecedented.

The scary thing for PayPal is that the “Buy with Amazon Prime” service is in its infancy. The magnitude of its disruption on payments could be severe.

The Bottom Line on PayPal Stock

Just how much of the treacherous road ahead is baked into PayPal stock after its vicious crash?

It’s tough to say. There doesn’t seem to be any relief ahead, and as Amazon and Apple ramp up their digital payment efforts, things could have the potential to get really ugly for the incumbents in the payments space.

Pending a transformative acquisition, I think it’s too soon to call a bottom in PayPal stock.

Read full Disclosure