Nvidia (NASDAQ:NVDA) is a leader in the semiconductor industry. Its high-end graphics processing units (GPUs) are wildly popular, fueling its revenue to staggering levels. The company has since then expanded into high-growth markets such as automotive, data centers, AI, and more. Its stock has seen remarkable gains of 227% year-to-date, overtaking the S&P 500’s (SPX) 13% gain. The strong demand for its GPU chips and its ability to evolve in this complex niche is why I am bullish on NVDA stock now. Analysts are bullish as well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nvidia’s graphic processors are used in a variety of applications, ranging from computers to video game consoles. Their robust computing capabilities are essential for AI-focused tasks, playing a pivotal role in the success of OpenAI’s ChatGPT and similar AI applications.

Nvidia Shattered Q2 Estimates. The Future Looks Bright

Nvidia reported an astounding 101% increase in revenue year-over-year to $13.5 billion for the second quarter ended July 30, 2023. Adjusted earnings per diluted share increased by a whopping 429% to $2.70, smashing the consensus estimate of $2.08 per share, and Data Center sales grew by 171% due to increased demand from cloud service providers. Meanwhile, its Gaming segment revenue grew by 22% in the quarter.

Also, the personal computer (PC) market is showing signs of recovery, according to market research firm Canalys, meaning more gaming revenue for Nvidia in the coming quarters.

Owing to the heavy demand for H100 GPUs, Nvidia is working to boost the supply of these GPUs over the next few quarters. Hence, management expects revenue of $16 billion in Q3, driven by this strong demand. If the target is met, that would reflect an impressive 170% increase over the corresponding quarter a year ago.

Each chip currently costs between $25,000 and $40,000. If demand stays strong, it could mean solid, consistent revenue for the company.

Meanwhile, analysts predict Q3 revenue in the range of $12.2 billion to $19.1 billion, with the consensus coming in at $16 billion. Earnings per share could range from $2.38 to $3.69, according to analysts, with the consensus EPS estimate coming in at $3.32. The company has beat expectations for the past three consecutive quarters, and its next earnings release will be on November 21.

Additionally, Nvidia closed Q2 with a sizeable cash balance of $16.0 billion and $8.46 billion in long-term debt. Its rapid growth in earnings should allow it to pay off the debt quickly. Free cash flow in the quarter stood at $6.3 billion, a drastic jump from $837 million in the prior quarter. This surplus cash can be used to fund future projects.

Risks and Rewards

Nvidia continues to forge partnerships and collaborations to bolster its market presence and revenue growth potential. For instance, recently, it collaborated with Indian conglomerates Reliance Industries Limited and Tata Group to create AI supercomputers using NVDA’s GH200 Grace Hopper Superchip and DGXTM Cloud technology.

This collaboration might ensue AI-led transformations in the manufacturing, consumer, industrial, and telecommunications sectors.

While the rewards seem enticing, there are also risks. According to Reuters, OpenAI might look into creating its own AI chips to combat the scarcity of expensive AI chips. It may also intend to diversify its supplier base beyond Nvidia. Furthermore, Microsoft (NASDAQ:MSFT) is planning to launch its first AI chip, “Athena,” next month during its annual developer conference for the same reasons, according to The Information.

With rising competition in the AI niche, only time will tell how this tech titan will capitalize on this massive growth while maintaining its dominant position in the chip market. For now, Citi analyst Atif Malik is optimistic that Nvidia will be able to sustain its market share of 90% in the AI GPU market for the next two to three years. The analyst rates the stock a Buy, with a target price of $630.

Also, analysts predict that Nvidia’s revenue will increase by 99.4% in Fiscal 2024 and by 47.5% in Fiscal 2025.

This month, Goldman Sachs (NYSE:GS) included the stock on its Americas Conviction List. Because of its competitive moat and complex AI models, the bank believes Nvidia will be able to retain its market dominance.

Nvidia trades at 29 times forward earnings. Its third-quarter results and analyst forecasts for future quarters will determine whether this valuation is justified.

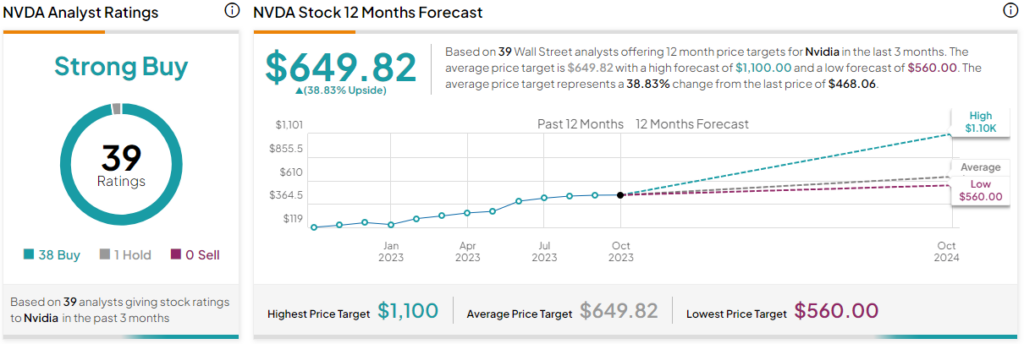

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, TipRanks rates NVDA as a Strong Buy, with 38 Buys, one Hold, and no Sell ratings assigned in the past three months. The average NVDA stock price target of $649.82 implies 38.8% upside potential. The highest price target for the stock stands at $1,100, while the lowest target price is $560.

The Takeaway

Nvidia’s revenue has increased from $4.3 billion in Fiscal 2013 to an outstanding $27.0 billion in Fiscal 2023, reflecting the magnitude of its growth. AI, according to experts, is only getting started. Between 2023 and 2030, the global AI market could grow at a compound annual growth rate of 36.8%, reaching $1.345 trillion.

Nvidia’s robust market position, diverse product portfolio, and ongoing innovation in AI technologies may help the company maintain or even increase revenue in the coming years. Therefore, I’m not surprised as to why Wall Street is so bullish on the stock.