Shares of fallen streaming giant Netflix (NFLX) have endured a painful crash this year. The valuation reset is ongoing, and this market will find a new range for the former high-flyer to settle down in.

For now, many investors are likely to take a hit on the chin by attempting to catch a falling knife. Billionaire investor Bill Ackman took a quick loss by catching Netflix after its first post-earnings flop. The second round of earnings results was just as painful for shareholders reluctant to ditch the ailing FAANG stock in its trying moment.

Undoubtedly, FAANG companies are known to move past tough times en route to much higher multiples. It’s their ability to continue raising the bar on growth that makes them such sought-after long-term holdings.

With the streaming world in chaos, Netflix came up with short-term-focused solutions, including the “freeloader crackdown” and price increases to shrug off inflation’s impact.

Indeed, Netflix overestimated its pricing power, with the recent uptick in competitive pressures. Every media firm has jumped aboard the streaming bandwagon. Under the weight of all the players, this bandwagon isn’t rolling as fast as it used to.

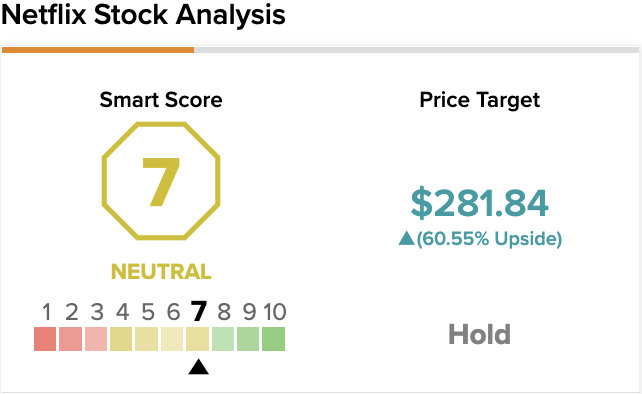

On TipRanks, NFLX scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in line with the broader market.

Netflix: Streaming Rivals are Catching Up, Fast

In a prior piece, I noted that big media’s move into streaming was a hefty expenditure that lowered switching costs. Nonetheless, the disruptive impact of Netflix has been felt, and the rest of the industry has reacted accordingly. As media feels the pinch of the lower switching costs of streaming (consumers can easily cancel subscriptions in favor of new ones in any given month), the streaming wars are ongoing, with no clear winner.

At the end of the day, media and streaming is a game where the strongest, deepest content library will win. Content is king. Nothing has changed in that regard. Though Netflix has a robust content library, with more titles on the way, it’s clear that the streaming giant no longer has the best relative content slate out there anymore.

Arguably, Disney (DIS) and its Disney+ platform seems to be the most engaging these days. As Netflix loses its luster, I find few things preventing the stock from crumbling come the next earnings report, which could reveal further subscriber losses.

Now, Netflix stock is getting cheap at around 15.9 times trailing earnings. But with some streaming rivals sporting single-digit price-to-earnings (P/E) multiples, the stakes are still high as the market continues its punishment of NFLX shares.

On the low-end, Paramount (PARA) boasts a 4.1 P/E, with Warner Bros. Discovery (WBD) commanding a mere 7.1 P/E. While Netflix is a bigger, better streamer than these two underdogs, I do think it’s really hard to draw a line in the sand, as the streaming behemoth looks to hemorrhage subscribers in the face of a recession. For now, I am neutral on Netflix.

Netflix: Could an Ad-Based Tier Reignite Growth?

A low-cost, ad-based tier may be the version of Netflix that helps the firm move through the coming economic slowdown. When times get tough, many may be more willing to sit through a few ads for a discount. While such an ad-based tier will eat away at the pricier flagship subscription service, I do think that such margin pressures will not last long. If anything, ads may be the future of Netflix.

The ad world has endured quite the shakeup in recent years. With Roku (ROKU) poised to team up with Walmart (WMT) to offer interactive ads that allow one to buy through the Roku platform, one has to think that such streaming-based ads are the way of the future.

Indeed, streaming ads hold a lot of potential. They could prove more effective than the user-targeted social-media ads that have come under fire in recent years.

If Netflix plays its cards right, ads could help propel the stock back on the growth track. Still, there’s plenty of competition out there. At the end of the day, it’s a paradise for consumers.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, NFLX stock comes in as a Moderate Buy. Out of 41 analyst ratings, there are nine Buy recommendations, and 26 Hold recommendations, and six Sell recommendations.

The average Netflix price target is $281.84, implying an upside of 60.55%. Analyst price targets range from a low of $157 per share to a high of $405 per share.

The Bottom Line on Netflix Stock

Netflix stock will eventually bottom out at a new P/E (likely in the teens). Still, such a low multiple discounts the company’s innovative capabilities.

For now, ads and the video-game push and their implications on long-term growth are a major unknown. If Netflix can out-innovate its peers on these two fronts, perhaps NFLX stock can find itself commanding a much higher growth multiple again?