So far, Nvidia (NASDAQ:NVDA) has positioned itself as the winner in the AI chip market, where it currently commands more than an 80% share. While the company has undoubtably gained advantage by cornering the market this early in the AI game, it’s unlikely the chip giant is resting on its laurels here, knowing other companies are ready to eat away at its domination.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the forefront of those looking to steal its AI crown, is competitor Advanced Micro Devices (NASDAQ:AMD). The Lisa Su-helmed firm has already shown it can close a gap in the market. Over the past few years, it has taken a big chunk out of Intel’s prior dominance of the CPU market.

Now with the company readying to start shipping to customers its most-advanced AI GPU, the MI300X, Raymond James analyst Srini Pajjuri decided to see how it stands up against Nvidia’s H100 AI processor. Both boast intricate designs that utilize cutting-edge manufacturing and advanced 2.5D packaging to merge multiple chips. The high quantity of silicon elements and extensive chip sizes make manufacturing yields “particularly challenging.” This issue significantly affects the overall expenses involved.

Pajjuri’s analysis shows that given its higher HBM Memory and more complex packaging, the MI300X, with a cost of about $5,800 is ~75% more than that of the H100, which costs around $3,300 to make.

That is a big difference, but luckily for AMD, the H100 gross margin, which Pajjuri reckons is over 85%, gives it “enough buffer to price MI300X at a significant discount and still generate accretive margins.”

More specifically, with the H100 priced at about $25,000 vs. the expected price of around $15,000 for the MI300x (>40% discount to H100), AMD could still generate over 60% gross margins.

“While the lower cost gives NVDA optionality to aggressively price H100 to limit AMD’s share,” Pajurri sums up, “we do not foresee such a scenario given the strong demand and NVDA’s focus on performance leadership. We see enough opportunities for both suppliers in the $100B+ Gen AI silicon market.”

Pajurri’s conclusion, then, is that both chip giants are coming out on top, earning a solid Strong Buy rating. Pajurri’s NVDA price target stands at $500, suggesting upside of 15% from current levels, while his $145 price target for AMD makes room for one-year returns of 35%. (To watch Pajurri’s track record, click here)

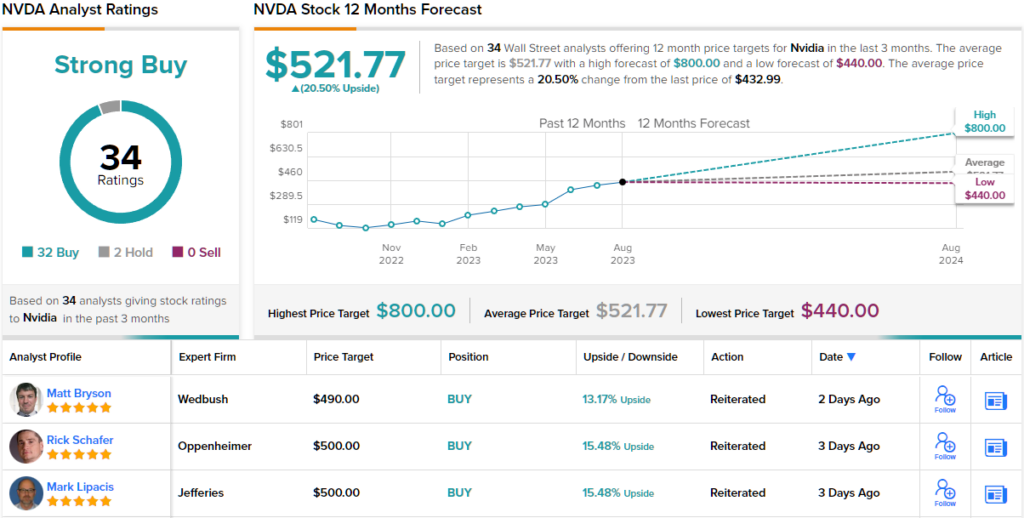

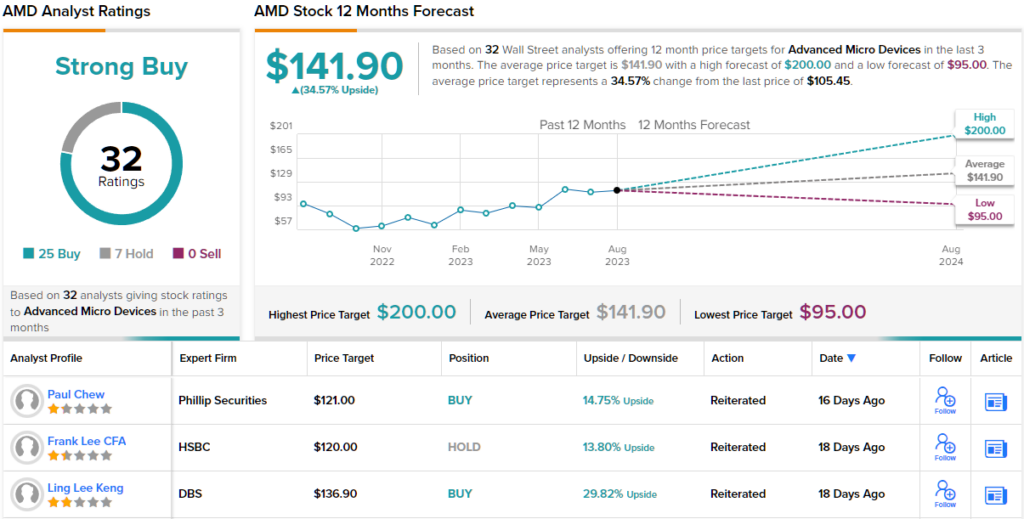

According to TipRanks, a platform that tracks and measures the performance of analysts, both companies have received Strong Buy ratings from the rest of the Street as well.

Nvidia’s Strong Buy consensus rating is based on 32 Buys and 2 Holds, while the $521.77 average target implies shares will post growth of 20.50% over the coming months. (See Nvidia stock forecast)

Meanwhile, AMD’s ratings breakdown into 25 Buys and 7 Holds, also coalescing to a Strong Buy consensus view. At $141.90, the shares are anticipated to appreciate by ~35% over the one-year timeframe. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.