Netflix stock (NASDAQ:NFLX) has rallied strongly following its Q3 results, with the company’s growth reaccelerating. Impressively, Netflix posted the best quarterly subscriber additions in years while also revealing optimistic Q4 guidance. Clearly, Netflix appears to be emerging as a winner in the highly saturated streaming video-on-demand (SVOD) industry. However, the stock’s recent rally appears to have pushed its valuation to hefty levels. Accordingly, I am neutral on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Growth, Subscriber Adds Reaccelerating

The highlight of Netflix’s Q3 report was the fact that the company’s revenue growth and subscriber additions showed a reacceleration. Revenues for the quarter landed at $8.54 billion, implying a year-over-year increase of 7.8%. For context, Netflix’s revenue growth in the previous four quarters, Q2 2023, Q1 2023, Q4 2022, and Q3 2022, was 2.7%, 3.7%, 1.9%, and 5.9%, respectively. The striking contrast between Q3 2023 and Q2 2023, in particular, left a highly positive impression on the market.

Netflix’s robust revenue growth stems from an impressive 9% year-over-year increase in average paid memberships, marking the addition of 8.76 million paid subscriptions, a significant rise from the 2.41 million secured in Q3 2022. This surge is largely due to the effective rollout of paid sharing, Netflix’s robust and consistent content library, and the continuous global expansion of the streaming platform.

While the average revenue per member (ARM) experienced a slight 1% year-over-year decrease, there is no cause for alarm. This decline can be attributed to non-critical factors. These include a higher proportion of membership growth stemming from countries with lower ARM, a deliberate strategy of limited price increases over the past 18 months, and some adjustments in the mix of subscription plans.

I would like to emphasize that the addition of 8.76 million paid subscribers represents the company’s most impressive performance in years. The last time the company topped this result was back in Q2 2020, when it gained 10.09 million subscribers. This significant resurgence, especially when compared to the mere 2.41 million additions from the previous year, underscores the company’s dominance in the highly-competitive SVOD market.

To provide some context, Disney’s (NYSE:DIS) Disney+ has experienced a decline in memberships for three consecutive quarters. In the meantime, Netflix not only continues to attract new subscribers but is doing so at an accelerating pace. In my view, this speaks volumes about the platform’s enduring strength and appeal against growing competition.

Netflix’s Q4 Guidance is Even More Optimistic

Another aspect of Netflix’s most recent quarterly report that enthused investors was its Q4 guidance, which appears to be even more optimistic. For Q4, management forecasts revenues of $8.7 billion, a year-over-year increase of about 11% or 12% on a foreign-exchange neutral basis. In other words, revenue growth is set to accelerate even further from the already impressive Q3 figure of about 8%.

The company anticipates that the forthcoming net additions will mirror those of Q3. Again, this is a remarkable achievement, particularly in light of the considerable challenges facing the SVOD industry, such as intensifying competition, pricing wars, and the distracting allure of social media apps. It’s also worth noting that the Q4 guidance incorporates a $200 million decline in revenues due to the recent strengthening of the U.S. dollar. This factor accounts for the elevated FX-neutral forecast of 12%.

The Valuation is Still Hefty

Netflix’s reacceleration in revenues and subscriber additions is certainly impressive. However, I believe that the stock’s valuation remains hefty, endangering investors’ total return prospects, moving forward.

On the one hand, Netflix’s operating margin landed at 22.4% in Q3, up from last year’s 19.3%. Further, free cash flow in Q3 came in at $1.89 billion, up from last year’s $557 million and the best result in the company’s history.

On the other hand, following the stock’s post-earnings rally, even these numbers fail to justify the stock’s valuation. Netflix is expected to post EPS of about $12.19 this year, suggesting a 22.5% increase year-over-year.

No doubt, this is a very impressive growth figure in the current market landscape, especially within the SVOD industry. However, it also implies a forward P/E ratio of 35.7, which is quite rich, in my view. While it illustrates the market’s expectations for further rapid EPS growth, it leaves little to no room for error. For context, the S&P 500 Index’s (SPX) forward P/E (for 2023) sits at around 21.

Is NFLX Stock a Buy, According to Analysts?

Looking at Wall Street’s view on Netflix, the stock has drawn a Moderate Buy consensus rating based on 23 Buys, 10 Holds, and one Sell assigned in the past three months. At $464.97, the average Netflix stock price target implies 7% upside potential.

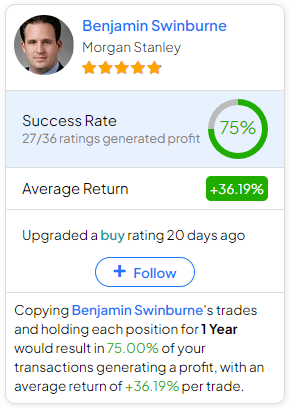

If you’re wondering which analyst you should follow if you want to buy and sell NFLX stock, the most profitable analyst covering the stock (on a one-year timeframe) is Benjamin Swinburne from Morgan Stanley, with an average return of 36.19% per rating and a 75% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, Netflix’s Q3 results and Q4 guidance undeniably reflect the company’s resurgence in a competitive SVOD market. The substantial growth in revenue and subscriber additions showcases Netflix’s enduring appeal.

However, the stock’s valuation has surged to hefty levels, raising concerns about its sustainability. Despite strong operating margins and free cash flow, the elevated P/E ratio affords Netflix little margin for error. While Netflix’s recent performance is commendable, caution should be exercised by investors as they navigate the path ahead.