Is it time sentiment changed around EV truck startup Nikola (NKLA)? The pre revenue company was once a controversy magnet and has been hindered by underwhelming partnerships and abandoned plans, but it all seems to be slowly falling into place for this beaten-down stock.

As least, that is the impression Deutsche Bank analyst Emmanuel Rosner got following the company’s Analyst Day event. This took place at its Coolidge, Arizona manufacturing facility and Phoenix headquarters.

It appears Nikola is not far off generating revenue now that production of its Tre BEV electric Class 8 truck is truly underway.

Moreover, supported by “tailwinds from increasingly stringent emissions regulations and supplementary incentive programs,” both at the federal and state levels, the company’s pipeline is attracting “solid interest” from commercial customers.

For the Tre BEV, based on LOIs with 8 different customers, the company has up to 425 units of orders. And going by LOIs and contracts with 4 different customers, for the Tre FCEV, there are up to 1,010 units of potential orders.

Although there has been no change to 2022 targets and during the production ramp-up the company still expects “deeply negative gross margins,” Rosner sensed there could be “upside potential” from improved vehicle pricing.

“More impressive,” the analyst added, “NKLA expects to reach positive gross margin for the BEV in 2023, and around 20% in a steady state environment (likely 2025-2026).” A similar trajectory is anticipated for the the FCEV truck, albeit a year later, starting with -75-60% GM for 2023, followed by breaking even the next year, and 20% in a “steady environment” (2026-2027).

These are “bold gross margin targets,” notes Rosner, before adding that “questions remain around the exact path to getting there.”

So, is it time for a meaningful narrative change around Nikola? Not quite yet. Although that could happen, it is entirely dependent on Nikola delivering on its promises.

“Nikola will need to execute well in a challenging environment in order to ramp volumes and reach profitability on a seemingly tight timeline,” the analyst wrapped up. “And Nikola still needs to raise at least $650m of capital this year, which could dilute shareholders.”

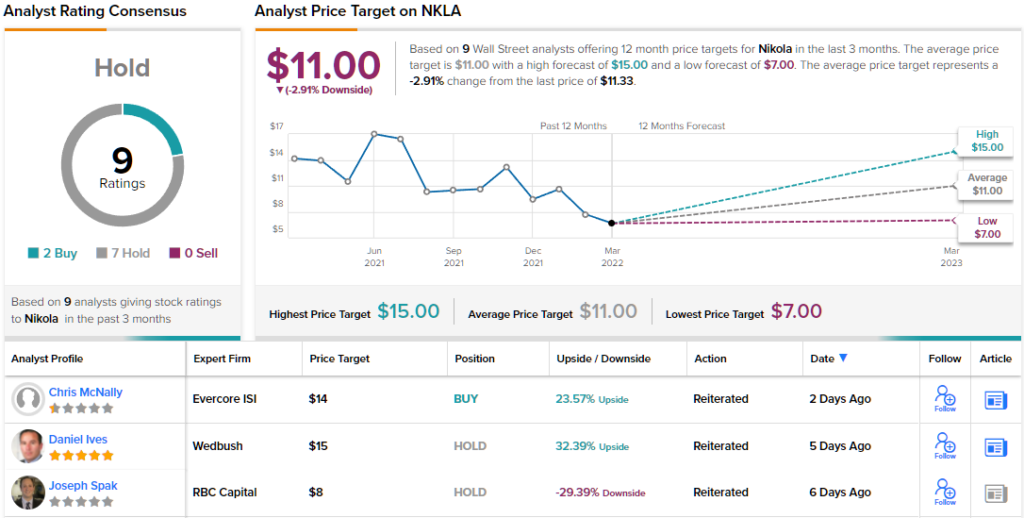

It’s a Hold rating, then, from Rosner, who also sticks with an $11 price target, indicating room for share growth of 9% over the coming months. (To watch Rosner’s track record, click here)

The Street fully agrees with Rosner’s stance. In fact, the average price target is identical, while barring one Buy, all 8 other ratings are to Hold, making the consensus view on NKLA stock a Hold. (See Nikola stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.