EV maker Nio (NIO) is currently demonstrating one of the simplest business aphorisms ever: if you don’t make anything, you can’t sell it.

With production halted, and only its current backlog left to sell, the company’s stock is in decline.

It dropped 8.4% in premarket trading on Monday and those losses carried on into Monday morning trading. Right now, I’m a bit pessimistic, and I’m pulling back to neutral on Nio as a result.

Nio has been in what amounts to freefall since late June 2021. Some updrafts have given the company brief boosts in the interim. However, given that Nio has lost over half its value since June 2021, the conclusion remains the same.

The latest news will prove no help. Nio announced on Saturday that it was shutting down production due to COVID-19 related supply chain issues. The factories that supply Nio with parts have shut down already, so Nio sees little point in staying open.

A day later, Nio also announced price hikes on its three sport utility vehicle (SUV) lines, the ES8, the ES6, and the EC6. All three would see prices jump 10,000 yuan — about $1,570 — starting May 10.

Wall Street’s Take

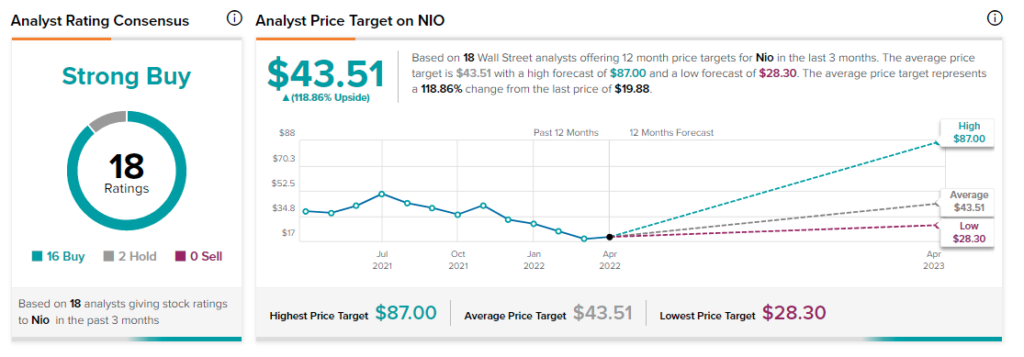

Turning to Wall Street, Nio has a Strong Buy consensus rating. That’s based on 16 Buys and two Holds assigned in the past three months. The average Nio price target of $43.51 implies 118.9% upside potential.

Analyst price targets range from a low of $28.30 per share to a high of $87 per share.

Hedge Funds Confident Despite No Dividend

Hedge funds proved their confidence in Nio by steadily ramping up their investment. The TipRanks 13-F Tracker shows that not only did hedge funds increase their investment between September and December 2021, but also, that’s part of a streak that dates all the way back to December 2020.

However, income investors looking for a dividend here will be stymied. Nio’s dividend history shows that the company has no plans to issue a dividend, and has yet to issue one at all.

A Temporary Problem?

Here’s the thing about Nio: your assessment of Nio right now is probably valid no matter what it is.

After all, before the recent ramping up of COVID-19 testing in China, and the lockdowns that came along with it, Nio was doing well. So to believe that Nio can return to that level once the lockdowns stop isn’t out of line. This is a temporary problem that will likely be solved in time.

Or is it? That’s the big issue here; Nio isn’t currently suffering due to anything it can control. Nio is shut down because its component suppliers can’t supply product. Why can’t its component suppliers supply product? Part of this would likely be traced back to the ongoing supply chain meltdown.

The Chinese government gets at least some of the blame here for its zero-tolerance and unnecessarily draconian response to COVID-19. In a time when even the most liberal enclaves of the United States have given up on lockdown fever, China has plunged back into it full-tilt.

Despite original projections suggesting that Shanghai would only be shut down for a few days, and only half the city at a time, the whole city has been shut down since April 5.

The response has been horrifying, and features reports of insanity and suicide. Other Chinese cities are on edge, fearing that they may be next to suffer lockdowns.

Nio’s ability to function will likely depend on how fast the Chinese government can get out of the way. Quickly enough, Nio can get parts in, assemble them, and sell the produce. The market is clearly there; it’s been there for some time.

Not quickly enough, and Nio goes under because it has nothing to sell. It has a market, but it can’t satisfy that market by government mandate.

Worse, even if the Chinese government concludes its COVID-19 interdiction efforts quickly — which seems more like a declining hope with each new day — that may not be enough.

This isn’t the first time Nio has shuttered production. March 29, just about two weeks ago, Nio shut down its Hefei plant for five working days. That was due to the ongoing semiconductor shortage.

Thus, the supply chain may have continued to bite on Nio, regardless of what the Chinese government did.

Concluding Views

I’m staying neutral on Nio right now because I can’t tell how the Chinese government will play this. Betting on the Chinese government to support business interests seems like a long shot.

Certainly, Nio has a stockpile that it can sell while the lockdowns go on. But if the lockdowns go on much longer, that stockpile may not hold out.

That stockpile already had to hold out an extra week beyond what the government contributed to thanks to that first shutdown over semiconductors.

Nio is as vulnerable to issues in the supply chain as anyone else is. With little to suggest these points will improve any time soon, Nio’s days may be numbered.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure