Companies that have increased their dividends for 25 consecutive years or more are called Dividend Aristocrats. Typically, these stocks generate sizeable cash flows across market cycles, a portion of which is distributed via dividends, allowing investors to create a predictable stream of recurring income. NextEra Energy (NYSE:NEE) is one such Dividend Aristocrat that boasts of an impressive dividend history with strong potential for long-term growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, its leadership position in the renewable energy space, visibility in growth projects, steady cash flows, and enticing valuation might allow NEE stock to deliver market-beating gains when investor sentiment improves. Hence, I’m bullish on NextEra stock.

NextEra Energy Stock Has Delivered Outsized Gains

NextEra is part of the recession-resistant utility sector, allowing it to enjoy stable cash flows even during recessionary periods. This stability has allowed NEE stock to return 584% to investors in the past two decades. After accounting for dividends, total returns are much higher at 1,165%. Comparatively, the S&P 500 Index (SPX) has returned 508% to shareholders in dividend-adjusted gains since October 2003.

Among the largest renewable energy companies globally, NextEra is valued at a market cap of $110 billion. It owns Florida Power & Light Company, which is the largest electric utility in the U.S. and sells electricity to 5.8 million customer accounts.

Additionally, NextEra owns a clean energy business called NextEra Energy Resources, which is the largest generator of renewable energy in the world. This business unit generates clean energy from seven commercial nuclear units in Florida, Wisconsin, and New Hampshire.

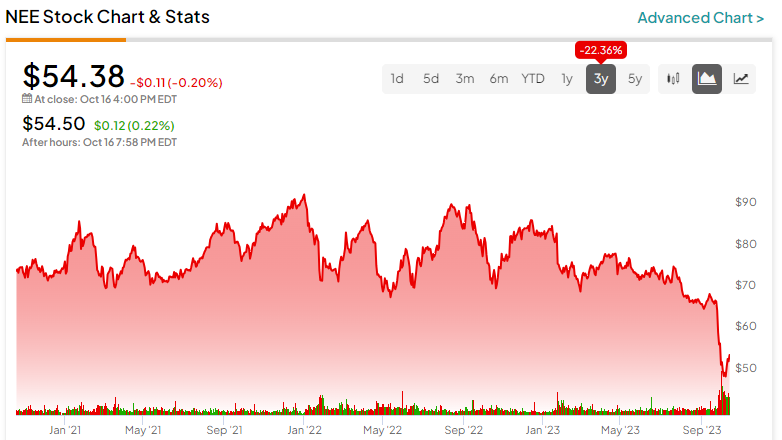

Despite its stellar returns and solid business, NextEra Energy stock is down 43% from all-time highs and is trading close to 52-week lows. As stock prices and dividend yields are inversely related, the drawdown in NEE stock offers investors an opportunity to buy the dip and enjoy a higher payout.

Currently, NextEra Energy pays shareholders an annual dividend of $1.87 per share, translating to a dividend yield of 3.4%. Comparatively, the average yield for companies part of the S&P 500 Index is around 1.6%.

Moreover, NextEra Energy has increased its dividends by 11% annually for the past 10 years, showcasing the resiliency of its business model.

NextEra Energy is Armed with a Solid Balance Sheet

In the last 20 months, investors have worried about rising interest rates, elevated inflation, and a sluggish macro environment. NextEra is part of a capital-intensive sector, which suggests that it needs to fuel expansion plans with vast amounts of debt. For instance, since 2000, NextEra’s capital expenditures have totaled $181 billion, increasing its balance sheet debt significantly.

The Federal Reserve has hiked interest rates at an accelerated pace since early 2022, increasing the cost of debt for companies and resulting in lower profit margins and cash flows.

Still, NextEra aims to maintain its investment-grade credit rating as it continues to invest in regulated businesses that are backed by long-term contracts. The company ended Q2 with $72.2 billion in debt and $21 billion in available liquidity, providing it with enough flexibility to grow its businesses.

NextEra’s sound investments in these regulated assets have driven the growth of its operating cash flows over the past two decades. Between 2000 and 2022, NextEra’s cumulative operating cash flows totaled $105.6 billion, indicating an operating efficiency ratio of over 37%, which is the highest among utility peers.

Alternatively, NextEra is not immune to interest rate hikes. Its wholly-owned subsidiary, NextEra Energy Partners (NYSE:NEP), recently announced that it would lower its annual dividend growth guidance to between 5% and 8% through 2026 compared to its earlier guidance of growth between 12% and 15%.

Is NEE Stock Undervalued?

Despite a challenging macro environment, NextEra increased adjusted earnings per share by 8.6% year-over-year in Q2 of 2023. Analysts tracking NEE stock expect its adjusted earnings to grow by 7.6% year-over-year to $3.12 per share. So, NEE stock is priced at 17x forward earnings, which is not too steep, given that its earnings are forecast to rise by 8.8% annually in the next five years.

Is NEE Stock a Buy, According to Analysts?

Analysts tracking NEE stock remain mostly bullish, as they expect the company to benefit from the worldwide shift towards clean energy solutions. Out of the 16 analysts covering NextEra stock, 13 recommend a Buy, three recommend a Hold, and none recommend a Sell, giving it a Strong Buy rating. The average NextEra stock price target is $75.07, implying 38.1% upside potential.

The Key Takeaway

NextEra Energy remains a top investment to consider, given the secular transition towards renewable energy globally. It continues to deploy significant resources toward capital expenditures, driving future cash flows and dividends higher. NextEra is also armed with robust liquidity, a leadership position, and a strong earnings profile. Therefore, the ongoing sell-off provides investors the chance to buy what I believe is a quality dividend stock at a compelling valuation.