With the prospect of a recession representing a non-zero probability event, investors may initially want to consider a fast-food play like Papa John’s (NASDAQ:PZZA). As a provider of cheap but delectable food products, it stands to benefit from the trade-down effect. Unfortunately, shares have been volatile recently, raising concerns about greater pain ahead due to certain options trading dynamics. Therefore, I am bearish on PZZA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PZZA Stock Should Swing Higher, but It’s Not

Based on both the core business undergirding PZZA stock as well as its historical trend, Papa John’s should be a solid performer this year. In terms of bang for the buck, it’s hard to beat the fast-food brand, especially if it offers customer incentives. However, PZZA stock has fallen by 16% year-to-date, pointing to broader risks.

While the Federal Reserve remains committed to tackling the rise in consumer prices that has hurt sentiment across the board, inflation has been stubbornly high. Not only that, but the September jobs report came in hotter than expected, which means more dollars chase after fewer goods. Thus, it’s not unreasonable – it’s perhaps even likely – that the Fed will raise interest rates again.

Of course, rising borrowing costs impose their own distinct challenges. With consumers keeping their wallets closed for as long as possible, demand across multiple industries has waned. In turn, impacted enterprises will likely issue layoffs. Subsequently, people are seeking cheaper alternatives to common goods and services, meaning that the trade-down effect is in full bloom.

Under this scenario, PZZA stock should thrive. Following the initial shock of the 2008 financial crisis, Papa John’s shares eventually marched higher. And after the early outbreak of COVID-19, PZZA came back with a vengeance, especially as the pizzeria marketed its no-contact delivery service.

So, with economic troubles in the air, Papa John’s should benefit as one of the low-cost calorie leaders. However, it’s not, and that may lead to another set of problems.

Options Setup Points to Possibly More Pain for Papa John’s

At first glance, PZZA stock options paint a seemingly bearish picture. Presently, the put/call ratio – or the total number of open put options divided by open call options – clocks in at 3.8. In other words, there are nearly four times as many puts as there are calls. Because puts give holders the right but not the obligation to sell the underlying security at the listed strike price, this ratio seems pessimistic.

However, a face-value interpretation is difficult to make without considering options flow or big block transactions likely made by institutions. If major entities are selling (writing) the puts, the underlying implication is the opposite of buying the puts. Stated differently, put writers have the obligation but not the right to fulfill the contract; as in, they must buy the underlying security at the listed strike price.

Still, if the puts expire worthless, then the put writers get to keep the premium received for writing the options.

Here’s where things get interesting. One of the biggest “exposed” puts is the Nov 17 ’23 67.50 put. Currently, open interest for the option stands at 3,420 contracts. Most of this open interest came from one big block trade involving 3,375 contracts on September 18. At the moment the transaction was made, PZZA stock was trading at $75.27.

Unfortunately for the put writer, the option has now gone in the money (ITM). Therefore, the buyers of the puts can choose to exercise the contract, meaning that the writer would be obligated to buy PZZA stock at a higher price than the open market price.

Further, that’s not the only put option that has gone ITM, and many others threaten to go ITM if PZZA stock continues falling. To mitigate the failed trade, institutional put writers may buy puts (to cancel the sold puts), thus possibly sparking downside.

Is PZZA Stock a Buy, According to Analysts?

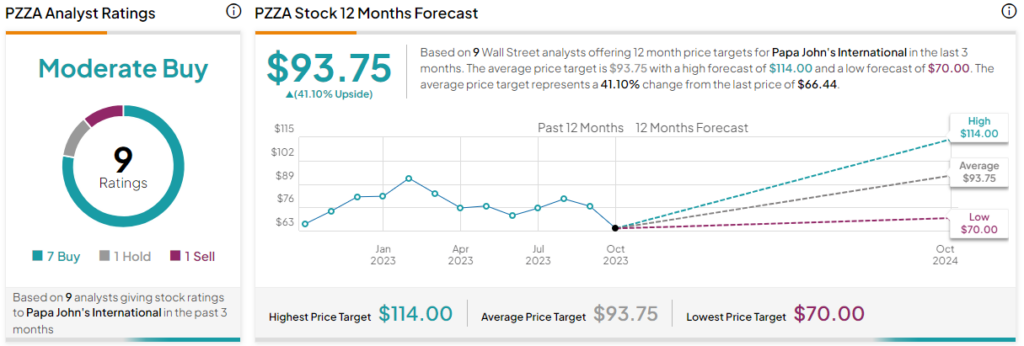

Turning to Wall Street, PZZA stock has a Moderate Buy consensus rating based on seven Buys, one Hold, and one Sell rating. The average PZZA stock price target is $93.75, implying 41.1% upside potential.

The Takeaway

On paper, economic downturns should cynically benefit PZZA stock because the underlying entity provides low-cost fast food. It’s possible, then, that major traders decided to write put options thinking that PZZA would stabilize. However, its recent downturn leaves many options traders exposed. To correct this apparently failed trade, traders may take actions that could possibly lead to further pain for Papa John’s.