Monster Beverage (MNST) is a company with an excellent growth and profitability history. For 20 years now, MNST has grown at a double-digit pace and is one of the most profitable companies in the food and beverage industry.

Monster can continue to maintain strong revenue growth as the company is one of the leaders in the growing energy drink market. In addition, MNST has a hidden profitability driver. If the company increases the leverage to two, which is quite low for the industry, the ROE will increase by 16%.

According to my estimate, MNST is trading at a discount to the fair price. I am bullish on MNST stock.

Company Profile

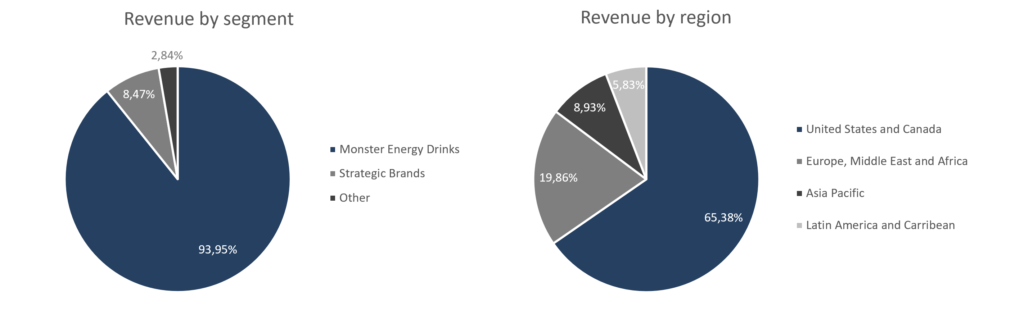

Monster Beverage Corporation is an American company specializing in developing, marketing, and distributing energy drinks, non-carbonated dairy-based coffee, non-carbonated energy drinks, and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, and Other. The revenue structure is presented below:

Past Performance and Future Prospects

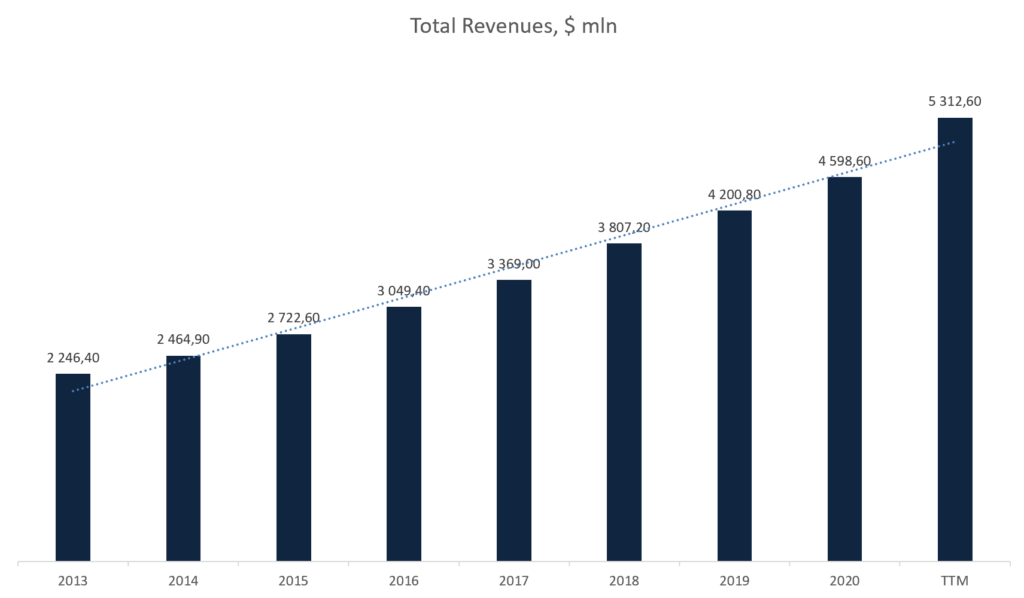

Monster has a unique history of growth – the company has been growing at a double-digit rate for over 20 years. The average annual growth rate for revenue over the past five years is 11.1%. Over the past three quarters, revenue grew by 17.1%, 33.6%, and 13.2%, respectively.

Monster can maintain sustainable growth as the company operates in a large and growing market. According to Brandessence, the Energy Drink Market was valued at $61.23 billion in 2020 and is expected to reach $99.62 billion by 2027 with the CAGR of 7.2% over the period. MNST’s competitive positioning is very strong, with the company ranking second in terms of sales and growing faster than the market.

Although the gross and operating margins have been flat for the last five years, the net profit margin has grown steadily until 2020. The net margin declined slightly in the last reporting period due to problems in the supply chain.

Despite the decline, MNST’s net profit margin is still significantly higher than that of its major publicly traded competitors.

Due to the high net margin and asset turnover, Monster has the highest ROA in the industry, 20.5%. Due to the low asset-to-equity ratio, ROE is slightly higher than the return on assets, 24.47%. Low financial leverage is a hidden driver for profitability growth. If MNST increases leverage to 2 (still relatively low), return on equity will increase by 16%, to 40%.

In addition, Monster is actively repurchasing shares. Since 2015, the number of common shares outstanding has decreased by 14%. As of November 2021, approximately $441.5 million remained available for repurchase under the previously authorized repurchase program.

Valuation

Within the DCF model, I made several assumptions. I expect revenue to grow in 2021 in line with management’s expectations and continue growing in line with expected energy drink market growth. Margins and other relative indicators are predicted based on historical dynamics and the current trend. The terminal growth rate is 3%. The assumptions are presented below:

Based on our assumptions, the expected dynamics of key financial indicators are presented below:

With a stable-growth cost of equity equal to 7.0%, the weighted average cost of capital (WACC) is 7.0%.

With the terminal EV/EBITDA of 16.93x, the fair market value is $61.83 billion, or $118.9 per share. Thus, the upside potential is about 35%.

Wall Street’s Take

Turning to Wall Street, Monster Beverage earns a Strong Buy consensus rating based on 11 Buys and two Holds assigned in the past three months. At $107.91, the average Monster Beverage price target implies 23% upside potential.

Conclusion

Monster Beverage is steadily growing in revenue, and its profitability is very high. I expect the company to grow at least in line with the energy drink market as it has strong competitive positioning.

In my estimation, MNST is trading at a significant discount to its fair price. Notably, my target price is roughly the same as Wall Street’s target price. I am bullish on the company.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure