I am bullish on Nio Inc. (NIO), as it has a strong competitive position and a promising long-term growth runway. Moreover, Wall Street analysts are overwhelmingly bullish on the stock, and the average price target implies massive upside potential over the next year.

Nio Inc. is an automotive manufacturer based in China, specializing in the electric vehicle market. It also provides subscription services and charging solutions to the growing EV market. NIO seeks to create an ecosystem of products that provide personalized services to users. Its suite of EV products includes battery swap stations, power mobile, super chargers, and power mobile.

The company has enormous investor confidence, with stakes from high-profile companies like Tencent, Lenovo, and TPG. The flagship product is Battery as a Service (BaaS) in collaboration with Contemporary Amperex Technology Co. Limited and other groups.

Strengths

NIO sits at the helm of innovative EV products that are poised to become the go-to solution for the automotive industry in the future. The company already has a significant head start in the market with innovative electric vehicles, including the ET5 and ET6 cars. Its flagship car, EP9, is said to be one of the world’s fastest electric cars, with a lap record of 06:45.900 at the Nurburgring Nordschleife race track.

But more importantly, NIO offers comprehensive charging solutions to users of electric vehicles. Over the years, these services will become indispensable, and the lack of significant competition suggests a strong revenue outlook for the future.

Recent Results

In NIO’s third quarter of 2021, it managed to bring in a whopping US$1.5 billion in revenue after delivering 24,439 vehicles, including 5,418 ES8s. This is an increase of 100.2% from the third quarter of 2020 and 11.6% from the second quarter of 2021.

Although the company also provides BaaS services and a suite of EV products, vehicle sales accounted for a significant portion of its revenue, with US$1.3 billion in the third quarter of 2021.

Valuation Metrics

NIO stock is very difficult to value, as it is far from profitable and is growing rapidly. The company currently trades at 6.26x revenue, which is below its historical average of 6.91x.

Analysts expect the company to maintain its strong growth momentum in 2022 by growing revenue by 74.4%, after growing revenue by 120.8% in 2021 and 107.8% in 2020.

EBITDA margins are also expected to improve remarkably, from -21.9% in 2020 and -7.9% in 2021, to a near break-even -0.2% in 2022. That means that, beginning in 2023, NIO should begin generating profits.

Wall Street’s Take

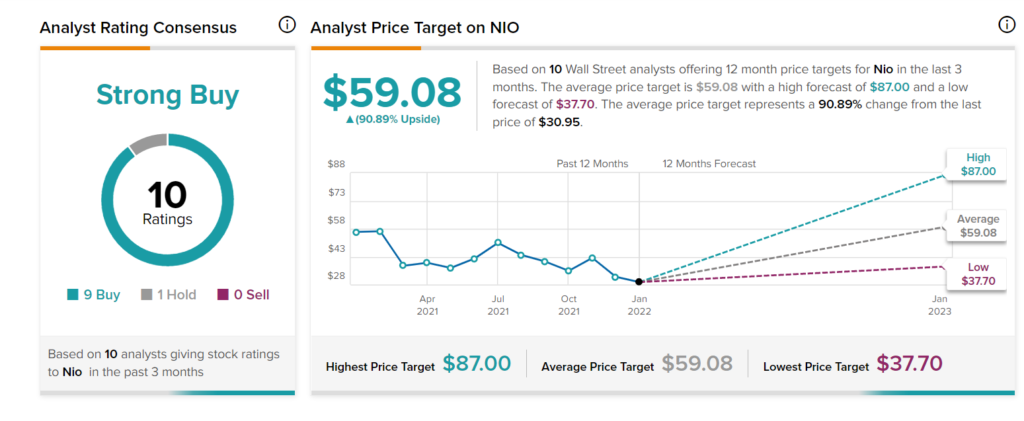

According to Wall Street analysts, NIO earns a Strong Buy analyst consensus based on nine Buy ratings, one Hold ratings and 0 Sell ratings in the past three months. Additionally, the average Nio price target of $59.08 puts the upside potential at 90.89%.

Summary and Conclusions

NIO has tremendous upside potential, thanks to its top tier competitive positioning in the world’s largest electric vehicle market (China). On top of that, it receives support from the government in China, which gives it a key competitive advantage. That’s in addition to its well-respected brand, large network and economies of scale advantages, and leading technology.

NIO is also pursuing international growth in Europe, which could prove to be a very profitable venture and lead to massive long-term growth for the company. As a result, Wall Street analysts are almost unanimously bullish on the stock and the average price target implies that the stock could more than double over the next year.

As a result, it looks like it might be a good time to add shares.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure