Morgan Stanley (MS) is a financial holding company that offers a wide range of products and services to institutions, individuals, corporations, and governments.

Morgan Stanley specializes in Institutional Securities & Wealth Management and Investment Management. Specifically, its core offerings include capital raising and financial advisory services, underwriting of debt, equity, and other securities, as well as advice on mergers and acquisitions.

The company had a fantastic 2021, posting record profits while returning substantial amounts of capital to its shareholders.

With shares remaining reasonably priced and an above-average dividend yield that should extend investor interest in the stock, I am bullish on Morgan Stanley.

Record Profits

Morgan Stanley wrapped up 2021 on a great note, with the company’s latest results coming in very strong. Quarterly revenues came in at $14.52 billion, 6.48% higher year-over-year, while earnings per share landed at $2.01 or $2.08 on an adjusted basis, 8% higher versus the prior-year period.

The company’s performance was powered primarily by investment banking revenues growing 5.6% during the period, driven by elevated fee-based asset management revenues on a record AUM of $1.6 trillion. Specifically, asset management revenues rose 37% to $5.4 billion.

Overall, we see that last year’s acquisition of E-Trade and the successive acquisition of Eaton Vance were confirmed far more thriving than previously expected, forcing momentous operational efficiencies that led to record revenues for the company.

EPS was also substantially boosted by Morgan Stanley’s commitment to its share repurchase program. The company repurchased $2.8 billion worth of stock during the quarter alone.

Total stock repurchases for the year reached a record $11.46 billion. Consequently, the company achieved record EPS of $8.03 for the year, a 24.3% increase compared to fiscal 2020.

Dividend & Valuation

Along with its strong buybacks that comprise a great chunk of the company’s capital returns, Morgan Stanley now counts 13 years of consecutive annual dividend hikes. The latest dividend hike last summer was by a staggering 100% to a quarterly rate of $0.70.

The company is expected to achieve EPS close to $7.59 this year, a slight decline from last year’s record numbers likely driven by assumptions deeming the bank’s performance normalizing.

This implies that the stock’s payout ratio currently stands close to 37%, which is a comfortable spot that should indicate adequate room for further compelling dividend hikes ahead.

It also implies that the stock is trading at a forward P/E close to 12.2 at its current levels, which I find quite a reasonable valuation considering the ongoing tailwinds in Morgan Stanley’s Asset Management segment, and aggressive capital returns.

Wall Street’s Take

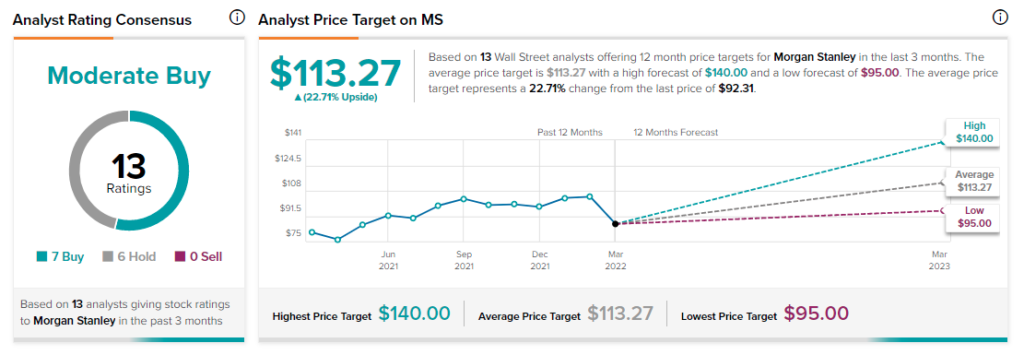

Turning to Wall Street, Morgan Stanley has a Moderate Buy consensus rating, based on seven Buys and six Holds assigned in the past three months. At $113.27, the average Morgan Stanley price target implies a 22.7% upside potential.

Conclusion

Overall, I consider Morgan Stanley one of the better picks amongst financials. The stock combines a solid growth at a reasonable price, while management’s commitment towards returning cash to shareholders remains potent.

The 2.6% dividend yield, along with enough room on the bottom line to aggressively grow the dividend going forward, should also be a strong catalyst for investors to drive shares higher. Accordingly, I am bullish on the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure