When it comes to evaluating ASX mining shares such Rio Tinto Limited (ASX:RIO) and South32 Ltd. (ASX:S32), most investors only focus on the companies’ primary mining operations.

However, many ASX mining companies sit on highly valuable assets in the form of royalties, that are often overlooked by investors.

In recent months, Rio Tinto and South32 have made hundreds of millions of dollars from mining royalty trades.

What are mining royalties?

If a company owns a royalty in a mine or project, then it becomes entitled to a share of revenue from the operation. A company may obtain a royalty in a project after making an initial investment in the project. Royalty arrangements can also come through other types of deal-making, such as when a company cuts its stake in a project. A royalty agreement pays the royalty holder without it being involved in the operation of the associated project.

Why are mining royalty trades suddenly buzzing?

The demand for royalties tied to mining projects has increased amid high commodity prices. For example, prices of copper, iron ore, nickel, and lithium have remained evaluated in 2022. While gold is seen as a hedge against a possible recession.

These factors have helped to make mining royalties more lucrative, which provides some background to the recent run of royalty trades.

Rio Tinto sells gold mine royalty for US$525 million

Mining giant Rio Tinto recently sold its royalty in the Nevada-based Cortez gold mine and Fourmile project for US$525 million in cash, according to a Wall Street Journal report. The Cortez gold mine is owned by Barrick Gold (GOLD) and Newmont Mining (NEM) as a joint venture, while the Fourmile project is owned solely by Barrick.

According to TipRanks’ analyst rating consensus, Rio Tinto stock is a Moderate Buy. The average Rio Tinto share price prediction of AU$109.50 implies over 17% upside potential.

Moreover, Rio Tinto scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

South32 makes US$200 million from royalty sales

South32 also recently cashed in on its royalty portfolio. The company sold a collection of royalties tied to copper and nickel projects for about US$200 million in cash and stock, according to the Journal report. Following the trades, South32 is still left with about three dozen royalties that it could sell in the future.

According to TipRanks’ analyst rating consensus, South32 stock is a Moderate Buy. The average South32 share price forecast of AU$5.25 implies over 33% upside potential.

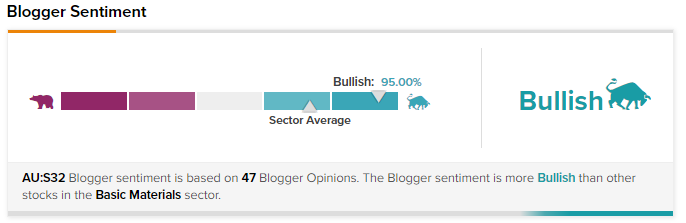

Furthermore, South32 stock is attracting positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 95% Bullish on South32 shares, compared to a sector average of 74%.

Final thoughts

Mining royalty trades are enabling companies like Rio Tinto and South32 to raise cash for project funding or acquisitions. In light of recent deals, investors may begin to take more interest in royalty holdings when assessing mining shares. However, a lack of sufficient public information on royalty portfolios may be a stumbling block to investors’ due diligence.