Athletic footwear and apparel maker NIKE, Inc. (NYSE: NKE) will release its financial results for the fourth quarter of Fiscal 2022 today, June 27, after the market close. It offers footwear, apparel, equipment, accessories, and services globally.

Though uncertain macroeconomic conditions and supply chain challenges remain headwinds for the stock, Nike has demonstrated resiliency and operational capabilities even in tough times.

In the third quarter, Nike posted upbeat results. The company’s direct-to-consumer (DTC) strength, product innovation, and digital platform drove revenues. The top-line numbers increased 5% year-over-year, while gross margins expanded by 100 basis points. However, sales in China were impacted due to COVID-related restrictions.

During the Q3 earnings call, Nike’s CFO Matt Friend commented, “NIKE’s brand strength and consumer demand remains at an all-time high, and we are confident in our business momentum.”

Therefore, prior to the fiscal Q4 2022 earnings release, with the help of TipRanks’ Website Traffic Tool, we can see the company’s performance in Q4. This new tool measures and analyzes a company’s website visits over a particular period.

Website Visit Data Reflect an Uptrend

Using the website traffic tool, an uptrend was identified. In Fiscal Q4 2022, total visits to nike.com showed a rising trend, on a global basis, representing a surge of 26.43% from the prior-year quarter and an 8.79% sequential rise.

The rise in website visits could be due to increased customer demand for the company’s products and services. As a result, strong revenues might be expected in the to-be-reported quarter.

For Fiscal Q4 2022, the consensus estimate is pegged at earnings of $0.82 per share on total revenues of $12.1 billion.

Wall Street’s Take

Recently, Guggenheim analyst Robert Drbul reiterated a Buy rating on Nike but reduced the price target to $160 (41.71% upside potential) from $195.

Maintaining his bullish stance, Drbul said, “While we do not believe Nike is immune from the numerous challenges brought on by COVID-19, logistics, and other geopolitical uncertainties, we believe many of these issues are transitory in nature.”

The analyst considers the current level as an attractive buying opportunity.

“On the call, we expect several important updates from the company, including trends in its China business, inventory levels, the outlook for its important North American business, and visibility into FY23 earnings expectations,” Drbul added.

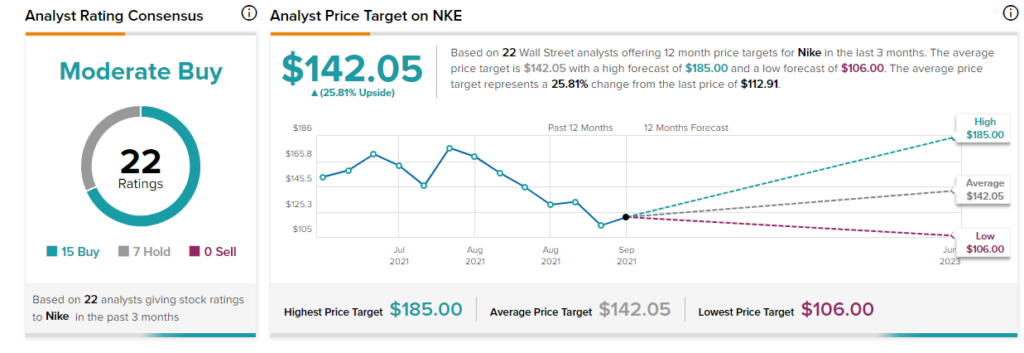

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys and seven Holds. The average Nike price target of $142.05 implies 25.81% upside potential. Shares have lost 25.28% over the past year.

Also, Nike scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Hedge Funds

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Nike is currently Positive, as the cumulative change in holdings across all 35 hedge funds that were active in the last quarter was an increase of 537,000 shares.

Bottom-Line

According to website traffic trends reflected on TipRanks’ Website Traffic Tool, Nike might report strong results in Q4. Also, hedge funds seem optimistic about the stock.

As a result, income-focused investors buying the dips may consider the stock as a valuable investment at the current level based on its long-term prospects and robust capital deployment activities.

Read full Disclosure