Tech giant Microsoft (NASDAQ:MSFT) delivered impressive fiscal first-quarter results, driven by the strength in the company’s cloud business. The company’s investments in generative artificial intelligence (AI) seem to be fetching the desired results, with management attributing revenue growth in its Azure cloud business to “higher-than-expected AI consumption.” Overall, MSFT’s Q1 FY24 performance and guidance reinforced analysts’ bullish stance about the company’s prospects in the AI space and demand for its offerings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Optimistic About MSFT’s Growth Potential

Clients’ growing interest in Microsoft’s AI capabilities helped drive solid growth in its cloud business in the fiscal first quarter. Microsoft Cloud revenue increased 24% to $31.8 billion in Q1 FY24. In particular, Microsoft’s cloud computing platform Azure witnessed 29% revenue growth, accelerating from 26% in Q4 FY23.

Microsoft’s substantial investments in AI, including $10 billion in ChatGPT-creator OpenAI, are expected to drive growth in the years ahead. It is worth noting that Azure’s growth rate in the September quarter outpaced the 22% growth in Alphabet’s (NASDAQ:GOOGL) Google Cloud revenue and the 12% rise in Amazon’s (NASDAQ:AMZN) Amazon Web Services (AWS) revenue.

Reacting to the results, Wedbush analyst Daniel Ives called MSFT’s performance “very strong,” given the ongoing macro headwinds. Ives noted that more enterprises are shifting to the cloud, with the company integrating AI across its entire tech stack.

Ives believes that more than half of Microsoft’s installed base will eventually use the AI functionality for the enterprise and commercial landscape, which indicates a major monetization opportunity. The analyst reiterated a Buy rating on MSFT stock with a price target of $400 on October 25.

On the same day, HSBC analyst Stephen Bersey upgraded Microsoft stock from Hold to Buy and raised the price target to $413 from $347. The analyst thinks that the weakness in MSFT’s performance in FY23 compared to the overall software sector is in the rear-view mirror, with PC sales and gaming business inflecting and the company gaining from a compelling AI product portfolio.

The analyst now expects Microsoft to outperform the broader sector on revenue growth. Bersey also highlighted MSFT’s expense discipline, which has been enhancing its operating margins.

Like Ives and Bersey, RBC Capital analyst Rishi Jaluria also reiterated a Buy rating on the stock following the results. The analyst said that aside from Azure and generative AI opportunities, he was also impressed that the company guided for a flat operating margin for the full-year FY24 despite concerns over dilution due to expenses related to the Activision Blizzard acquisition.

What is the Target Price for Microsoft Stock?

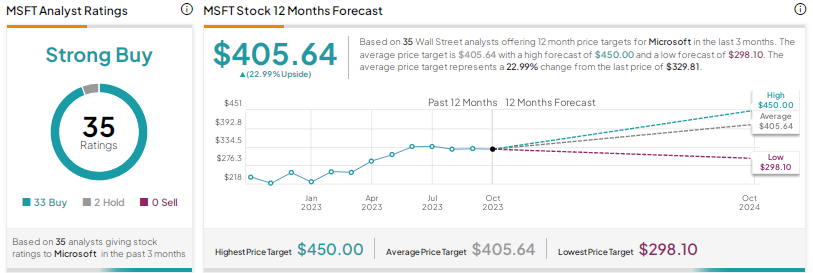

Overall, analysts are bullish on Microsoft due to AI-related tailwinds and strong execution. Wall Street’s Strong Buy consensus rating on MSFT stock is backed by 33 Buys and two Holds. The average price target of $405.64 implies 23% upside potential. Shares have risen more than 37% year-to-date.

Conclusion

With its recently reported results, Microsoft has established that it is one of the frontrunners in the generative AI race. Microsoft is well positioned to drive revenue and earnings growth in the years ahead, thanks to an extensive customer base, innovative AI offerings, and the recent acquisition of Activision Blizzard.