2021 has been one of the best years to date for online food ordering and delivery platform, DoorDash Inc. (DASH). With the pandemic in its full swing, restaurants and retailers closed shops for consumers, and people merrily turned to online ordering, which turned out to be a saving grace for both food and non-food essentials.

The trend continues post-pandemic as convenience becomes more of a “habit” than a “need” for consumers. However the growth witnessed in the pandemic years will certainly slow down, with more people wanting to venture out, and enjoy dine-in with loved ones or pick up items on their own.

Meanwhile, the recent spike in oil and gas prices has further aggravated problems for companies to attract and retain drivers as they become increasingly wary of the impact on their income.

In response, DoorDash announced that it would give drivers a cashback of 10% while filling up gas using DasherDirect debit cards. Moreover, the company has also started weekly bonuses for drivers who drive the maximum miles. These programs are scheduled to run through April.

In 2021, DASH’s stock had a volatile year, with shares touching highs of $257 and lows of $74, losing more than 40% in value. Year-to-date, its down more than 45%.

Does this suggest a good entry point if you want a pie into the burgeoning online delivery market? Needham analyst Bernie McTernan is highly optimistic about the bright future for grocery delivery and delivery overall.

After an insightful rendezvous with industry veteran and consultant, Ronald Kyslinger, McTernan has reiterated a Buy rating on the DASH stock with a price target of $160, which implies a whopping 100.6% upside potential to current levels.

Additionally, according to TipRanks Hot Stocks by Insiders tool, recent insider trading activity of DASH shows that some of the majority owners and insiders have accumulated the stock giving it a Very Positive Insider’s Strategy Signal.

Find it interesting? Let us dig deeper into Kyslinger’s view of the sector.

Huge Digital Grocery Opportunity

According to Kyslinger, “the pandemic pulled forward five years of demand with the expectations of continued growth in the industry in ’22E and beyond.” What’s more, he believes that the sector is in a very nascent stage giving ample opportunities for players to widen their moat.

DoorDash is already a popular name in the segment, with its DashPass subscriptions crossing 10 million in Q4FY21, which translates into higher reorder frequency and profit per user.

In the quarter ending December 31, 2021, the company saw its monthly active users (MAUs) increase 22% year-over-year to over 25 million. Furthermore, DoorDash’s Total Orders grew 35% to $369 million and Marketplace Gross Order Value (GOV) jumped 36% to $11.2 billion.

Kyslinger also gives equal importance to the quality of the product being delivered to ensure that consumers continue to order online. The onus of quality depends majorly on the merchant and also in part on the delivery company.

Competition from Walmart

According to Kyslinger, American department store chain Walmart Inc. (WMT) is one of the biggest threats in the space to both the grocers and delivery companies. Walmart accounts for about 10% of U.S. grocery spending and more than 20% including Sam’s Club.

Since Walmart has in-house delivery employees, it can disrupt the same-day delivery market with possible deliveries from its multiple locations. Add to that, 64% of Walmart sales, which are grocery, threatens the existence of smaller grocers and the third-party delivery companies who service their orders.

Potential Threat from Tech Innovations

According to Kyslinger, the existence and increase in dark stores in retail directly affects traditional grocers. Dark stores are huge warehouses with an automated picking and packing system, which primarily caters to online ordering.

Additionally, increasing technological innovations like delivery drones, which ensure the last mile and last foot deliveries threaten the future of delivery companies like DoorDash.

Although delivery drones have weight constraints for parcels, it does hamper smaller deliveries, which form a chunk of the delivery companies’ business. Some companies have started pilot testing and a few are also commercially using drones to deliver food items, medicines, etc. to consumers posing a direct threat to DASH.

Finally, Kyslinger is bearish on the fast delivery industry. He believes that “speed makes delivery density and picking efficiency more difficult and hurts the unit economics of the business.” According to him, the acceptance of wider delivery windows will help companies to “maximize network efficiency to minimize cost per delivery.”

Concluding Views

In 2021, around 6 million people dashed, and the company generated almost $30 billion in sales for merchants within DoorDash’s community on its Marketplace, and billions of dollars in sales through its Platform services.

The company continues to make meaningful acquisitions and attracts merchant partners to strengthen its foothold in the delivery segment. DoorDash is considered a leader in the restaurant category in the U.S. and continues to grow its presence in non-restaurant delivery segments (grocery, convenience, and pharmacy) across multiple geographies.

Looking ahead, DoorDash expects Q1FY22 Marketplace GOV to fall in the range of $11.4 billion to $11.8 billion, and full-year fiscal 2022 Marketplace GOV is projected to be between $48 billion and $50 billion.

Analyst McTernan forecasts the above two metrics at their midpoints in his estimates. Additionally, the analyst forecasts Q1 revenue of $1.36 billion (26% Y/Y growth) and FY22 revenue of $5.87 billion (20% Y/Y growth), showing slower growth over FY21 growth numbers. Continual operating losses and the absence of dividends also negate the attractiveness of the stock.

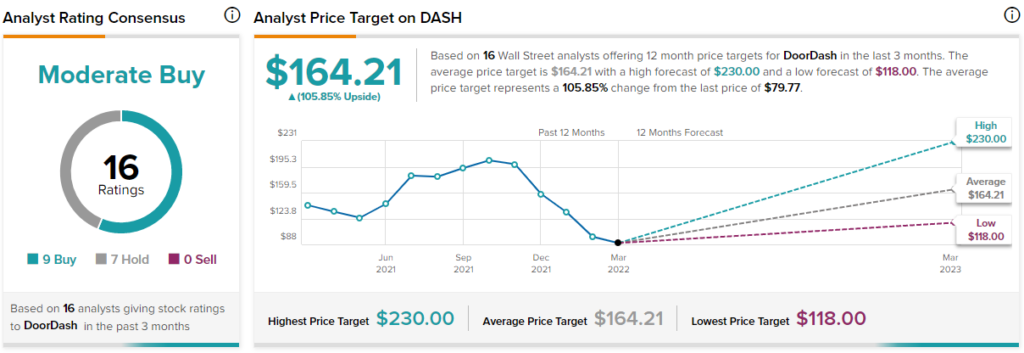

Other analysts on the Street, too, are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 9 Buys and 7 Holds. The average DoorDash price target of $164.21 implies 105.8% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure