Oceaneering International (OII) is an engineering company that provides services and hardware to companies that operate in the energy, aerospace, and marine industries. I am bullish on the stock.

Momentum Pattern Has Formed

Oceaneering is overlooked by the market, as indicated by its average daily traded volume of 854,850.

The stock has picked up a great deal of momentum lately, with a year-to-date surge of about 30%. Additionally, Oceaneering stock is trading above its 10-, 50-, 100-, and 200-day moving averages, signaling intent from bullish investors.

Momentum plays can be lucrative. In 2014, Carhart released a stock pricing model called the “four-factor model” that discovered momentum as one of the leading indicators of a stock’s future performance.

Of course, this can’t be considered in isolation, but it does help when analyzing a stock’s prospects.

What Ignited the Momentum?

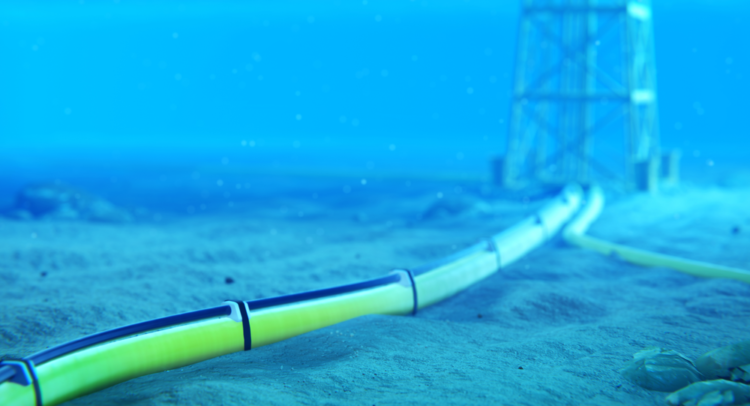

As mentioned before, Oceaneering has a significant ancillary representation to energy producers, meaning the company’s performance is positively correlated with the cash pile-up and subsequent CapEx of primary energy producers.

Energy stocks have performed phenomenally during the past year, with the sector outperforming the S&P 500 by approximately 4x. Furthermore, the energy sector’s CapEx totaled $1.5 trillion during 2021, which certainly had a positive effect on ancillary businesses.

Earnings Analysis

Oceaneering’s earnings report is clearly very cohesive with fundamental factors.

The company released its fourth-quarter earnings report earlier this month, revealing above-par earnings, beating expectations by $0.03 per share. It’s thought that much of the company’s earnings success derived from its subsea robotics services due to a 10% increase in revenue/days of hire ratio, and an adjusted EBITDA ratio improvement to 31% (from 29% in Q3).

A final aspect worth mentioning is Oceaneering’s success in its Manufactured Products segment, which yielded $103 million in revenue, while absorbing fixed costs better to achieve an EBITDA margin of 14%.

Valuation Metrics

Matters are looking good from a valuation perspective, Oceaneering stock is trading at a P/S discount of 1.3x, suggesting that it remains a growth stock with value in abundance.

Additionally, the firm’s EV/sales ratio is trading at a 61.8% sector relative discount, conveying its ability to produce sales more efficiently than its peer group.

Investor Sentiment

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Oceaneering, as 23.9% of investors on TipRanks increased their exposure to the stock over the past 30 days.

Concluding Thoughts

Oceaneering is overlooked by many and could be a solid investment in a challenging market. The stock holds value in abundance amid a surge in the energy industry, subsequently bolstering its offshore energy services offerings.

The company’s appealing EV/Sales multiple indicates that we’re looking at an entity with an ability to squeeze the maximum amount of revenue from its business model.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure