Say what you want about the stock market but there’s barely ever a dull day for investors. This week the markets are anticipating the release of consumer price data on Wednesday, which will be followed the next day by a report on wholesale prices.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The findings are important indicators of how far the economy has advanced since the Fed started sharply raising interest rates in reaction to soaring inflation more than a year ago.

While the markets await these key readouts, the analysts at banking giant Morgan Stanley have been seeking the right equities for investors to lean into right now. Their conclusion appears to be: stick to some industry titans. They believe it is time to turn bullish on two category leaders with both stocks receiving upgrades recently.

We ran these tickers through the TipRanks database to see whether there’s widespread agreement amongst Wall Street’s legion of stock experts that these names represent sound investing opportunities right now. Let’s check the results.

General Motors Company (GM)

We’ll start in Detroit, with one of the names that made Motown the Motor City: General Motors. The world’s largest automaker until 2008 (when it was surpassed by Toyota), GM is still the largest auto company in the US markets. From its headquarters in Detroit’s iconic Renaissance Center, the company oversees manufacturing operations in eight countries and distributes it four core nameplates – Chevrolet, Buick, Cadillac, and GMC – worldwide. The company is invested in China’s auto sector, and its GM Defense division produces customer vehicles for the US military.

In addition to making cars, GM has its hands in multiple auto-related businesses. These include the OnStar roadside assistance, security, and information services provider, and the ACDelco auto parts maker. GM also operates the General Motors Financial company, providing credit and financing for car purchasers.

While cars are frequently regarded as discretionary purchases, that’s only partly true. John Q. Public can’t get along without a car, most places, and so his discretion is sometimes limited to which car he’ll buy. In that sense, providing a necessary product, GM has taken a recession-proof niche.

And the company has leveraged that to good effect. GM has a $46.5 billion market cap, and brought in $156.8 billion in total revenues last year. In the last quarterly release, for 1Q23, the company showed a top line of $39.99 billion, up 11% year-over-year and ahead of the forecasts, beating the estimates by $610 million. The company’s non-GAAP EPS figure was reported at $2.21, beating the year-ago quarter by 5.7% and outpacing the forecast by 48 cents, or 27%. The company generated $2.23 billion in net automotive cash from operations in the quarter ending March 31, for a hefty y/y gain of 36%.

All of this has caught the eye of Morgan Stanley’s auto expert – and 5-star analyst – Adam Jonas, who writes of GM, “The internal combustion franchise within General Motors is proving to be stronger and more resilient than we had anticipated. We expect a more gradual de-adoption of internal combustion in the US market versus expectations and a materially higher level of free cash flow conversion over the course of the internal combustion runoff vs. history due to lower investment burden and a more targeted/premium approach.”

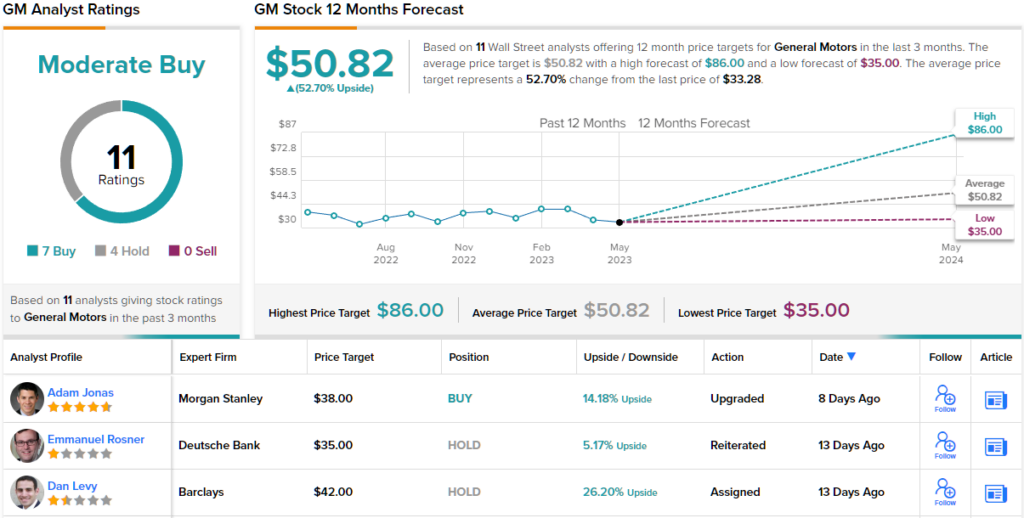

Jonas has recently upgraded GM from Neutral to Overweight (i.e. Buy), and his price target, now set at $38, suggests the stock will grow 14% this year. (To watch Jonas’ track record, click here)

In total, there are 11 recent analyst reviews for GM, and they include 7 Buys and 4 Holds, for a Moderate Buy consensus rating. (See GM stock forecast)

Dell Technologies (DELL)

The second stock we’ll look at is a well-known name in the personal computer business, Dell. The company is, perhaps, best known for the black and white ‘cow pattern’ on its shipping boxes, making them instantly recognizable – but the product inside, high quality PCs and laptops, delivered off the shelf or built to customer specs – made the firm’s reputation. Dell got its start in 1984, the early days of the personal computer revolution. Today, the company offers a wide range of PC-compatible computers and peripherals, as well as business-oriented workstations, servers, and storage systems.

The fact that we live in a digital world provides Dell with a level of protection from recessionary economic environments. In good times or bad, no matter what, this company’s product lines will always be in demand. Offices and individuals will need computers, computers will need periodic upgrades or replacement; there is no way around this fact.

And that helps to underlie Dell’s success. The company’s shares are up more than 14% so far this year, compared to the 8% year-to-date gain in the S&P 500 – and the company beat the revenue and earnings forecasts in its last quarterly report, released in March for fiscal 4Q23.

In that report, Dell showed a top line of just over $25 billion. While this was down 10% year-over-year, it beat the Street’s expectations by over $1.5 billion. The firm’s non-GAAP earnings-per-share came in at $1.80, up from $1.72 in the prior-year period – and 16 cents above the estimates. Dell saw strong performance in servers and networking, which gained 5% to $4.9 billion; in its infrastructure solutions, which were up 7% y/y to $9.9 billion; and in storage revenue, which saw a 10% y/y increase to $5 billion.

At the end of the fourth fiscal quarter, Dell reported a cash flow from operations of $2.7 billion. The company finished the fiscal year 2023 with total cash and liquid assets of $10.2 billion, enough to support a 12% increase in the annualized cash dividend to $1.48 per common share. This dividend gives investors a yield of 3.3%.

All in all, Dell’s sound position has caught positive attention from Morgan Stanley analyst Erik Woodring, who has upgraded the stock from Neutral to Overweight (Buy). Despite the year-to-date gains, Woodring makes the case for why the shares are primed to push higher from here.

He writes, “[We] are now getting more constructive on the PC ecosystem and forecast a cyclical PC market rebound off the March quarter bottom… which is an important catalyst that historically precedes DELL outperformance given DELL stock 1) has historically bottomed one quarter ahead of the PC market bottoming, and 2) is closely correlated to the trajectory of Client Solutions Group (CSG) revenue growth. Risks remain, with the primary risk being a weakening enterprise infrastructure spending environment, but with FY24 estimates materially de-risked, in our view, and the stock trading at 7x P/E (8x adjusted for SBC), we believe this risk has already been discounted, and that valuation is attractive.”

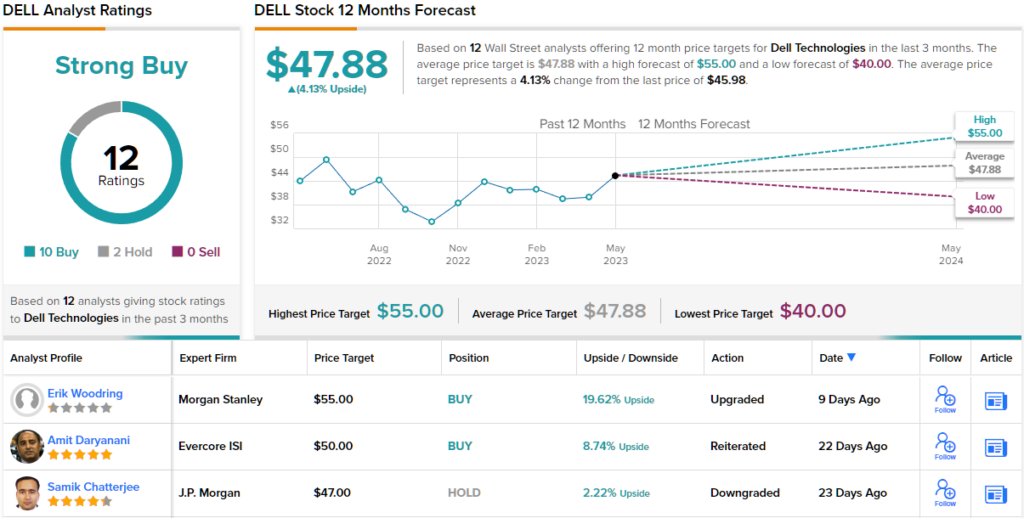

Looking forward, Woodring puts a $55 price target here, implying a potential upside for the next year of 19%. (To watch Woodring’s track record, click here)

This stock’s Strong Buy consensus rating is supported by 12 recent Wall Street analyst reviews, which have a breakdown of 10 to 2 favoring Buy over Hold. (See DELL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.