Recently, Moderna (MRNA) held its third annual vaccine day, where the company provided an update on its pipeline.

While Moderna is primarily known for the outstanding success of its Covid-19 vaccine, its bulging pipeline consists of 31 vaccines in development, focusing on everything from Covid variants to the seasonal flu, to HIV and herpes.

In fact, following the event, Deutsche Bank’s Emmanuel Papadakis’ main impression is that the company is “throwing the kitchen sink at infectious disease development, complementing the existing respiratory focus with a broad latent virus programme.”

However, it is still early days for most of the candidates and Papadakis is not entirely convinced of the pipeline’s merit yet.

“The event was short on rare disease and oncology updates and did not necessarily convey why probability of success in many of the more difficult (latent) infectious settings will be higher for an mRNA approach (nor did it necessarily convince on unique differentiation vs multiple competitors in most settings),” the analyst explained.

The company also provided an update from the Phase 2 trial of the flu vaccine candidate mRNA1010, which it touted as showing “potential” for superiority over standard flu shots. That said, similar to the trends shown by the Phase 1 data when presented last December, the data was “mixed,” suggesting an overall similar level of effectiveness compared to available flu shots, making it hard to gauge whether Moderna’s offering can trump those already on the market.

As far as the commercial progress of Moderna’s Covid vaccine, following recent orders from Japan and Colombia, Moderna has increased its anticipated revenue in 2022 to $21 billion from the prior $19 billion. However, Papadakis says the FY22 “nudge” on the revenue guide was a “very minor positive given it fell within the existing bracket of FY22 APAs.”

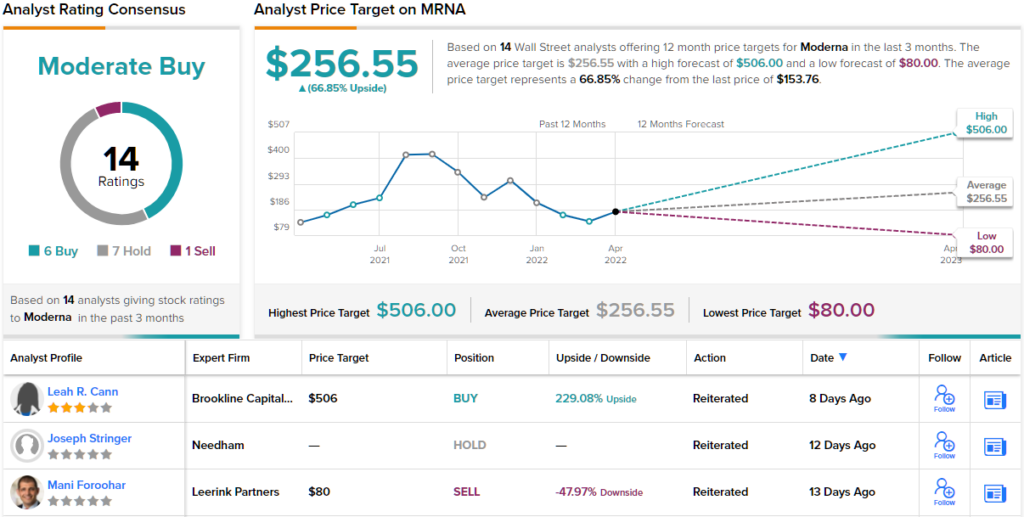

Accordingly, Papadakis signed off with a Hold rating, to go alongside a $155 price target, suggesting shares will stay range-bound for the foreseeable future. (To watch Papadakis’ track record, click here)

There are plenty of analysts sitting on the Moderna fence – 7, in fact – although with the addition of 6 Buys and 1 Sell, the stock qualifies with a Moderate Buy consensus rating. That said, the average price target is a lot more positive than Papadakis’; at $256.55, the figure suggests shares will appreciate ~67% over the coming months. (See Moderna stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.