Not shirking from its ambitious plans to dominate the chip space, at its recent annual GTC conference, Nvidia (NVDA) announced that it is putting together the NVIDIA Eos, or as it is more impressively known – the world’s fastest AI supercomputer.

The next-gen, AI-optimized machine’s specs and size are mightily impressive as they are, says Wells Fargo’s Aaron Rakers, who highlights the fact it will probably be used for a plethora of different “AI-optimized workloads.” One use, though, probably more than investors currently realize, according to Rakers.

“We think investors could / should also consider NVIDIA’s Eos as playing a significant role in the company’s development as an autonomous (software-defined) vehicle platform provider, something we believe is not fully appreciated; consider positioning vs. Tesla’s Dojo supercomputer strategy,” said the 5-star analyst.

Basically, Rakers thinks the Eos supercomputer should be perceived as a “foundational” part of NVIDIA’s DRIVE (autonomous/software-defined vehicle) software strategy, with the platform enabling Nvidia to “develop and deliver” AI-created software for the automotive industry.

According to a recent Ericsson report, by 2025, it anticipated that software and the software experience will account for 50% of “vehicle value.” Therefore, it stands to reason, that amongst auto manufacturers, being able to deliver “software-defined” vehicles is a strategic necessity.

And that is why Rakers believes Nvidia – as the creator of the DRIVE software’s capabilities – sees itself as well-positioned to capture a huge chunk of up to 50% of the “economics of the automotive industries drive toward connected subscription services / OTA software functionality.”

The company is already making inroads with the right clientele. So far, Nvidia has signed on the dotted line with a couple of key full stack DRIVE platform customers, which are set to make use of NVIDIA DRIVE Hyperion 8. The agreement with Mercedes-Benz was disclosed in June 2020 with vehicles set to become available in 2024 and Jaguar Land Rover was announced this February with vehicles slated for release in 2025.

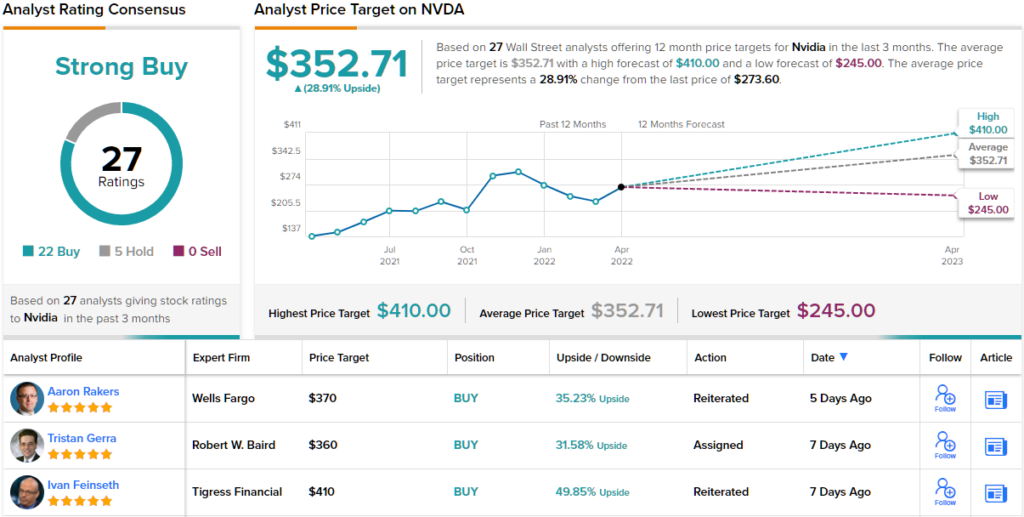

All in all, Rakers rates Nvidia shares an Overweight (i.e. Buy) while the $370 price target makes room for ~35% upside in the year ahead. (To watch Rakers’ track record, click here)

Over the past 3 months, 27 analysts have thrown the hat in with NVDA reviews, of which 22 are to Buy and 5 to Hold, all coalescing to a Strong Buy consensus rating. The average target clocks in at $352.71, suggesting shares could climb 29% higher over the one-year timeframe. (See Nvidia stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.