Streaming pioneer, Netflix (NFLX), flourished during the pandemic and enjoyed an intense pull-forward effect, with its subscriber count rising aggressively. However, the tailwinds have now faded away as we look toward a post-pandemic world. The drop in the company’s subscribers and sub-par quarterly reports have resulted in the stock going down more than 60% year-to-date. While these challenges are alarming, it is imperative to remember that Netflix can pivot and overcome these issues in the long-run. Currently, NFLX trades at a cheap valuation, and couple that up with its growth juggernaut, you have a recipe for long-term success. Hence, I am bullish on NFLX stock.

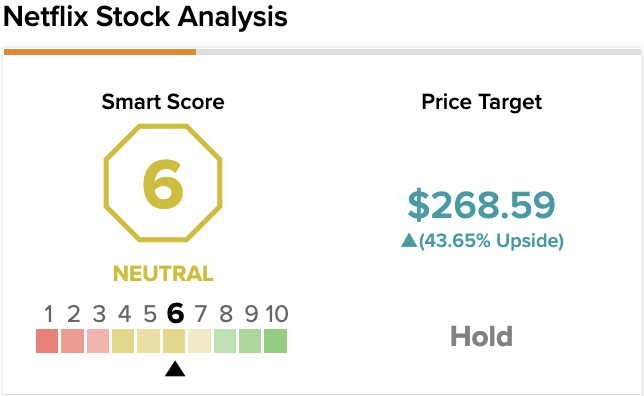

On TipRanks, NFLX scores a 6 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

First Quarter Results Were a Surprise

Netflix enjoyed its peak, experiencing massive annual revenue growth during the pandemic. In addition, the company’s spending skyrocketed, as it had the impetus to continue producing more content.

In the last five years, Netflix has tripled its top-line revenue and earnings before interest and tax. However, its first-quarter results took investors by surprise. The company’s revenue increased 10% to $7.8 billion, However, it fell short of analyst expectations of $7.9 billion. Moreover, Netflix lost 200,000 million subscribers vs. the 2.7 million gain expected.

However, on the bright side, Netflix has earnings per share of $3.53, which is well above the analyst’s expectations of $2.80. In addition, its free cash flow stood at $802 million in the second quarter, which is up from $692 million in the prior-year period.

The company mentioned that the suspension of its services in Russia resulted in the loss of millions of subscribers. Moreover, it stated that password sharing in paid subscriptions had affected its top line. According to company estimates, more than 100 million households are using Netflix through account sharing.

The password sharing and the winding down of Russian paid subscriptions have affected Netflix’s revenue. But the company continues to push forward into gaining a higher share in the market, and maintaining revenue growth in double digits.

Netflix recently increased its content spend on originals to attract more audiences to the platform. To cover the higher expenditure, Netflix raised the price of its service. The company mentioned that the price hike would help it boost revenue in the near future. So, the decline in revenue growth shouldn’t bother long-term investors.

Ad-tier Could be a Tipping Point

Investors might be of the belief that Netflix’s current business model isn’t sustainable. However, this could be less of a concern now, given that the company has pivoted to an ad-supported version of streaming services.

The company’s CEO, Reed Hastings, said that it would charge a lower price and cover its costs by running ads. In addition, Netflix’s Co-CEO, Ted Sarandos, confirmed that the company is talking to multiple ad-tech companies to support its services. Hence, it looks like Netflix will be back in the game once its ad-venture starts up.

This decision makes it easier to believe that Netflix’s future is bright. However, there are other factors that strengthen the given belief. At this point, Netflix has more than $6 billion in cash. This is enough to offer financial security to the company and allow it to make short-term investments on content.

Moreover, the company’s stock is trading at a price-to-earnings ratio of 16.3, which is its lowest in the past five years. This valuation entails that the stock could climb as soon as there’s a turnaround in subscriber losses, and the Wall Street darling will be on everyone’s radar yet again.

Wall Street’s Take

Turning to Wall Street, NFLX stock maintains a Hold consensus rating. Out of 41 total analyst ratings, 10 Buys, 25 Holds, and six Sell ratings were assigned over the past three months.

The average NFLX price target is $268.59, implying 43.65% upside potential. Analyst price targets range from a low of $157 per share to a high of $405 per share.

Takeaway –Is NFLX Stock a Buy or Sell?

NFLX’s current price drop might convince investors to ignore the stock. However, the streaming giant still has plenty of tricks up its proverbial sleeve. The company’s revenue didn’t meet analyst’s expectations, but it is still above last year’s revenue despite higher competition and the closure of streaming services in Russia. Moreover, Netflix isn’t sitting idle waiting for subscribers to add up. Instead, the company is undergoing necessary changes to increase earnings. Netflix’s decision to shift to an ad-supported version of streaming services could bring in more revenue in the future. So, you shouldn’t let NFLX go off your radar.

Read full Disclosure