Earlier this week, Nvidia (NVDA) and Mercedes-Benz announced a joint venture to bring self-driving cars a step closer to mainstream adoption. Mercedes’ next generation of luxury vehicles, set for a 2024 launch, will come equipped with Nvidia’s DRIVE platform, giving the vehicle automated driving capabilities.

Needham analyst Rajvindra Gill believes the new initiative will put a hitherto less lauded segment of Nvidia’s business on a par with its two main revenue drivers.

“Along with Datacenter and Gaming, we view Automotive as a major long-term growth opportunity for NVDA, which we believe is the leader in the automotive SoC (system on a chip) space,” the 5-star analyst said.

Nvidia’s automotive segment already brings in between 6-7% of Nvidia’s overall revenue, but the new partnership, according to the analyst is “a game changer for their automotive business.”

“Unlike NVDA’s prior engagements in the automotive space, its recent partnership with Mercedes is its first publicly announced full stack end-to-end partnership, which we believe paves the way for future full stack partnerships with other automotive OEMs,” Gill said.

Along with the ability to perform automated driving tasks, one of the more exciting aspects of the new computer powered cars will be the “over-the-air (OTA) software updates.” This feature will allow the vehicle to receive system upgrades automatically, while the owner will be able to purchase additional features, ADAS (advanced driver-assistance systems) applications and services.

The feature, according to Gill, can provide a “recurring revenue stream for NVDA.”

“For example,” the analyst explained, “if NVDA were to develop applications or services that would be purchased by the owner of the vehicle, the revenue from those applications would be split 50/50 between NVDA and Mercedes. The same goes if Mercedes were to develop an application or service based on NVDA’s platform that they would offer to their end customers.”

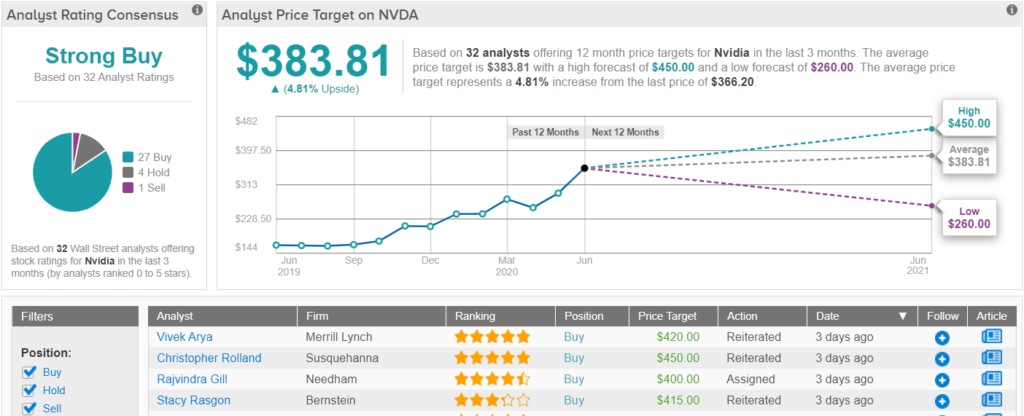

No surprise to learn Gill keeps a Buy rating on Nvidia shares along with a $400 price target. The implication for investors? Upside of 9% from current level. (To watch Gill’s track record, click here)

Going by the Strong Buy consensus rating, the rest of Street is backing Nvidia, too. The rating is based on 27 Buys, 4 Holds and 1 Sell, and comes with a $383.81 price target attached. There’s a modest 5% upside in the cards, should the figure be met over the next few months. (See Nvidia stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.