The travel industry is certainly cyclical, and a weak economy might scare some folks away from travel stocks. Yet, I invite you to pack up your bags and take a trip with me as we explore two stock picks — EXPE and RCL — for adventurous investors.

Unfortunately, the post-pandemic travel boom faded in 2022, and elevated inflation compelled some consumers to delay trips. However, inflation has already declined from its mid-2022 peak, and there’s room for some travel stocks to fly higher this year. So, here are a pair of travel stock picks, EXPE and RCL, to add to your itinerary.

Expedia (NASDAQ: EXPE)

Let’s say you don’t want to wager your hard-earned capital on one particular airline or hotel. Instead, you could consider Expedia, a platform where shoppers book flights, hotel stays, and more.

EXPE stock got slammed last year, falling from over $200 at one point to less than $100. The result, though, is that Expedia’s price-to-sales (P/S) ratio is quite reasonable at 1.6x; I like a P/S ratio to be below 5x, and I believe anything below 3x is in the bargain zone.

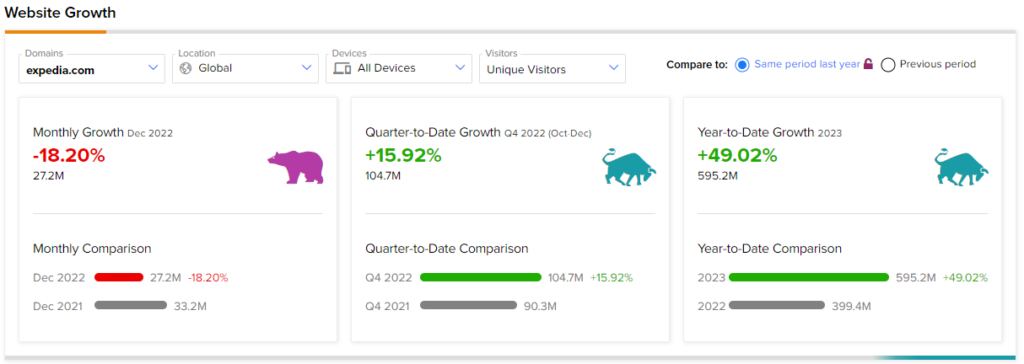

Plus, here’s a fact I’ll bet you didn’t know: Expedia’s year-to-date website traffic for 2023, at around 595.2 million unique visitors, is up 49.02% year-over-year. This is a positive sign, as website traffic is a fairly reliable indicator of interest in a product or service.

Even while EXPE stock disappointed investors last year, Expedia’s financial performance wasn’t terrible, especially during the third quarter. Impressively, Expedia reported record quarterly revenue that was up 22% year-over-year, as well as record third-quarter lodging bookings. Moreover, Expedia’s net income increased 33% year-over-year in Q3 2022 – not too shabby, considering this was a time of high inflation.

In addition, Oppenheimer analyst Jed Kelly set his sights high with a $120 price target on Expedia stock. Kelly also upgraded the stock from Perform to Outperform, with Oppenheimer analysts assuring that ” [online-travel booking] trends remain robust on pent-up demand and a resilient consumer.” Now, let’s see how other analysts feel about EXPE stock’s future prospects.

What is the Price Target for EXPE Stock?

EXPE has a Moderate Buy consensus rating based on 10 Buys, nine Holds, and one Sell rating assigned in the past three months. The average Expedia stock price target of $124.05 implies 7.2% upside potential.

Royal Caribbean (NYSE: RCL)

If the future of online travel booking looks bright, what about cruises? Like EXPE stock, RCL stock was a poor performer last year. Like Expedia, however, Royal Caribbean delivered surprisingly strong results during 2022’s third quarter. After many consecutive quarters of negative EPS, Royal Caribbean posted EPS of $0.26 (positive, not negative) in Q3 2022. That result beat the analyst consensus estimate of $0.20, as well.

Furthermore, Royal Caribbean’s year-to-date 2023 website traffic is roughly 74.7 million unique visitors, up 97.48% compared to the same period in 2022. Clearly, there’s been a surge in prospective travelers who may be interested in booking a cruise; now, it’s up to Royal Caribbean to convert its website surfers into paying customers.

Another thing in common with Expedia is that Royal Caribbean has a very reasonable P/S ratio. Indeed, Royal Caribbean’s P/S ratio of 2.2x suggests a possible bargain, and this should pique the interest of value seekers – albeit ones with an appetite for risk and volatility.

Despite the choppy seas of 2022, Royal Caribbean actually ended the year with a show of strength. Notably, Royal Caribbean division Celebrity Cruises posted its greatest day ever in terms of Black Friday bookings and then its strongest Cyber Monday ever last year.

On top of all that, Royal Caribbean International reported that Black Friday of 2022 was “the cruise line’s single largest booking day in its 53-year history.” This, evidently, was the “third time the record was broken in 2022 and the peak of what is now the brand’s highest volume booking week.” That’s certainly a milestone moment for Royal Caribbean, so now let’s check in to see what Wall Street’s experts think about RCL stock.

What is the Price Target for RCL Stock?

RCL has a Moderate Buy consensus rating based on five Buys, three Holds, and one Sell rating assigned in the past three months. The average Royal Caribbean price target of $71.89 implies % upside potential.

The Takeaway: Try These 2 Travel Stocks for the Long Haul

Last year was a bust for travel stocks, but P/S ratios indicate there may be a couple of prime bargains for long-term investors. Also, website traffic and other data point to a potential bump in travel interest and unexpectedly strong financial performances from Expedia and Royal Caribbean. Therefore, if you can handle what might be a turbulent 2023, consider a position in EXPE and RCL stock.

Join our Webinar to learn how TipRanks promotes Wall Street transparency