If you have been a Palantir (PLTR) shareholder like myself over the past few months, I salute you because we have definitely been on a wild ride. While many treat Palantir as a meme stock, anybody who’s researched the company’s capabilities knows that Palantir is a high-quality company with high-quality revenues.

Still, the stock is pretty polarizing, hence the endless swings between $21 and $27. On the one hand, Palantir exceeds its own growth estimates, expanding its contractually-secured revenues rapidly. Further, the business model is highly scalable, resulting in significant margins. On the other, bears are not wrong to criticize Palantir’s cash-burning problem and excessive stock-based compensation, which keeps diluting shareholders to oblivion. (See Insiders’ Hot Stocks on TipRanks)

Anyone who tells you they can predict where Palantir will be in five or ten years is simply lying, even if that’s not their intention. The truth is, nobody knows. The company’s platform is way too complicated. Further, the lack of insight regarding counterterrorism software for governments and Palantir’s own reserved language regarding its operations leaves little room for the average shareholder to make accurate predictions.

I have personally concluded that Palantir is a wild bet at the end of the day. Even if the company’s current revenue growth trajectory persists and it does eventually report a profit in the medium term, it’s more than likely that the current hefty valuation has already been priced into this scenario. That would leave little to no upside for existing investors.

Despite these concerns, which I am thinking of quite often, Palantir’s overall investment case remains too compelling to ignore. The moat is deep, and we know that companies who build long-term relationships with the U.S. government and its allies tend to benefit over the long term, due to the minimal counterparty risk and uncle Sam’s deep pockets.

In my view, Palantir’s Q3 results once again demonstrated the company’s high-quality customer base and revenue growth capabilities. The company added 34 new customers to its client base while achieving robust upselling enhancing customer monetization. This was evident in its growing average revenue per user (ARPU). Specifically, ARPU in each of its top 20 customers grew on average by $41M million, or 35% year-over-year.

Further, the company is also seeing great success in its commercial segment, where the customer count grew 46% quarter-over-quarter. Overall, revenues grew 36% year-over-year to $392 million, which exceeded the company’s guidance for revenue CAGR of 30% in the medium term.

In terms of its free cash flow, the company generated $119 million during the period, which, based on revenues of $392 million, translates to a decent free cash flow margin of around 30%. For context, the free cash flow margin in the previous quarter was just 13%, implying that Palantir’s potential profitability is constantly evolving. Hence, we may see stock-based compensation easing going forward, restoring investor confidence in terms of more limited dilution in the medium term.

All in all, I am happy with Palantir’s developments. While the stock’s investment case remains speculative, however one wants to see it, I like the company’s overall prospects and a deep moat. Of course, risks remain, but Palantir seems like a company I have to own in my portfolio. For this reason, I remain bullish on the stock.

Wall Street’s Take

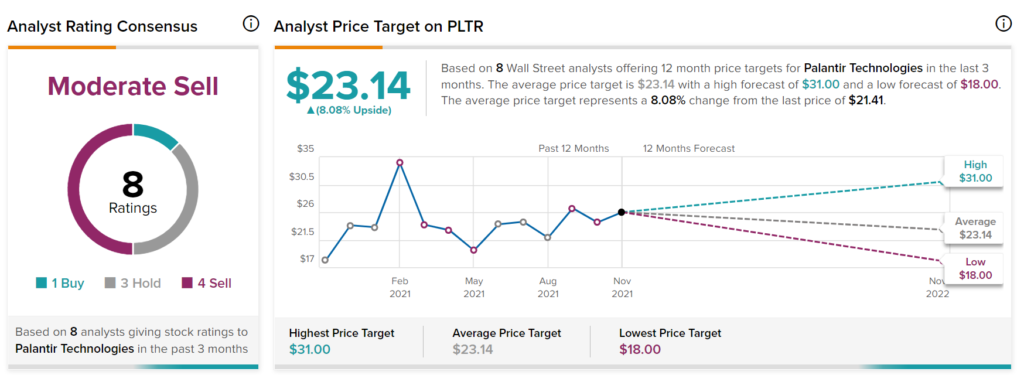

Turning to Wall Street, Palantir Technologies has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. At $23.14, the average Palantir Technologies price target implies 8.08% upside potential.

Disclosure: On the date of publication, Nikolaos Sismanis had a beneficial long position in the shares of Palantir Technologies through stock ownership.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.