PayPal Holdings (PYPL) is a digital payments platform that enables its customers to send and receive payments. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, iZettle, and Hyperwallet products.

With the stock price falling significantly from its highs, and an attractive 21.4x price-to-free cash flow valuation multiple, we are bullish on the stock.

Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating the earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value can be measured using total asset value. If earnings power value is higher than reproduction value, then a company is considered to have a competitive advantage.

The calculation is as follows:

EPV = EPV adjusted earnings / WACC

$56.6 billion = $4.814 billion / 0.085

Since PayPal has a total asset value of $75 billion, we can say that it does not have a competitive advantage. In other words, assuming no growth for PayPal, it would require $75 billion of assets to generate $56.6 billion in value over time.

However, PayPal does have a big redeeming quality — brand recognition. The calculation above is a theoretical measure of competitive advantages, but a strong brand is a real advantage that is very difficult to achieve. PayPal is synonymous with secure online payments and the movement of money.

Indeed, the company’s business has performed very well over the years, consistently growing revenue and profit by double digits. In addition, analysts believe that this trend will continue going forward for the foreseeable future.

Growth Catalysts

PayPal has a few growth catalysts that will allow the business to continue thriving and ultimately have the share price follow. The company is a cash flow machine that prints money, with management guiding for around $6 billion in free cash flow for 2022.

Acquisitions have been a major part of PayPal’s growth strategy in the past, and the free cash flow will allow it to continue acquiring businesses that may potentially add strategic value.

Furthermore, the company actively engages in share repurchases. By reducing the number of shares outstanding, the earnings per share figures increase even if profits stay flat. Therefore, even the price-to-earnings multiple stays constant, the price per share increases.

With the share price absolutely collapsing from its highs, buybacks will be much more effective at boosting earnings per share as they will be able to buy more shares.

Risks

The main risk for PayPal is inflation. If consumers are forced to pay more for essential items like food and energy, then the level of discretionary spending is likely to go down.

Furthermore, there are risks with Russia’s invasion of Ukraine. If the conflict drags on longer than expected, it could drive inflation even higher, especially if Russia retaliates on the sanctions imposed by the West by stopping exports of commodities.

In addition, PayPal suspended business out of Russia in response to the invasion. Although this will impact sales, it’s important to note that only less than 1% of sales come from the country. Therefore, there will not be a material impact on operations.

Valuation

As mentioned earlier, we think PayPal’s 21.4x price/FCF multiple is attractive. If PYPL’s free cash flow for 2022 reaches analyst estimates of around $6.6 billion, this would bring its forward multiple down to under 18x.

When looking at earnings estimates for the next three years, earnings per share for 2022, 2023, and 2024 are expected to come in at $4.65, $5.83, and $7.15, respectively. These estimates imply forward earnings multiples of 21.2x, 16.9x, and 13.8x, respectively.

Compared to other fintech companies, PayPal is trading at a cheap valuation. Even compared to itself, the stock is historically cheap, as from July 2017 to the end of February 2020 (just before COVID-19 got serious), its forward P/E multiple ranged from 30-40x.

Although it is hard to forecast three years out, the estimates are definitely achievable for PYPL based on its past track record of steadily increasing earnings.

Wall Street’s Take

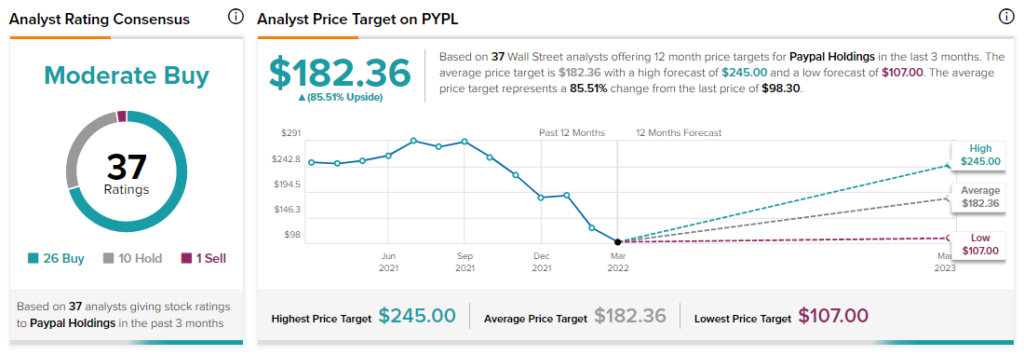

Turning to Wall Street, PayPal has a Moderate Buy consensus rating, based on 26 Buys, 10 Holds, and one Sell assigned in the past three months. The average PayPal price target of $182.36 implies 85.5% upside potential.

Final Thoughts

PayPal is a globally recognized brand with a very profitable business. In addition, with its valuation being very attractive, analysts see strong upside potential for the stock going forward. As a result, we are bullish on the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure