The growing market share of EVs (electric vehicles), favorable policies, and elevated demand have driven EV stocks higher. However, that’s not the case with Nio (NYSE:NIO).

Shares of this Chinese EV maker have lagged its peers and underperformed the Nasdaq composite index. To be precise, Nio stock is down about 32% on a year-to-date basis. Further, it has fallen by 18% over the past three months.

During the same period, Tesla (TSLA) and Lucid (LCID) have increased by 43.4% and 124.3%, respectively.

What Dragged Nio Down?

Industry-wide supply-chain challenges and the restructuring of its manufacturing lines for new product launches dragged Nio stock down.

Meanwhile, investors’ negative sentiment on Chinese stocks amid increased government regulations also weighed on the stock. TipRanks’ Stock Investors tool shows that about 2% of the investors who hold portfolios on TipRanks have lowered their exposure to Nio stock over the past month. Further, 1.1% of these investors cut their holdings in the last seven days.

It’s worth noting that NIO earnings topped the Street’s consensus estimate in Q3. However, its Q4 revenue guidance fell short of Wall Street’s expectations. Nio expects Q4 revenues to be in the range of $1.46 billion to $1.57 billion. In comparison, the Street’s consensus estimate stood at $1.7 billion.

What’s Next?

While supply-chain issues remain, Nio’s strong November deliveries suggest that the company is on the right track. Nio delivered 10,878 vehicles in November and 80,940 vehicles year-to-date, representing year-over-year growth of 105.6% and 120.4%, respectively.

Further, Nio stock has positive indicators from bloggers and hedge fund managers. TipRanks’ Hedge Fund Trading Activity tool shows that hedge funds have added 3.5 million NIO shares in the last three months.

Looking ahead, Vijay Rakesh of Mizuho Securities termed “2022 a big year for Nio” and expects three new product launches and E.U. expansion to support its growth. Rakesh maintained a Buy rating on Nio with a price target of $65.

Wall Street’s Take

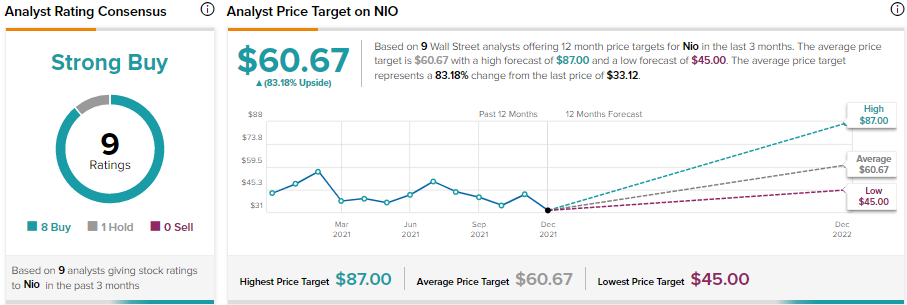

On TipRanks, Nio stock sports a Strong Buy consensus rating based on 8 Buys and 1 Hold. Furthermore, Nio scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that it will likely outpace the market averages.

The average Nio price target of $60.67 implies 83.2% upside potential to current levels.

Disclosure: On the date of publication, Amit Singh had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >