Shares of secretive data analytics software company Palantir (PLTR) have been sinking steadily lower over the past few months. Following the release of some underwhelming earnings results, many investors are probably wondering what they should do with shares of the former WallStreetBets darling.

A lot of high-multiple tech companies that have clocked in marvellous results have still seen their shares crumble in recent quarters. Undoubtedly, a quarterly flop alongside a broader souring of the tech trade is not where investors want to find themselves these days.

Not when so many high-tech firms are continuing to impress in an attempt to offset the longer-term headwind of rising rates. I’m neutral on the stock.

Palantir Stock Under Pressure

Higher rates eat out of the value of unprofitable, high-multiple growth stocks. The higher rates rise, the worse off many of the “story” stocks will be once the U.S. Federal Reserve gets to it.

Indeed, Fed chair Jerome Powell has retired his “transitory” viewpoint of inflation. He recognizes the dangers of high and persistent inflation and his tone seemed to give off the impression that the Ukraine-Russia crisis will not prevent him from raising rates this year.

The trajectory of rates is enough of a headwind to avoid high-multiple tech stocks like Palantir. Recent quarterly weakness, I believe, is just another reason why it may be better to follow ARK Invest’s Cathie Wood by selling some PLTR stock before the weakness has chance to worsen.

Wood isn’t one to sell plunging stocks at a loss if she still believes in its innovative growth story.

She’s all about doubling down on innovative companies on the way down. Undoubtedly, such a dip-buying strategy has been questionable thus far. In any case, Wood’s recent ditching of around $123 million worth of Palantir stock should ring some alarm bells.

Changes Regarding Palantir’s Growth Narrative?

Given Wood’s propensity to buy more shares of companies she believes in on the way down, I do view her selling activity as a cause for concern.

For now, I am neutral on the stock given the high multiple (PLTR stock trades at a hefty 14.3 times sales) and modest quarterly miss, which may or may not have been overblown by fearful investors. On the plus side, I don’t think the fourth quarter was as abysmal as some investors believe.

Growth and margins could still be poised to ascend from here. Though the earnings miss was underwhelming, I think PLTR stock is on the right track and do not view the narrative as being changed at a fundamental level.

The valuation, though, remains suspect and could still leave the stock at risk of substantial downside as investors expect more than just robust top-line growth.

While the Palantir quarter was technically a miss, it wasn’t nearly as bad as recent selling pressure would suggest. The 34% pop in year-over-year sales growth was decent, with the Commercial segment doing more than its share of heavy lifting.

Looking farther out, the company is still pointing to 30% top-line growth at a minimum through 2025.

While margins aren’t where investors want them to be with rates to rise soon, management is still focused on various margin-enhancing initiatives. For long-term investors, that has to be soothing.

Wall Street’s Take

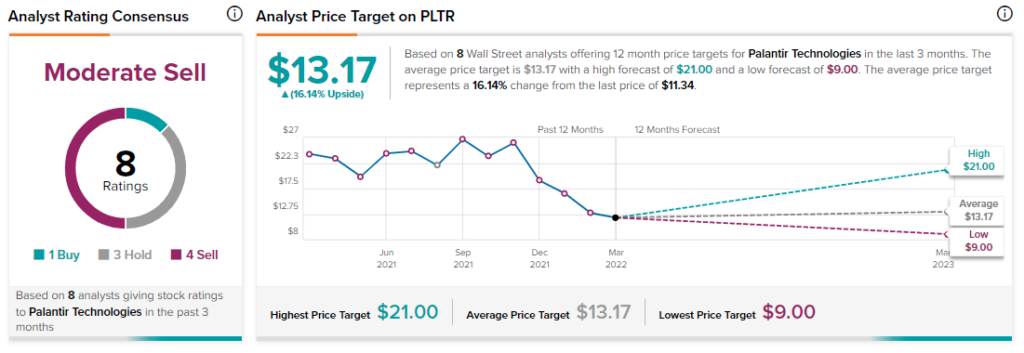

According to TipRanks’ analyst rating consensus, PLTR stock comes in as a Moderate Sell. Out of eight analyst ratings, there is one Buy recommendation, three Hold recommendations and four Sell recommendations.

The average Palantir price target is $13.17, implying an upside of 16.1%. Analyst price targets range from a low of $9 per share to a high of $21 per share.

Bottom Line on Palantir Stock

Rising rates, a lack of profits and a hazy growth narrative are not where investors want to be at a time like this. Personally, I think the narrative has not changed nearly as much as the price has.

While popular innovation investor Cathie Wood may be wrong to sell shares of PLTR on weakness, I do think there are easier places to make money these days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure