Investors are increasingly showing interest in data analytics stocks. Data is used in different ways in organizations, from revamping their marketing strategy to understanding customers better and personalizing content. Data analytics software companies help organizations make sense of this data and use it effectively.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a Market Research Future (MRFR) report from earlier this year, the global data analytics market is expected to be worth $132.9 billion by 2026, indicating a compounded annual growth rate (CAGR) of 28.9% from 2016 to 2026.

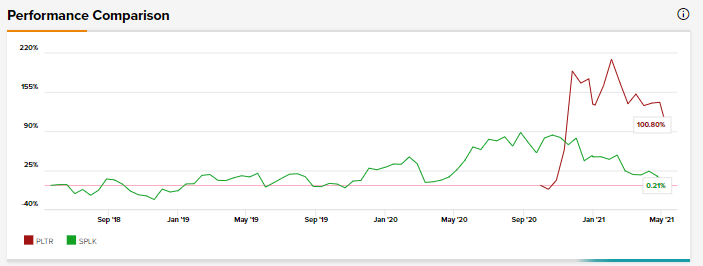

Using the TipRanks Stock Comparison tool, let us compare two data analytics companies, Palantir Technologies, and Splunk, and see how Wall Street analysts feel about these stocks.

Palantir Technologies (PLTR)

Palantir Technologies is a data analytics company that has developed two data analytics platforms, Gotham and Foundry. Gotham specifically addresses the needs of the intelligence sector and enables such customers to identify patterns in datasets. Meanwhile, Foundry addresses the data analytics needs of companies.

61% of PLTR’s customers were government agencies at the end of Q1 while commercial customers made up the remaining 39%.

Last week, Palantir announced its Q1 results with total revenues of $341 million, a jump of 49% year-on-year. On an adjusted basis, Palantir earned $0.04 per diluted share in Q1, versus an adjusted loss of $0.01 per diluted share in the same quarter last year.

Average revenue per customer increased 29% year-over-year to $8.1 million during the trailing twelve months ending on March 31. However, Palantir expects the growth rate for average revenue per customer to slow down as it targets customers across different segments, particularly the middle market and small-to-medium business enterprises (SMBs) in a bid to broaden its customer base.

In the second quarter, PLTR expects revenues to grow 43% year-over-year to $360 million. The company anticipates revenues to rise at a rate of 30% or more annually from 2021 through 2025.

PLTR is also optimistic about its Apollo software, which has now become operational. It is a continuous delivery software powering PLTR’s software-as-a-service (SaaS) platforms, Foundry and Gotham.

At the end of the first quarter, PLTR generated 58% of its revenues from customers in the United States while the remaining 42% came from abroad. The company expects that its international business will pick up this year as international markets, particularly, Europe, continue to recover from the effects of the pandemic. (See Palantir Technologies stock analysis on TipRanks)

Following PLTR’s earnings, Jeffries analyst Brent Thill lowered the price target from $40 to $28 (37.4% upside) and reiterated a Buy on the stock. Thill commented on the results, “PLTR posted a 1Q beat while guiding 2Q revenue growth above Street estimates. As with others in growth software over the past 2-3 months, valuation is under pressure with the CY22 revenue multiple getting cut in half since February to 24x today. We remain positively biased on fundamentals and reiterate the unique nature of the asset.”

Overall, consensus among analysts is a Hold based on 2 Buys, 3 Holds, and 4 Sells. The average analyst price target of $21.75 indicates upside potential of around 6.5% from current levels.

Splunk (SPLK)

Splunk is expected to announce its first-quarter FY22 results on June 2. Splunk is a data analytics company that provides cloud-based software services and solutions. The company’s portfolio includes its Splunk platform that powers data management and insights and application solutions.

In the first quarter of FY22, SPLK expects total annualized recurring revenue (ARR) to range between $2.42 billion and $2.44 billion while revenues are anticipated to range between $480 million and $500 million. The company’s forecast for non-GAAP operating margin is a negative 30%.

In the fourth quarter, Splunk had total revenues of $745 million, a decline of 6% year-on-year while total ARR was $2.36 billion, a jump of 41% year-on-year. Splunk’s offerings include licensed software and cloud services.

In FY22, the company expects a sizeable chunk of its customers who have converted from perpetual licensing to term licensing will renew their bookings, which will meaningfully contribute to its overall bookings. SPLK anticipates that its remaining performance obligations (RPO) and ARR growth rates will converge over the next year or the next year and a half.

SPLK had cautioned at its Q4 earnings call that considering the economic uncertainty due to the pandemic, it remained cautious on growth expectations. The company also said that as a result of the pandemic, its customers, especially those opting for term licensing software remained wary of making long-term commitments.

As a result, SPLK expects the term licensing business to remain volatile while it anticipates cloud business to ramp up quickly. The company expects that 70% to 80% of software bookings could be cloud-based offerings in the next few years. As a result, in FY22, SPLK anticipates that around 50% of its revenues could be from the cloud business.

Earlier this week, Splunk announced the proposed acquisition of TruSTAR for an undisclosed amount. TruSTAR is a cloud-native security company that offers a data-centric intelligence platform. This acquisition is expected to help expand the company’s cloud security solutions portfolio and will enable its customers to detect threats effectively and respond to them more quickly and autonomously. (See Splunk stock analysis on TipRanks)

On May 18, Oppenheimer analyst Ittai Kidron reiterated a Buy and a price target of $203 (75.1% upside) on the stock. Kidron commented on SPLK’s acquisition of TruSTAR and said in a research note to investors, “We believe the acquisition, combined with Splunk’s core log/performance monitoring solutions, expands its detection and response capabilities and can enable its customers to utilize data from third-party threat intelligence sources in an effort to reduce the average time to remediate security issues.”

“The addition of TruSTAR can accelerate Splunk’s effort to compete with emerging XDR solution providers, which have been increasingly viewed as an alternative to SIEM solutions. Overall, we view the acquisition as an incremental positive,” Kidron added.

Overall, consensus among analysts is a Moderate Buy based on 13 Buys and 9 Holds. The average analyst price target of $187.28 indicates upside potential of around 61.5% from current levels.

Bottom Line

Analysts are in a wait-and-watch mode with Palantir as the company is still in the process of broadening its customer base by targeting customers across different market segments. At the same time, it is also looking to bring more government agencies on board as customers.

In contrast, analysts are cautiously optimistic about Splunk, despite the stock offering more upside potential over the next twelve months. The company is looking at expanding its cloud-based software offerings, especially cloud-based security solutions, and expects that the share of cloud-based software solutions in its total revenues will continue to grow.