In this piece, I evaluated two broadcasting stocks, Nexstar Media Group (NASDAQ:NXST) and Liberty Global (NASDAQ:LBTYA), using TipRanks’ comparison tool to determine which is better.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Broadcast TV has gotten a bad rap in recent years, as online news sources and video streaming services have overtaken traditional forms of media like broadcast TV. Of course, where the eyeballs go, the advertising dollars follow, which has made things very challenging for traditional media.

Nexstar Media is the largest TV station operator in the U.S., while Liberty Global describes itself as a “leading converged video, broadband and communications” company, with operations in six European countries in addition to the U.S. Neither stock is doing well this year, although they are holding up better than some.

Nexstar Media stock is down 4.6% year-to-date, while Liberty Global is off 6.3%. However, Nexstar is up 3.5% for the last 12 months, while Liberty Global has plummeted more than 20%.

A closer look is needed to determine whether there might be any upside in either of these broadcasting stocks. As a point of reference, the broadcasting industry is trading at a price-to-earnings (P/E) ratio of about 10.5 times versus its three-year average of 12.9. The industry is also trading around its three-year average price-to-sales ratio of 1.0.

Nexstar Media Group (NASDAQ:NXST)

Nexstar Media looks undervalued from a P/S standpoint, but there’s much more to consider when valuing broadcasting companies. The shift to online media sources is killing many broadcasting companies, so it’s critical that they participate in the online transition. Thus, the deals Nexstar struck recently with major online players, as well as its solid fundamentals, suggest a bullish view may be appropriate.

Based on its P/E of about 6.8, Nexstar Media looks significantly undervalued versus its industry and against its five-year mean P/E of 9.9. However, it’s trading in line with the industry P/S, at 1.1, and below its five-year mean P/S of 1.4. These low multiples look particularly attractive considering the company recently struck a multi-year deal with YouTube TV to launch 59 stations and a multi-year distribution agreement with Hulu.

Unfortunately, Nexstar came up far short of the profit consensus in its latest earnings report at the end of February, which may be responsible for much of the year-to-date decline. However, taking a longer view reveals steadily growing revenue over the last five years and stable net income margins at around 18% to 18.5% over the last three years.

Nexstar is also generating plenty of free cash flow, in excess of $1 billion over the last three years, and has a solid balance sheet. It’s also paying down its debt, repaying almost $3 billion in 2022 while issuing about $2.5 billion.

Finally, Nexstar pays a 3.2%-yielding dividend and has raised it annually for the last 10 years.

What is the Price Target for NXST Stock?

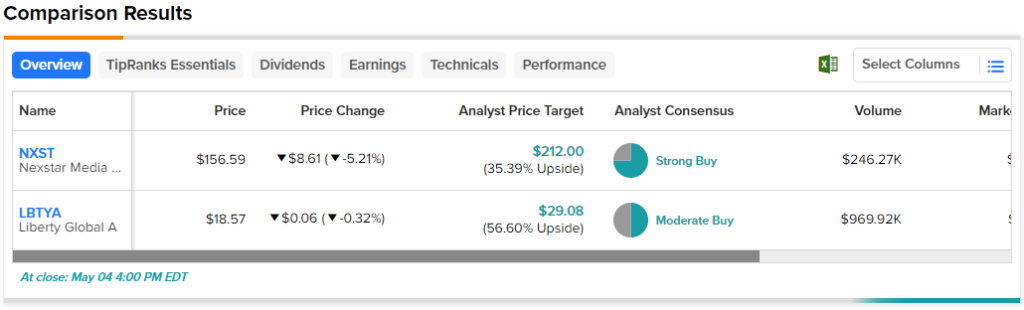

Nexstar Media has a Strong Buy consensus rating based on three Buys, one Hold, and zero Sell ratings assigned over the last three months. At $212, the average Nexstar Media stock price target implies upside potential of 35.4%.

Liberty Global (NASDAQ:LBTYA)

At a P/E of 15.6, Liberty Global looks overvalued despite its P/S of 1.2. A look at its fundamentals reveals a company with steadily declining revenue, including a drop of almost $3 billion from 2021 to 2022. Thus, a bearish view looks appropriate.

Liberty Global has a more diversified business that includes broadband in addition to broadcasting, but there’s not a lot of action on the online transition front.

It has highly-volatile net income margins ranging from -14% in 2020 to more than 100% in 2019 and 2021. While 2022 saw a more normal net income margin of 20.5%, the steadily declining revenue is a concern. Additionally, Liberty Global’s free cash flow has been falling alongside its revenue.

Finally, Liberty Global doesn’t pay a dividend, so it’s not even a potential addition to a dividend portfolio.

What is the Price Target for LBTYA Stock?

Liberty Global has a Moderate Buy consensus rating based on three Buys, three Holds, and zero Sell ratings assigned over the last three months. At $29.08, the average Liberty Global stock price target implies upside potential of 56.6%.

Conclusion: Bullish on NXST, Bearish on LBTYA

Overall, there’s not much to dislike about Nexstar, while there’s not much to like about Liberty Global. Analysts’ views on Liberty Global are mixed, likely because of the major risks of investing in a company with steadily declining revenue.

Meanwhile, Nexstar displays stability and is taking clear steps to participate in the online transition. Finally, Nexstar even pays a dividend, an added bonus that makes it a decent dividend play.