Chip giant Nvidia (NASDAQ:NVDA) is scheduled to announce its fiscal second-quarter results after the market close on Wednesday, August 23. NVDA shares have skyrocketed over 221% since the start of this year, as the company is being viewed as one of the biggest beneficiaries of the generative artificial intelligence (AI) wave. Most Wall Street analysts are upbeat about the company’s ability to beat Q2 FY24 estimates and the growth potential of its advanced chips and technology.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A Look at NVDA’s Q2 Expectations

Nvidia’s blockbuster fiscal first-quarter earnings report (ended April 30, 2023) in May drove a rally in the stock, as the company issued fiscal Q2 revenue guidance of $11 billion (plus or minus 2%), which was nearly $4 billion more than analysts’ consensus estimate. The company’s stellar Q2 FY24 outlook was driven by the solid demand for its data center family of products. Nvidia’s advanced graphics processing units (GPUs) are needed to power cloud computing and generative AI applications.

Meanwhile, analysts expect Nvidia’s Q2 FY24 revenue to rise 65% year-over-year to $11.2 billion and adjusted EPS to jump to $2.08 from $0.51 in the prior-year quarter.

On Monday, HSBC analyst Frank Lee increased his price target for Nvidia to $780 from $600 and reaffirmed a Buy rating on the stock. Lee raised his FY24 and FY25 AI server assumptions and believes that NVDA’s earnings upside potential is still not fully priced into the shares. He expects bullish AI server momentum to continue to surprise on the upside.

Similarly, CFRA analyst Angelo Zino raised the price target for Nvidia to $500 from $480 on Monday and increased his EPS estimates for FY24 and FY25, while maintaining a Buy rating. Zino cited the company’s AI prospects as the reason for his higher price target.

The analyst expects Q2 FY24 EPS of $2.09 on revenue of $11.1 billion. In particular, Zino expects Q2 revenue to be driven by a “greater appetite” for GPUs across the data center space, reflecting surging orders from cloud providers and pricing power for the company’s H100 chips. He also expects the gaming segment to return to year-over-year revenue growth after four quarters of declines. “We like NVDA’s strong competitive moat on the software side,” said Zino.

Zino thinks that management’s commentary highlighting software revenue potential and the outlook for the third quarter will be critical. He projects third-quarter EPS of $2.37 on sales of $11.1 billion, indicating sustained demand.

Last week, Raymond James analyst Srini Pajjuri boosted his price target for Nvidia to $500 from $450 and reiterated a Buy rating. While estimates “aren’t exactly low” heading into the Q2 FY24 print, the analyst feels that a more modest beat-and-raise report relative to last quarter and talk of visibility extending into 2024 should keep the rise in NVDA stock going.

Pajjuri increased his estimates, noting that GPU demand is significantly outpacing supply due to the AI spending boom despite mixed cloud capital spending trends.

Is Nvidia a Buy or Hold?

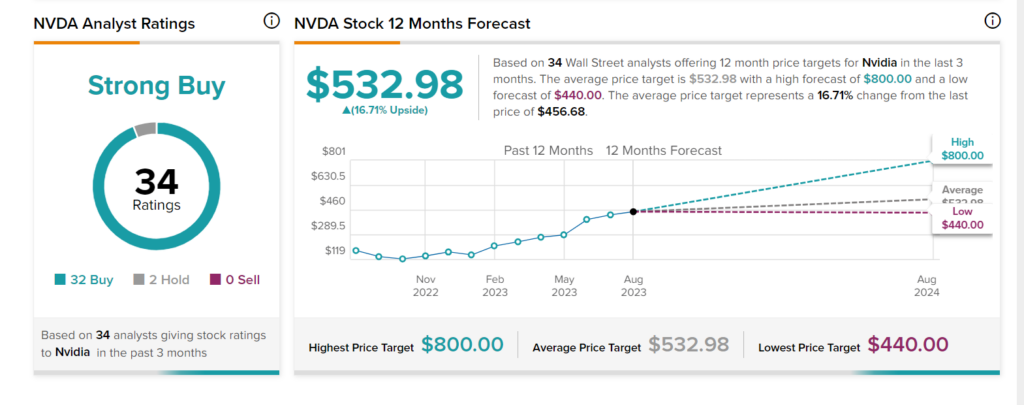

Ahead of Q2 FY24 earnings, Wall Street is highly bullish on Nvidia, with a Strong Buy consensus rating https://www.tipranks.com/stocks/nvda/forecastbased on 32 Buys and two Holds. The average price target of $532.98 implies 16.7% upside potential.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a 10.97% move on Nvidia earnings. NVDA shares have averaged a 6.3% move in the last eight quarters. In particular, the stock rose 24.4% in reaction to the Q1 FY24 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Conclusion

Investors and analysts have high expectations from Nvidia’s fiscal second-quarter results due to demand for its AI chips. Nonetheless, the stock might decline if the company fails to meet the market’s expectations or issues lackluster guidance.