The stock market corrected swiftly in the first half of 2022. This has created opportunities for investors to capitalize on the fall and invest in stocks trading at significantly lower prices than a year ago.

While stocks look attractive due to the recent fall, choosing the right stocks and taking a buy call is tough, especially as the market remains volatile and the economic trajectory remains uncertain. Thus, to get answers, let’s turn to the TipRanks Top Analyst Stocks tool. This tool identifies stocks that Wall Street’s best-performing analysts most recommend. Leveraging this tool, let us zoom in on two stocks analysts recommend investing in.

Microsoft (NASDAQ: MSFT)

Due to the selling in top growth and tech stocks, Microsoft has declined about 22% in 2022. Moreover, shutdowns in China, adverse currency movements, and geopolitical headwinds remain a drag.

Amid challenges, Microsoft continues to deliver stellar financials despite the tough year-over-year comparisons. Strength in Azure and strong bookings are positives.

With ongoing momentum in the business, Microsoft’s CFO Amy Hood expects to close FY22 with strong top-line growth, higher operating margins, and share gains.

Furthermore, for FY23, Hood expects MSFT to continue to deliver double-digit revenue and operating income growth.

Management’s upbeat outlook is positive. Meanwhile, Wall Street analysts also remain bullish about MSFT’s prospects. One of the analysts recommending a Buy on MSFT stock is Jefferies Brent Thill. Thill sees MSFT as the “safest large cap investment option.”

The analyst expects MSFT to continue to return capital to its shareholders on the back of its diversified business, multiple growth drivers, favorable secular trends, and strong revenue and earnings growth.

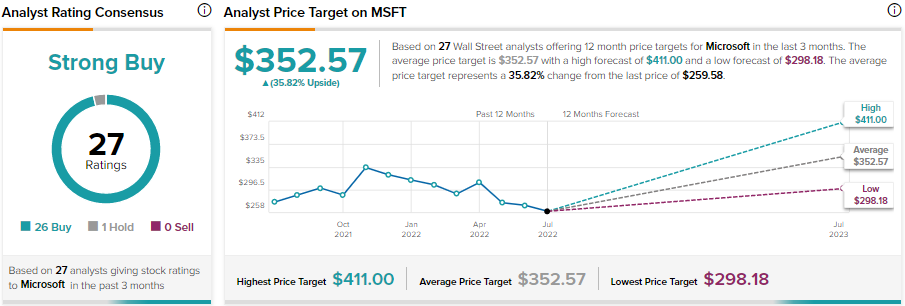

Including Thill, MSFT stock has received 26 Buy recommendations. Meanwhile, one analyst suggests a Hold.

Overall, MSFT stock sports a Strong Buy rating consensus on TipRanks. Moreover, the average Microsoft price target of $352.57 implies 35.8% upside potential.

Aspen Aerogels (NYSE: ASPN)

Aspen Aerogels offers aerogel insulation products to EV (electric vehicle) makers, energy infrastructure companies, and building owners. While ASPN stock has dropped significantly (about 80% year-to-date) due to macro concerns and fear of equity dilution, analysts are bullish about its prospects due to the significant growth opportunity arising from global megatrends like electrification of mobility.

Aspen recently increased its 2022 revenue outlook due to the strong demand. It now expects to deliver revenues between $180 million to $200 million, up from the earlier guidance range of $145 million to $155.

Orders from General Motors (NYSE: GM) and Toyota (NYSE: TM) will significantly boost its thermal barrier revenue. Moreover, ASPN stated that the demand remains strong in the energy industrial segment.

Strong demand, investments in growth, and productivity improvements position it well to deliver strong growth ahead. Moreover, ASPN is focusing on expanding its manufacturing capacity to support its growth. However, the higher cost environment and supply constraints could pressure margins in the near term.

In response to the upward revision in its guidance update, B.Riley Financial analyst Christopher Souther stated that despite the near-term pressure on margins, the outlook is positive and reflects the strong demand for its offerings. Moreover, the analyst expects ASPN’s costs to moderate in the coming years.

Along with Souther, H.C. Wainwright analyst Amit Dayal is also bullish on APSN. Dayal expects ASPN to benefit from the “uptake of its thermal barrier.”

Thanks to the solid demand, ASPN stock has a Strong Buy consensus rating, based on six unanimous Buy recommendations. Moreover, the average Aspen price target of $38 implies 274.4% upside potential.

Bottom Line

Unarguably, macro concerns, supply constraints, and uncertainty pose challenges. However, top analysts’ buy recommendations on MSFT and ASPN stocks reflect the strength of their strong fundamentals, product demand, and solid growth prospects.