Rivian (NASDAQ:RIVN) stock got a proper beating last week, recording its worst ever one-day drop (23%) after the EV maker announced a $1.5 billion convertible note offering.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The fact that the announcement came off the back of Q3 delivery numbers that beat expectations took investors by surprise. This is acknowledged by Needham analyst Chris Pierce, who says Rivian could have managed dilution better but “(1) that’s easier to see with the benefit of hindsight, and (2) dilution should now be well understood by all RIVN investors.”

In fact, given Rivian beat Pierce’s Q3 revenue estimate by $80 million at the midpoint and trumped his projected cash balance by more than $600 million, these amount to “clear execution positives,” such that the massive sell-off represents an opportunity.

“In our view,” Pierce says, “the stock’s risk/reward is at its most compelling level since we introduced coverage in March on the strength of consistent execution in 1H23, a projected strong 3Q23, and consensus out-year estimates not yet reflecting improved performance.”

With 3Q23 now derisked, the fourth quarter looks to be a “low bar,” and therefore Pierce sees “minimal risk to RIVN’s 2H23 numbers.”

After producing 14,000/16,000 in Q2/Q3, to hit its guide, Rivian only needs to produce 12,000 vehicles in Q4. “RIVN is becoming a more efficient operator,” says Pierce, “but is being given minimal credit when looking at the lack of upward movement in the consensus adj EBITDA estimate.”

Also standing in its stead is the fact that Needham’s EV OEM Used Vehicle Tracker shows that Rivian is performing above its peers, a “bullish indicator for new vehicle demand.” Specifically, the data shows its R1T pick-up truck is “holding up better” compared to Ford’s F-150 Lightning EV, while the R1S SUV is looking strong across the secondary markets tracked by Pierce.

It all adds up to a resounding recommendation from the analyst. “We think that the current window is the best time to own RIVN to-date, as the company is now past a convertible offering that created dislocation, short-term estimates appear achievable, and its long-term investment case is backed up by three successive quarters of hard evidence,” Pierce summed up.

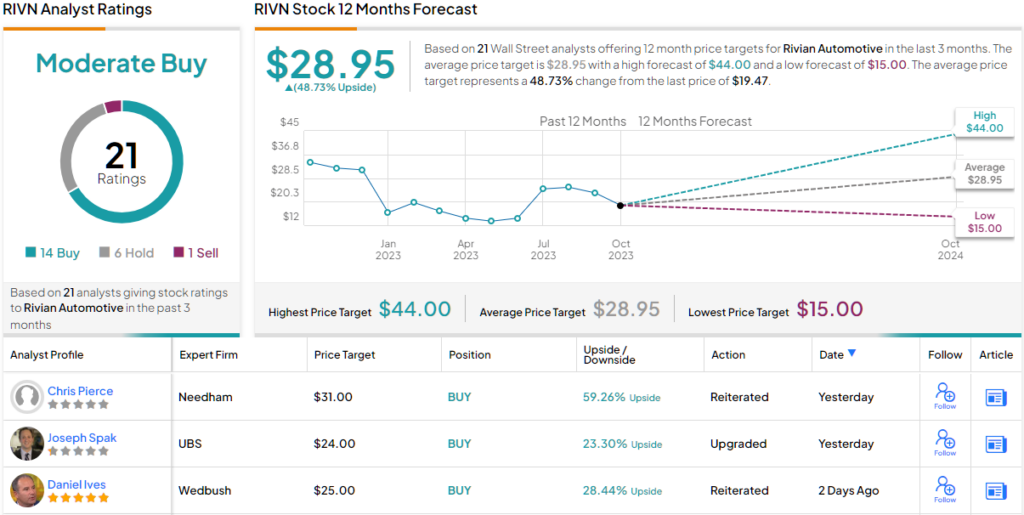

To this end, Pierce keeps RIVN stock on the Needham Conviction List, reiterating a Buy rating and $31 price target. There’s potential upside of 60% from current levels. (To watch Pierce’s track record, click here)

Elsewhere on the Street, the stock claims an additional 13 Buys, 6 Holds and 1 Sell, resulting in a consensus rating of Moderate Buy. Going by the $28.95 average target, a year from now, shares will be changing hands for ~49% premium. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.