The oil industry faces heightened uncertainty triggered by the deepening crisis in Ukraine and proposals to ban Russian crude oil.

Oil prices have almost doubled over the past year and reached around $140 a barrel last month, triggered by the repercussions of Russian oil supply losses and dislocations stemming from sanctions targeted at Russia by the international community.

However, most recently, oil prices have somewhat stabilized, supported by the steady output increases from the Organization of the Petroleum Exporting Countries (OPEC) member countries, the U.S., and other non-OPEC countries as well as coordinated stock releases from International Energy Agency (IEA) member countries.

To aid an extremely tight oil market, on April 1, IEA member countries agreed to utilize their emergency reserves for the second time within a span of a month.

Conversely, surging COVID-19 cases in China have led to severe new lockdown measures, pulling down demand for oil. Further, weaker-than-expected demand in Organisation for Economic Co-operation and Development (OECD) countries drove downward revisions in demand for global oil demand in the second quarter as well as the full year.

According to the IEA Oil Market Report, global oil demand has been lowered by 260 kb/d (thousand barrels per day) for the year against prior estimates issued last month.

However, demand is still higher by 1.9 mb/d (million barrels per day) compared to 2021 levels and is expected to average 99.4 mb/d in 2022.

Notably, utilization of a limited supply of reserves to overcome supply issues in the oil market is only a temporary solution and may not help bring down oil prices in the long run.

Analysts continue to have a bullish view of the oil sector, with continually rising oil prices and oil supply concerns acting as immediate catalysts.

Let’s take a look at a top pick from the booming oil sector, Murphy Oil (NYSE: MUR).

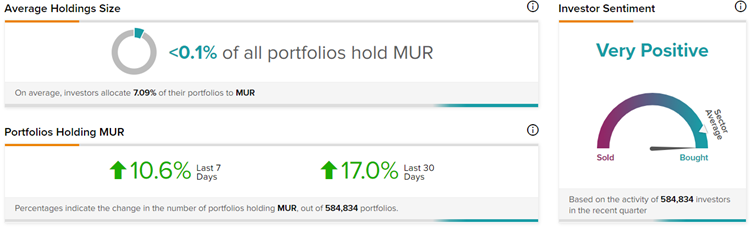

Interesting to note, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Murphy Oil, with 17% of investors increasing their exposure to MUR stock over the past 30 days. Furthermore, in the last week, 10.6% of investors increased their exposure to MUR stock.

Murphy Oil (MUR)

Outpacing the rising oil prices, Murphy Oil shares have almost trebled over the past year. What is driving the outperformance versus the overall oil price index?

Based in Texas, U.S., Murphy Oil Corp. is a holding company engaged in the exploration and production of oil and natural gas. The company has global offshore operations that are complementary to the North American onshore business.

The company’s exploration activities are focused in four main regions: the U.S. and Mexico deepwater Gulf of Mexico, Brazil, Vietnam, and Australia.

J.P. Morgan analyst Arun Jayaram holds a bullish view on the stock and believes that “MUR has meaningful oil torque.”

The analyst foresees “an important FCF inflection point for the company at mid-year 2022 given the start-up of Khaleesi, Mormont, and Samurai fields, while the 2023 outlook should benefit from the restart of Terra Nova field offshore Canada (7.5 MBo/d of net oil volume).”

Last week, MUR announced the first oil from its Gulf of Mexico (GoM) development project at Khaleesi, Mormont, and Samurai.

The consequential ramp-up in production couldn’t have come at a better time in this robust commodity price environment.

Notably, the company expects to place all seven wells sequentially online in the current year, with the second well coming online over the next few days and the third well expected to be online in early May.

Further, Jayaram is bullish on another catalyst for the company, with the potential consolidation of MUR’s position in the GoM by purchasing Petrobras’ share.

In 2018, MUR inked a joint venture agreement with Petrobras in the GoM worth $900 million under an 80%/20% structure. The GoM properties operated by MUR added 86 MBoe (thousand barrels of oil equivalent) of 2P reserves (probable reserves) and 41 MBoe/d of net production.

Recently, Petrobras has placed its 20% ownership position on the sales block, with MUR being the logical buyer for the assets.

Jayaram projects the consolidation to be completed by the end of this year or early 2023. He further highlighted that MUR will not overpay for the asset as it retains a preferential rights option in the JV.

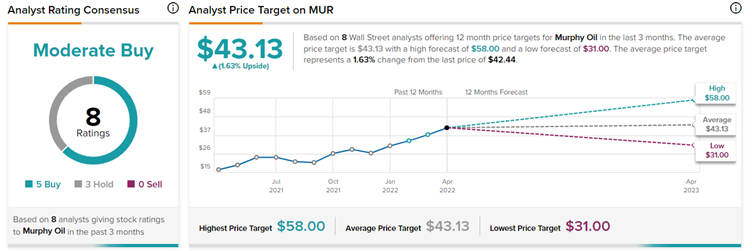

Based on all the above drivers, last week, Jayaram increased the price target on Murphy Oil to $51 (20.2% upside potential) from $37 and reiterated a buy rating.

The rest of the Wall Street community, however, is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on five Buys and three Holds. The average Murphy Oil price target of $43.13 implies 1.6% upside potential to current levels.

Key Take Away

There is a reason why Murphy oil has outperformed the oil industry overall and the benchmark over the past year, a year that was fraught with myriad uncertainties, pulling down investors’ confidence.

Combined with seven new wells going online and the possible GoM consolidation, Murphy Oil has a number of catalysts in the coming years that will keep the rising share price trajectory intact.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure