Sweeping consumer frugality has not spared even the lucrative FAANG stocks – Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL), which represent five of the most prominent American technology companies. That said, the pullback in these stocks could offer an attractive opportunity to build a long-term position. Using the TipRanks Stock Comparison Tool, we’ll stack up Netflix against Amazon to pick the FAANG stock that Wall Street analysts currently find more appealing.

The TipRanks Stock Comparison Tool enables a quick comparison of up to ten stocks on several parameters, including market cap, analysts’ consensus rating, yearly gains, and upside potential.

Netflix (NASDAQ: NFLX)

At a time when investors were already worried about slowing subscriber growth, Netflix triggered panic by reporting a loss of 200,000 subscribers in the first quarter. Further, the streaming giant cautioned that it could lose up to 2 million subscribers in the second quarter. Netflix shares have lost 71% of their value so far this year.

Netflix’s subscriber growth is getting hit by a confluence of factors, including growing competition in the streaming space, suspension of services in Russia, as well as rampant password sharing. Also, with the reopening of the economy, people have been eagerly seeking other forms of entertainment outside their homes.

Netflix is scheduled to announce its second-quarter results on July 19. Investors will focus on the company’s commentary about its subscriber base and outlook for the upcoming quarters.

Ahead of the 2Q results, Morgan Stanley analyst Benjamin Swinburne sees “risk to consensus estimates” due to growing macro challenges that could push consumers to cut back on their streaming spending. That said, Swinburne feels that NFLX stock has a “compelling valuation” and the company’s planned launch of an ad-based subscription tier “should benefit the business long term.”

Based on his investment thesis, Swinburne maintained a Hold rating on Netflix shares, but lowered his price target to $220 from $300.

Overall, the Street is sidelined on Netflix stock, with a Hold consensus rating that breaks down into 10 Buys, 25 Holds, and six Sells. At $266.09, the average Netflix price target implies 52.53% upside potential from current levels.

Amazon (NASDAQ: AMZN)

Rising inflation and a potential economic downturn are expected to impact consumer spending, which in turn could slow down Amazon’s e-commerce business.

Amazon guided for second-quarter net sales growth in the range of 3% to 7%, following 7% growth in the first quarter. After seeing stellar rise triggered by pandemic tailwinds, the company’s e-commerce sales growth slowed down in the recent quarters. Amazon is also facing higher fuel and labor costs as well as supply chain pressures.

However, Amazon Web Services, or AWS, continues to be the company’s key growth driver. The higher-margin AWS business is growing rapidly as more and more enterprises are transitioning to the cloud.

Meanwhile, J.P. Morgan analyst Doug Anmuth expects Amazon’s annual Prime Day sales event (July 12-13) to drive incremental revenue of $3.8 billion this year, up from nearly $3.6 billion of incremental revenue from the last year’s event.

Anmuth added, “Importantly, over the past 2 years AMZN has doubled its fulfillment & distribution network, & nearly doubled its workforce to ~1.6M employees. Therefore, AMZN should be well prepared for the elevated demand of Prime Day & the event should help AMZN leverage some of its excess capacity.”

While Anmuth is positive about Prime Day sales, he cautioned that the overall macro environment and impact on consumer demand cannot be ignored.

However, Anmuth continues to believe that Amazon is well-positioned as the leading player in e-commerce and public cloud. Anmuth maintained a Buy rating on Amazon stock with a price target of $175.

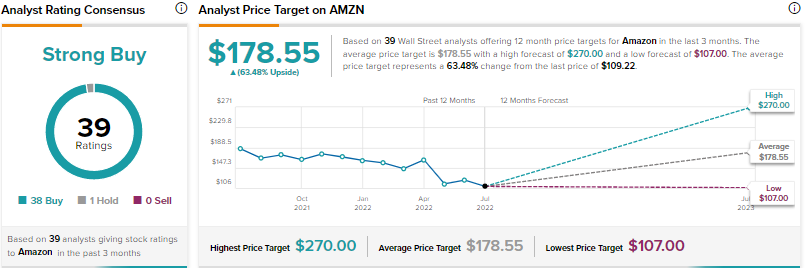

Overall, Amazon scores the Street’s Strong Buy consensus rating backed by an impressive 38 Buys and one Hold rating. The average Amazon price target of $178.55 implies 63.48% upside potential from current levels. Shares are down 34.5% year-to-date.

Conclusion

Both Netflix and Amazon are under pressure due to macro challenges. However, Wall Street analysts continue to be bullish on Amazon stock due to its leading position in the e-commerce space, and its higher-margin AWS business. In comparison, growing concerns about Netflix’s subscription base amid intense competition have kept the majority of Wall Street analysts on the sidelines.

Currently, Wall Street analysts see a higher upside potential in Amazon stock. What’s more, on the TipRanks Smart Score System, Amazon scores a nine out of 10, which indicates that the stock could likely outperform the broader market.