Headquartered in Las Vegas, MP Materials (MP) owns and operates rare earth mining and processing facilities. I am bullish on the stock.

Until a few years ago, most people on Wall Street probably didn’t spend much time thinking about rare earth materials. However, as supply chains became constrained and the U.S. strove to reduce its commodity dependence on other nations, the topic of rare earth materials started to appear in the financial headlines.

To be perfectly honest, there aren’t many publicly traded, pure-play rare earth companies in the U.S. The pickings are slim, but fortunately, MP Materials stock is available, has daily trading volumes in the millions, and is reasonably priced. Besides, as we’ll discover, MP Materials is demonstrating excellent top- and bottom-line growth.

On top of all that, MP Materials is teaming up with an automotive market giant to build a potentially game-changing production facility. Sure, the company can’t fix the world’s supply-chain woes single-handedly, but MP Materials can at least be part of the solution and enrich its investors along the way.

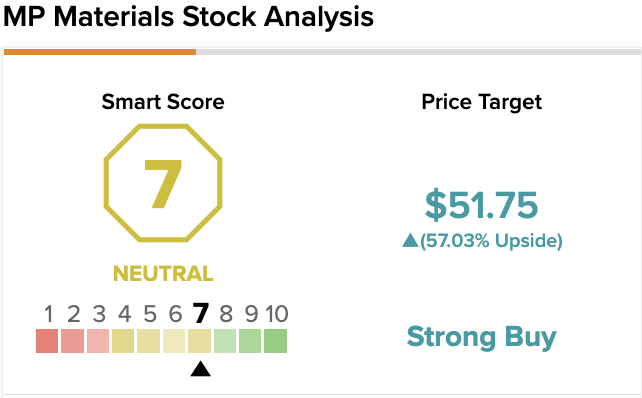

On TipRanks, MP scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in line with the broader market.

A Rare Value

MP Materials stock is rather reasonably priced in the $30s, as it has traded as high as $60.19 in the past year. The stock has bounced off of the low $30s on more than one occasion, so this area might be considered a support level.

Also, MP Materials’ trailing 12-month P/E ratio is 30.67, which isn’t unreasonably high. In other words, the company’s share price seems to be fully justified by MP Materials’ earnings. To confirm that this is true, we’ll need to delve deeper into the company’s financials.

As it turns out, MP Materials really knocked it out of the park in 2022’s first quarter with triple-digit growth across the board. On a year-over-year basis, the company increased its revenue 177% to $166.3 million (beating Wall Street’s expectation of $137.5 million); its net income 431% to $85.6 million; its adjusted EBITDA 301% to $132.3 million; and its adjusted diluted EPS 285% to 50 cents per share (versus the analysts’ consensus estimate of 38 cents per share).

In light of a slew of blockbuster data points, MP Materials Chairman and CEO, James H. Litinsky, engaged in a moment of well-deserved boasting for his company. “The MP team delivered strong execution and performance in the first quarter, highlighted by record quarterly revenues and profitability. We benefited from our continued focus on cost discipline and strong realized pricing,” Litinsky commented.

Thus, MP Materials is growing financially, but what about the industry in which the company operates? Make no mistake about it: The rare earth market is also in rapid growth mode, and that’s bullish for MP Materials.

Transforming and Revitalizing

So, let’s start off with the basics. As MP Materials explains, rare earths are a series of chemical elements found in the earth’s crust. They have essential applications in such areas as electric vehicles, military guidance and control systems, smartphone components, and wind turbines.

MP Materials purchased California’s Mountain Pass mine in 2017. Believe it or not, Mountain Pass is “the only integrated rare earth mining and processing site in North America” (according to MP Materials). So, America’s rare earth industry and MP Materials are practically inextricable.

Plus, there are global implications here, as MP Materials asserts that it “produces a concentrate that contains about 15% of the rare earth content consumed annually.” Furthermore, MP Materials is a significant producer of neodymium-praseodymium (NdPr) oxide, a magnet ingredient that’s used in many electric vehicles.

As the demand for electric vehicles grows, so will the need for rare earth magnetic materials. To help address to supply-and-demand gap, MP Materials is teaming up with General Motors (GM) to build a rare earth metal, alloy, and magnet manufacturing facility in Fort Worth, Texas. This gigantic facility will have the capacity to produce roughly 1,000 tonnes of neodymium-iron-boron (NdFeB) magnets annually.

It might be argued that this partnership will have implications far beyond the bottom lines of MP Materials and General Motors. Indeed, bringing magnetics-manufacturing capabilities home to the U.S. is “transformational for MP Materials and America’s supply chains,” Litinsky declared. Thus, with this collaboration, MP Materials is “leading the restoration of the full supply chain and the revitalization of the American manufacturing spirit in our sector.”

Wall Street’s Take

According to TipRanks’ analyst rating consensus, MP is a Strong Buy, based on seven Buy and one Hold ratings. The average MP Materials price target is $51.75, implying 57.03% upside potential.

The Takeaway

With so few pure-play U.S.-based investment options in the rare earth materials sector, it’s amazing that more traders aren’t hoarding shares of MP Materials stock. It seems that the stock is undervalued in mid-2022, so there’s a window of opportunity here for savvy investors.

Moreover, the collaboration with General Motors will not only provide enduring value for MP Materials’ shareholders but could also help to alleviate the imbalance between supply and demand for rare earth materials. Consequently, traders should seriously consider a buy-and-hold position in MP Materials stock as the company plays an indispensable role in addressing an under-reported supply-chain issue.