Shares of Swiss footwear firm On Holding (NYSE:ONON) ran face-first into a vicious correction this August, thanks in part to broader market weakness and currency headwinds. As the stock experiences a mild expectation reset following what was an impressive quarter, ONON appears to be a pretty smart buy on the dip for those seeking growth at a justifiable price in an otherwise frothy market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, the post-earnings reaction in ONON stock seemed to suggest the quarter was a dud. That simply was not the case. The second quarter was strong, with record revenue growth (net sales rocketing just north of 52% year-over-year) that gave management enough confidence to raise its outlook for Fiscal Year 2023. Despite the impressive results, investors couldn’t look past the strong Swiss franc, which weighed more heavily on the results than expected.

Over the long run, currency fluctuations will matter less than the company’s ability to deliver on its growth story. As it stands, growth is alive and well. As long the company keeps firing on all cylinders, I’m staying bullish on the stock.

ONON Could Have Room to Run

On Holding is a relative lightweight in the footwear industry, with a mere $9.3 billion market cap at the time of writing. The mid-cap sneaker company’s rise to popularity has been truly remarkable. You’ve probably seen On Holding’s logo in the wild in recent years. Personally, I’ve noticed that On sneakers are becoming more common at the race track.

Though On is nowhere close to breaking the wide moat of sneaker giant Nike (NYSE:NKE), I think that On is putting itself in a spot to step on the shoes of some of the heavyweight champs in the footwear scene.

Nike likely doesn’t have to hit the panic button over On’s recent rise. For Nike, On is a smaller player that seems unlikely to erode the power behind the iconic swoosh and its timeless sneakers like the Jordan. That said, On does have a lot to gain if it manages to take just a drop of market share away from the world’s footwear leaders. At this pace, I do believe On can keep on delivering for investors.

As such a small company with phenomenal growth prospects, it’s not a mystery as to why Mad Money host Jim Cramer is such a big fan of the stock. In fact, Cramer has praised On Holding’s growth story numerous times over the past several months.

Other folks, including BTIG analyst Janine Stitcher, have a more muted view of the company. Stitcher sports a “Hold” rating on the stock with the belief that On Holding’s strong growth “is largely anticipated by the market.”

Even after shares of On Holdings slipped more than 17% from their 52-week highs, the name goes for a premium at north of 200 times trailing price-to-earnings, which is well above the footwear & accessories industry average of 28.8 times.

Clearly, investors and analysts expect a great deal of growth from the firm. Despite currency headwinds, On is still on the growth track. For me, it’s enough growth to justify the relatively lofty price of admission.

Where Does On Holding Go From Here?

Getting into the sneaker business is no easy feat (forgive the pun). Plenty of larger companies with established brands — think Lululemon (NASDAQ:LULU) — have had mixed success in the footwear business.

So, what’s the “secret sauce” behind On? The company’s footwear is as functional and innovative as it is fashionable. In the U.S. and China, there’s still plenty of room to run, and as the firm continues to take share in the footwear space, there are few reasons to believe that any growth deceleration could be on the horizon.

A potential recession could weigh on the sneaker industry as a whole. That said, the firm’s growth seems resilient enough that it may be able to offset any such macro headwinds as it claws away some share away from some of the industry’s incumbent players.

Is ONON Holding Stock a Buy, According to Analysts?

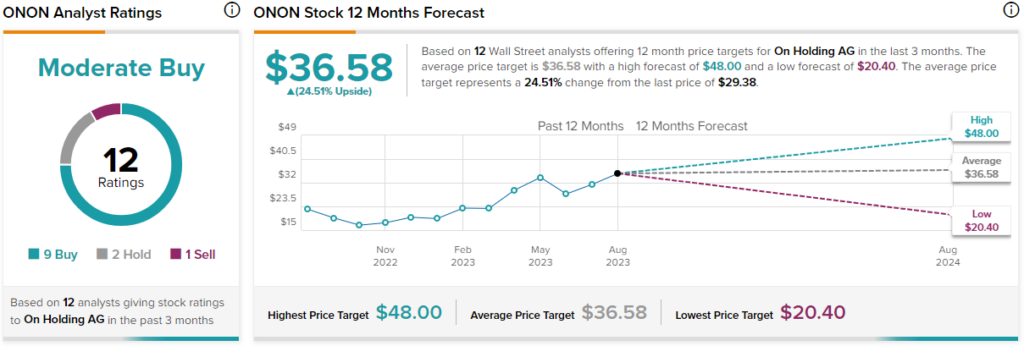

Turning to Wall Street, ONON stock comes in as a Moderate Buy. Out of 12 analyst ratings, there are nine Buys, two Holds, and one Sell recommendation. The average On Holding stock price target is $36.58, implying an upside of 24.5%. Analyst price targets range from a low of $20.40 per share to a high of $48.00 per share.

The Bottom Line on ONON Holding Stock

On Holdings is a sensational growth story that will make it through the wave of currency headwinds. Wall Street remains mostly optimistic about the stock, with the Street-high price target of $48.00 implying a whopping 63.4% upside potential from current levels.