On March 3rd, Okta (OKTA) announced a $6.5 billion deal to acquire Auth0, which is a top online identity management platform for application teams. Unfortunately, Wall Street was not thrilled with the move. For the next week or so, shares dropped from $269 to below $200. It should be noted, however, that Okta stock has since recovered some of its losses and is currently trading at around $230.

Large acquisitions in the tech world can be dicey, and the integration can be extremely difficult.

So, has Okta blundered here? Or perhaps Wall Street is missing something?

Let’s take a closer look.

Okta And The Identity Opportunity

The origins of Okta go back to 2009. The cofounders – which include Todd McKinnon and Frederic Kerrest – saw first-hand the complexities with secure logins to cloud systems while they worked at Salesforce.com (CRM). They realized that there was a massive opportunity to build a platform to help with this.

It’s important to note that the market was not new. It was actually large, featuring players like Microsoft (MSFT), Oracle (ORCL), IBM (IBM), VMWare (VMW) and Computer Associates.

However, the technologies were on-premise and not particularly modern. So, Okta saw an opening to provide a cloud platform.

The strategy was definitely spot-on. Consider that Okta has been able to generate consistently strong revenue growth. Last year, the top line jumped by 43% to $835.4 million and the operating cash flows came in at $128 million. What’s more, the customer base exceeded 10,000, and included companies like Twilio (TWLO), JetBlue (JBLU), Siemens and Nordstrom (JWN).

The Acquisition

Eugenio Pace and Matias Woloski started Auth0 in 2013. They were able to build an online identity system that was targeted at developers, which was similar to the approach of Twilio and Stripe.

No doubt, the developer-focused model can be powerful. One of the benefits is that it allows for a low-cost bottom-up adoption strategy. In addition, once the technology is embedded in an application or IT environment, it tends to remain sticky. For example, there are benefits like the ability to customize the software.

In terms of the growth metrics of Auth0, the company is on track to post more than $200 million in ARR (annual recurring revenues) and the growth is at 50% annually. On top of this, about 95% of the top line is recurring.

Bottom Line On The Okta Deal

So, why the thumbs down for Okta’s deal? Well, it looks like the main reason is the valuation as it’s about 33 times revenues.

But then again, the deal is accretive in terms of the revenue multiples. Additionally, Okta is smart to leverage its highly valued stock to snag high-growth assets. The fact is that – to remain competitive – the company will need to get more aggressive with its acquisitions. What’s more, the market opportunity is an enormous $55 billion and it will not be realistic to capitalize on this with organic growth.

There are certainly risks. Again, large tech deals can be tough to manage, and the markets can easily be disrupted, especially given the huge amounts of venture capital available.

Yet, it’s important to note that Auth0 will remain an independent unit, which should help with the transition. And the company’s developer-focused model will be a new valuable segment for the overall business.

What Are Analysts Saying?

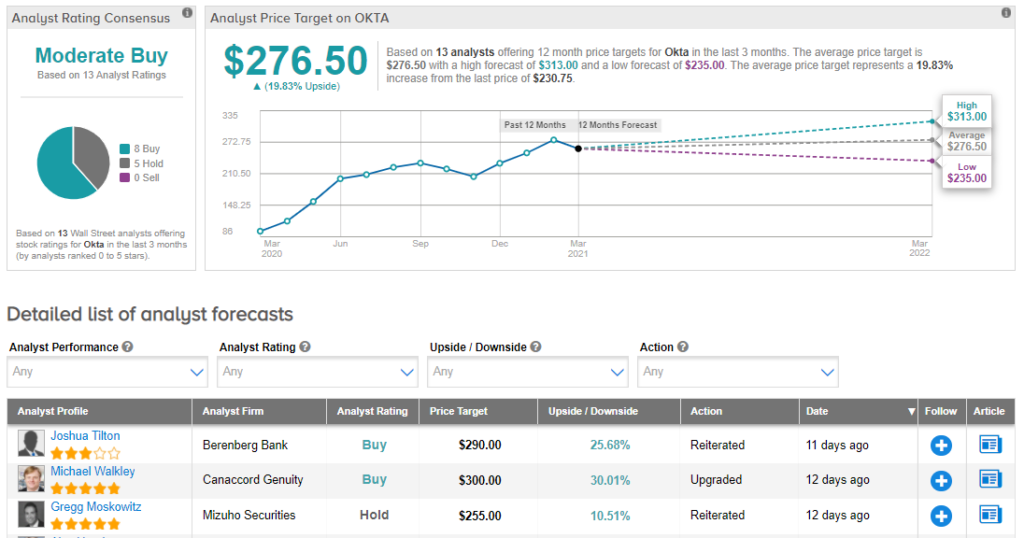

Even with the skepticism from investors on the deal, analysts are still upbeat on Okta’s prospects. 8 Buys and 5 Holds add up to a Moderate Buy consensus rating. The average analyst price target is $276.50, which implies 20% upside potential from current levels. (See Okta stock analysis on TipRanks)

Tom Taulli ranks among the top 125 bloggers tracked by TipRanks, thanks to his 58% success rate and 14.7% average return per rating.

Disclosure: Tom Taulli does not own the stocks mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.